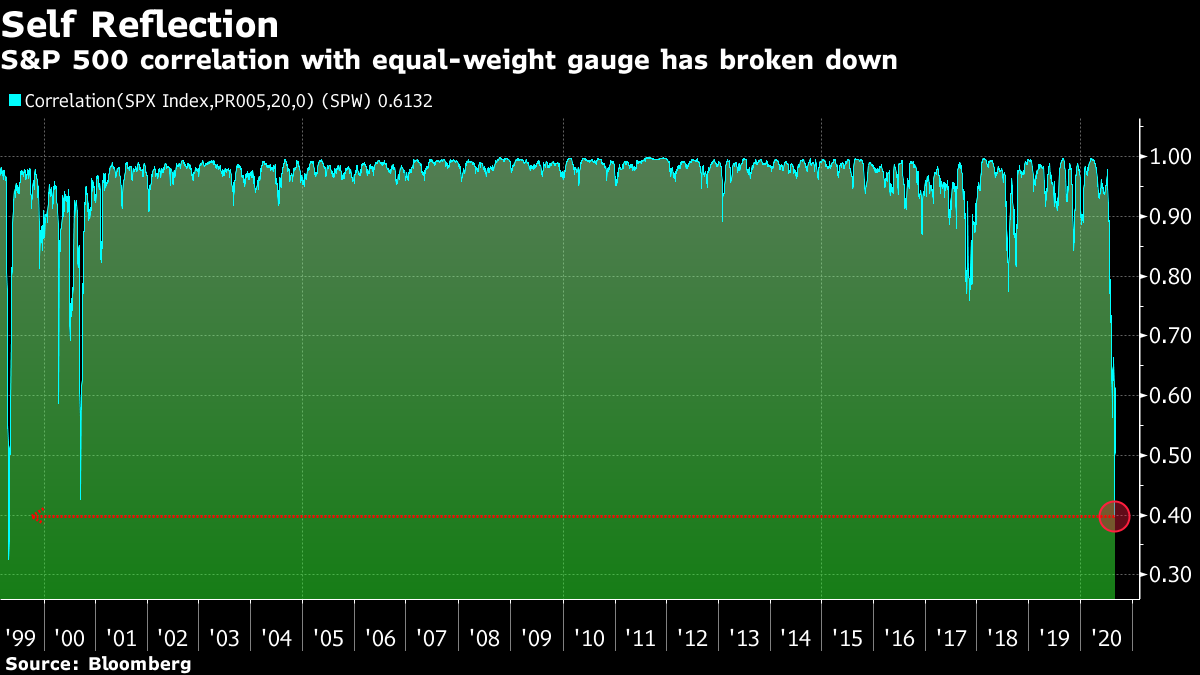

| Want the lowdown on what's moving European markets in your inbox every morning? Sign up here. Good morning. There's fresh optimism on a Covid-19 vaccine, more disappointing comments on Brexit talks, and new fiscal stimulus in France. Here's what's moving markets. Get Ready The U.S. Centers for Disease Control and Prevention has told states to prepare for a Covid-19 vaccine to be ready by Nov. 1, a date that suggests the federal government anticipates a vaccine will become available just days before President Donald Trump stands for reelection. However, a federal official familiar with the plans said that the date wasn't meant to influence the vote. In this region, France reported that new cases are being added at the fastest weekly pace since the pandemic began, and new infections in Spain remained near a four-month high. Finally, high-profile names to have caught the illness now include The Rock and former Italian Prime Minister Silvio Berlusconi. Disappointed It's the phrase one usually dreads hearing from a parent: "I am disappointed." The European Union's chief Brexit negotiator, Michel Barnier, accused the U.K. of failing to engage constructively in negotiations over their future relationship, giving one of his starkest warnings yet that the time to reach a deal is running out. Failure to make headway in talks next week could further raise the risk of a messy break-up when the transition period ends in December. Elsewhere, U.K. Chancellor of the Exchequer Rishi Sunak promised Tories there would be no "horror show" on taxes, while the Bank of England is touting its firepower. The pound is rising against the euro. France Boost France is getting another dose of stimulus, with 100 billion euros of shock and awe to get the economy moving again after the pandemic-induced lockdowns of the spring. The plan being announced today is focused on boosting supply and encouraging investment, and it includes a 10-billion-euro tax cut for industry next year. President Emmanuel Macron says the strategy is one of the biggest in Europe relative to the size of the economy, which shrank almost 14% in the second quarter. French companies can use the help: The nation's benchmark stock index is down almost 16% this year. Elsewhere, over in Germany, Chancellor Angela Merkel's ruling bloc backed plans allowing for extraordinary deficit spending next year. More Highs U.S. equities set a fresh all-time high, amid signs that the global rally is broadening into other sectors and away from technology. Several of this year's big tech winners, including Apple Inc., Zoom Video Communications Inc. and Tesla Inc. fell, with the last hit by news that Scotland-based fund manager Baillie Gifford had cut its holding in the electric-car maker. Over in foreign exchange, the dollar added to gains as the euro slid further below $1.20. Coming Up… Chicago Fed President Charles Evans discusses the U.S. economy and monetary policy, while Bank of England Governor Andrew Bailey speaks on the future of cryptocurrencies at a different event. There's purchasing managers index data due from most regions, too, though they're mainly final readings of August's numbers. French telecoms group Iliad S.A. and U.K. manufacturing investor Melrose Industries Plc report earnings. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morning The U.S. stock rally has become so narrow the S&P 500 is breaking away from itself. The 20-day correlation between the benchmark stock gauge and its equal-weighted version collapsed below 0.40 last week, the lowest since 1999. Similar correlations between the S&P 500 and its cumulative advance-decline line -- a measure of the breadth of movement of its underlying members -- have fallen to the lowest since late 2002, according to data compiled by Bloomberg. That's thanks to the well-documented theme of U.S. tech dominance and poor market breadth, according to Sundial Capital Research president Jason Goepfert. As he wrote to clients, "The index is becoming uncorrelated with itself." The S&P 500 closed at a fresh record high Wednesday, and is up 6% over the past three weeks. Its equal-weighted counterpart is up just over 2%. Goepfert also noted the correlations between U.S. growth and value shares have fallen into negative territory for the first time since 2000. That has happened only eight times before and the median one-year return in the S&P 500 following those occurrences has been about minus 7%, he calculated.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment