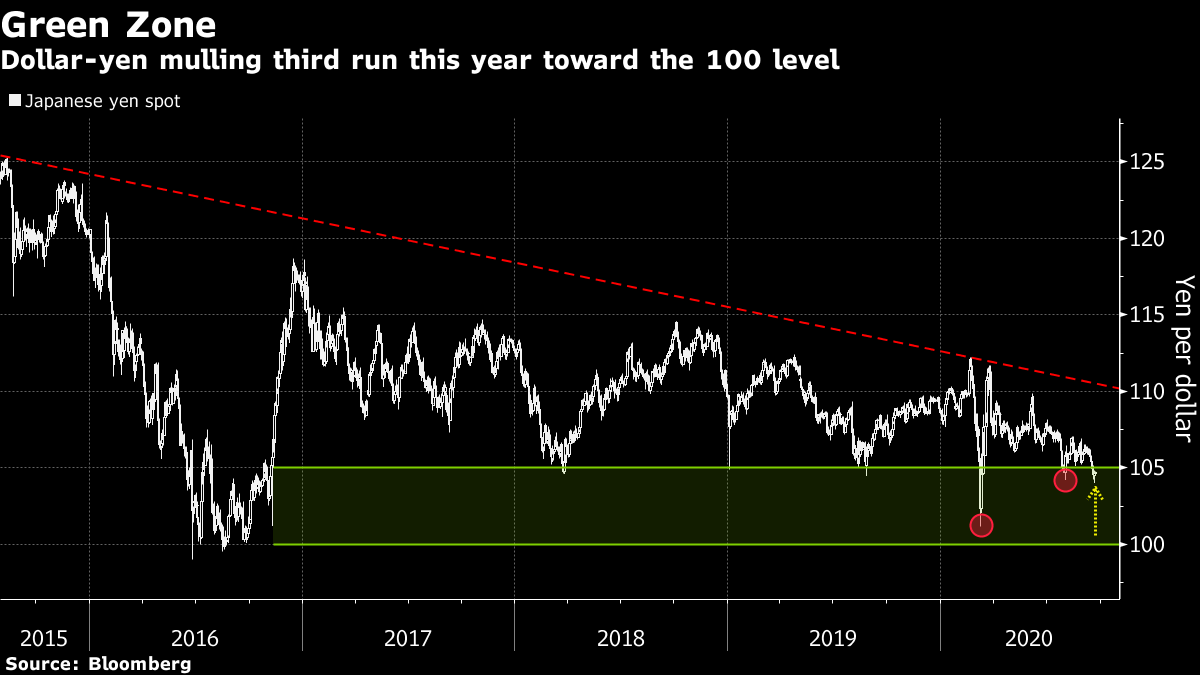

| Good morning. Equity markets stabilize after Monday's selloff, England's pubs and restaurants face new virus rules and Italy's regional elections are in focus. Here's what's moving markets. Dust Settles European stock futures are edging higher as we roll towards autumn today. The region's equities had their worst selloff since June on Monday as fears of new Covid-19 lockdowns swept markets, though shares in New York recovered from lows at the end of the session and Asia trading is mixed. Still, the pullback in equities may be more than just a passing phase, according to strategists, while Morgan Stanley reckons the tech-heavy Nasdaq 100 benchmark could fall more than 20% from its peak. Last Orders Hospitality venues across England will have to close by 10 p.m. from Thursday, Boris Johnson's office said, as it seeks to halt a surge in coronavirus cases. The U.K. prime minister will hold a Cobra emergency committee meeting this morning before briefing Parliament on further curbs and making a broadcast to the nation this evening. Elsewhere, Hong Kong is extending social distancing measures for another week, while deaths in America from Covid-19 approached 200,000. Meanwhile, an $18 billion initiative to deploy future Covid-19 vaccines around the world is moving into the next phase. Italy Vote Parties in Italy's ruling coalition, led by the anti-establishment Five Star Movement and the center-left Democratic Party, held on to three regions including the leftist bastion of Tuscany and Puglia in the south, in elections held Sunday and Monday, according to projections by Consorzio Opinio Italia for Rai state TV. The outcome of the vote strengthens Premier Giuseppe Conte's grip on his quarrelsome coalition ahead of negotiations over the European Union's recovery fund, with voters further bolstering the government as a nationwide referendum overwhelmingly backed reducing the number of seats in parliament to 600 from 945. Battery Day It's all eyes on Tesla Inc. later as Elon Musk's firm holds its highly anticipated "Battery Day" event. The presentation is expected to showcase innovations designed to keep the company's lead in electric cars as rivals flood the market with new vehicles over the next couple of years. The tiniest improvement in batteries can have a huge impact, because they are an electric car's most-expensive part. Here's seven educated guesses about what the company may unveil. Tesla fell last night as Musk tweeted on what to expected. Coming Up… Interest rate decisions are due in Sweden and Hungary, while in the U.S., Federal Reserve Chairman Jerome Powell and Treasury Secretary Steven Mnuchin are due to testify on pandemic relief. Powell warned in pre-released remarks that "the path ahead continues to be highly uncertain." Elsewhere, DIY retail group Kingfisher Plc and French nursing home operator Orpea report earnings. Finally, watch Italian banks after a report saying Italy sounded out executives at UniCredit SpA on a possible sale to the bank of the government's stake in Banca Monte dei Paschi di Siena SpA. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morning The Japanese yen is emerging as a new favorite way to bet on a weaker U.S. dollar as it eyes a third run at the key 100 level this year. Fears that the euro's rally is behind it, an appraisal of policies from Japan's new prime minister and worries about a fourth-quarter volatility spike in risk assets all point to the potential for further yen strength against the beleaguered greenback. After breaking below its recent trading range, the dollar-yen fell first below 105, a level it has defended for most of the past four years. It then briefly touched 104 on Monday amid the broad risk-off market move before a sharp overnight reversal. That brought back memories of late July, when the dollar slumped to just above 104 but quickly rebounded. Back then, Tokyo strategists suggested a combination of reduced repatriation flows and dollar demand from local investors -- as well as seasonal factors -- would halt its decline. This time, the looming volatility catalyst that is the U.S. presidential election is likely to keep the pressure on. The yen may get another chance yet to prove its haven bona fides are still intact.  Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment