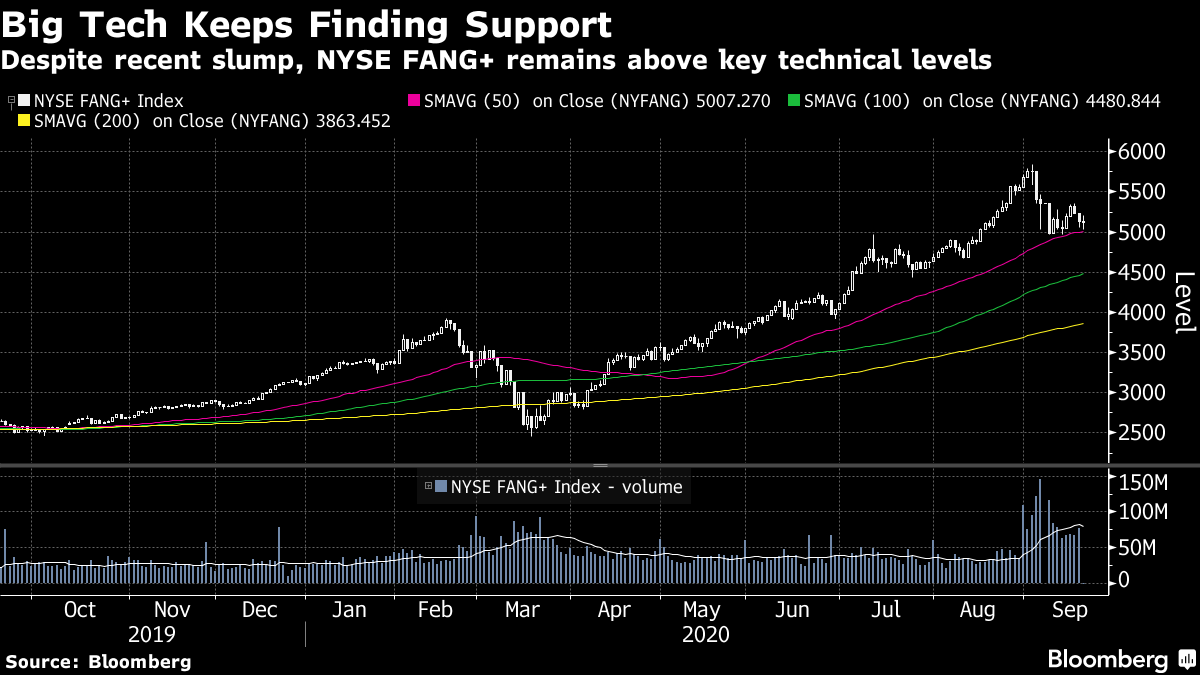

| Want the lowdown on what's moving European markets in your inbox every morning? Sign up here. Good morning. New virus restrictions could be coming to London, there's an investigation out on the banking sector and the U.S. says it's re-imposing sanctions on Iran. Here's what's moving markets. Wakeup Call There are warnings of a potentially grim autumn and winter amid rising Covid-19 cases around Europe, with the World Health Organization saying the latest data should serve as a "wakeup call for all of us." The virus has started spreading in older populations again, though on a more positive note, U.S. researchers say advances in medical care are improving the chances of survival. New restrictions to stem the illness's growth in London could be announced, with the U.K.'s chief medical officer set to sound the alert to Prime Minister Boris Johnson today. FinCEN Files An investigation released over the weekend by the International Consortium of Investigative Journalists found that banks moved money for people or entities they couldn't identify, and in many cases failed to file the required suspicious activity reports until years afterward. The report, based on leaked documents obtained by BuzzFeed News and shared with the consortium, said that in some cases the banks kept moving illicit funds after receiving warnings from U.S. officials. Shares of Europe's largest bank, HSBC Holdings Plc, fell as pressures mount on several fronts. ECB Review The European Central Bank has launched a review of its pandemic bond-buying program to consider how long it should continue and whether its exceptional flexibility should be extended to older programs, the Financial Times reported, citing two Governing Council members that it didn't identify. The 1.35 trillion euro-program was aimed at calming markets and supporting the economy as coronavirus lockdowns hit. The euro is rising this morning and stock futures are declining. Snapback Secretary of State Michael Pompeo said the U.S. is re-imposing sanctions on Iran and expects all other United Nations members to follow suit. Most countries say the Trump administration doesn't have the authority to demand adherence to the sanctions "snapback" after quitting 2015's nuclear accord, a pact Pompeo describes as "silly." Here's a refresher on the oil-producing nation. Crude futures are little changed this morning after their biggest weekly rally since June. Coming Up… Regional voting continues in Italy, which could affect the stability of the country's coalition government. Watch telecom stocks in Eastern Europe this morning after France's Iliad SA agreed to buy Play Communications SA of Poland for about 2.2 billion euros. Meanwhile, U.K. home builder shares could get a boost from monthly data showing advertised prices for homes rose the most since 2016. Keep an eye on shares of Netflix Inc. in New York later, too, after the streaming firm mostly missed out at last night's Emmy awards. In sport, tennis's French Open begins after a rookie won the Tour de France at the weekend. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Adam Haigh is interested in this morning Markets are already off to a volatile start to the week in Asia, and what's becoming clear in September is that investor positioning is continuing to shift with some quite telling trends. One is the renewed dollar weakness that may be exacerbated going into the end of the current quarter. Another important trend is how allocations are changing to tech stocks. The latest CFTC data, released Friday, showed how speculative positioning in Nasdaq e-mini futures has climbed to the most bearish level since 2008. Clearly big tech is taking a hammering and the NYSE Fang+ index is down almost 10% in September. Still, as the chart below from my Markets Live colleague Eric Weiner shows, there is some strong technical support on offer at this point. In fact, the index has bounced off the 50-day moving average support line twice this month already. But watch this closely. Any sign that the gauge is breaking below this level could see losses accelerate rather quickly.  Adam Haigh is an editor covering global markets for Bloomberg News in Sydney. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Awesome and interesting article. Great things you've always shared with us. Thanks. Just continue composing this kind of post. affliate omiyou

ReplyDeleteI just got to this amazing site not long ago. I was actually captured with the piece of resources you have got here. Big thumbs up for making such wonderful blog page! Ethiopia News

ReplyDelete