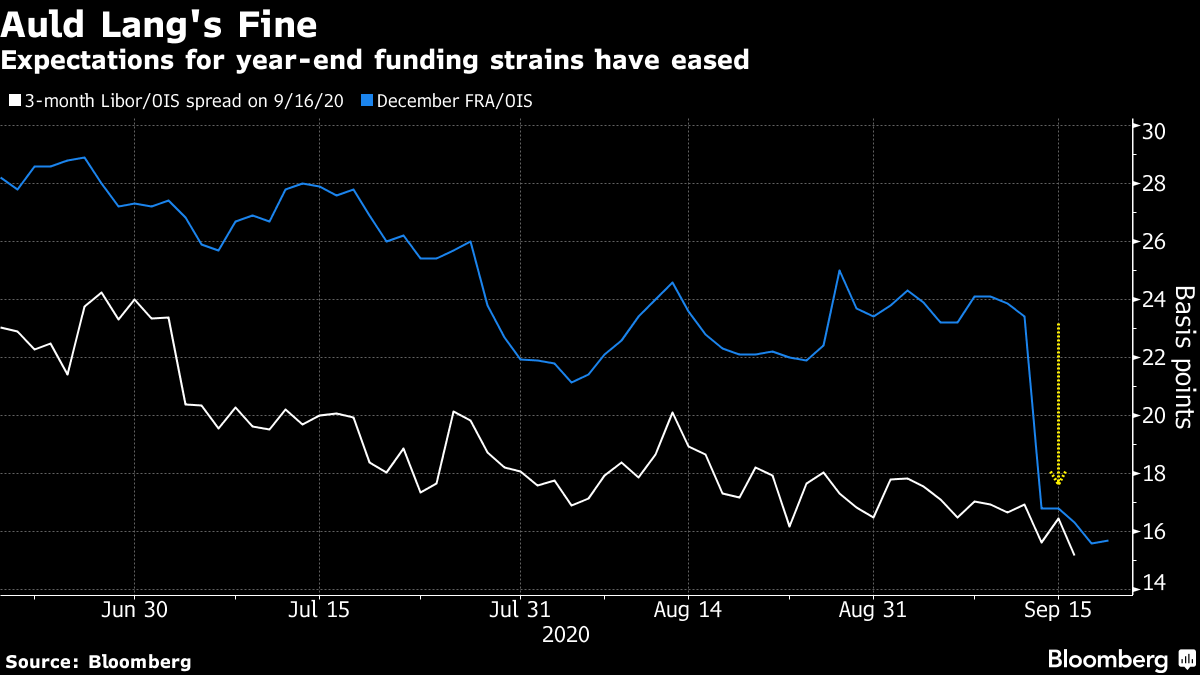

| Want the lowdown on what's moving European markets in your inbox every morning? Sign up here. Good morning. A grim pandemic milestone, encouraging signs in Brexit talks, and a new chapter in the Sino-U.S. tech tussle. Here's what's moving markets. Grim Milestone Global coronavirus cases topped 30 million, with infections showing no signs of slowing more than six months after the pandemic was declared. The global death toll is approaching 1 million, with the U.S. topping the list with almost 200,000 fatalities. Many health experts believe the actual number of cases and deaths is much higher than what's been reported. The virus is spreading at a rate of 1 million cases every four or five days. From France to South Korea, former hotspots that had brought the virus under control are fighting fresh outbreaks, complicating efforts to reopen economies. In other worrying news, a study published in the Journal of the American Medical Association found that 11 of 19 volunteers who had developed antibodies as of April seem to have lost them only two months later. Positive Noises The U.K. government said a round of informal EU trade talks this week were "useful," as European Commission President Ursula von der Leyen told the Financial Times she's "convinced" a deal is possible. The discussions "covered a broad range of issues and some limited progress was made," the U.K. government said in a statement late Thursday. The positive noises from both sides contrast with the saber-rattling in recent days, as Prime Minister Boris Johnson's government introduced a draft law to Parliament that tore up sections of the Brexit deal he reached less than a year ago, and the EU threatened to retaliate with legal action. Tech Crusade After Huawei Technologies Co. and TikTok owner ByteDance Ltd, a third Chinese business -- this time, the world's largest gaming company -- faces U.S. scrutiny. The Trump administration has asked gaming companies to provide information about their data-security protocols involving Chinese technology giant Tencent Holdings Ltd., people familiar with the matter said. Tencent owns Los Angeles-based Riot and has a 40% stake in Epic, which is the maker of the popular video game Fortnite. Government officials and representatives for the companies declined to comment or didn't immediately respond. Meanwhile, TikTok Global, the new U.S. company that Bytedance plans to form with Oracle Corp., intends to hold an initial public offering in about a year, according to people familiar with the matter. Dividend Drought The U.S. Federal Reserve, which just started a second round of Wall Street stress tests, is considering extending the unprecedented constraints on dividend payments and share buybacks it imposed on the biggest U.S. banks. The Fed said in a statement overnight that it will decide in the next two weeks whether to prolong the limits, which are scheduled to lapse at the end of the third quarter. Any extension through the end of the year would likely disappoint banks, as JPMorgan Chase & Co. has already indicated it might resume buybacks in the fourth quarter if allowed to by regulators. Investors in European peers are already set for a longer dry spell, with the European Central Bank only due to revisit its de facto bank dividend ban in December. Coming Up… Amid the re-awakening of Europe's equity capital markets, three small-cap IPOs are due to start trading this morning: Norwegian fishery Salmon Evolution Holding AS, Danish hearing aids maker Audientes A/S and Belgian anti-snoring tech firm Nyxoah SA. With a practically empty earnings schedule, the morning holds U.K. retail sales for August, with economists forecasting a slight increase from July. Italian industrial orders are due later. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morning As traders gear up for what could be a tumultuous fourth quarter, the good news is they have one less source of volatility to worry about. The traditional year-end funding squeeze, which can manifest as a shortage of dollars that can roil swaps, rates and currencies, is unlikely to make an appearance, according to one influential money market guru. A positive update from JPMorgan's CFO on America's largest bank's capital requirements was enough to get Credit Suisse's Zoltan Pozsar to change his view of year-end funding turmoil. His call for a muted year-end prompted traders to back away from bets of a spike in rates. One closely watched gauge of future stress promptly slid as some of the risk-premium already priced in evaporated. The year-end is often a fraught time for traders as banks scale back activities for regulatory reasons, reducing available liquidity which can lead to outsized spikes in short-term borrowing costs.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment