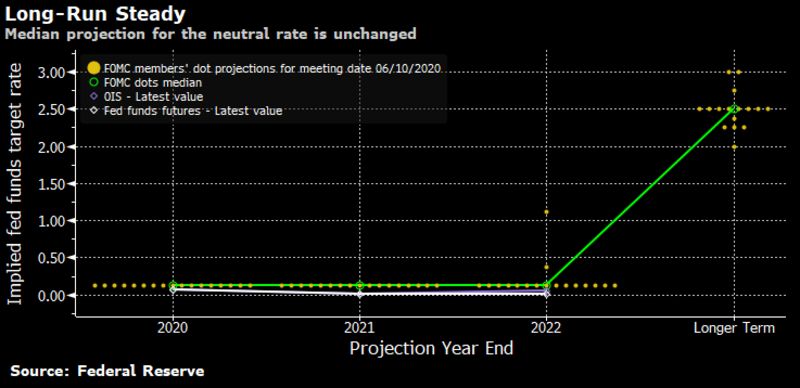

Trump won't extend TikTok deadline, Brexit talks don't go well, and China's latest vaccine candidate. DeadlinePresident Donald Trump said there would be no extension to the Sept. 15 deadline for ByteDance Ltd. to sell the U.S. operations of its TikTok video sharing app. Authorities in China said last month that any deal for the company would have to be approved by regulators in Beijing, a move which practically guaranteed a sale could not be made on time. ByteDance, the world's most valuable startup, seems set to concentrate its future expansion plans in Asia. For Trump, it seems there is little to be gained from changing his mind on the deadline as he again makes "tough on China" a central part of his election campaign. FrayingIt would be fair to say that talks between the European Union and the U.K. on a post-Brexit trade deal did not go well. The EU gave Boris Johnson's government three weeks to drop its Internal Market legislation which would allow ministers to override parts of the withdrawal agreement. There are no signs the U.K. will agree to this demand. The pound dropped yesterday as the differences became clear, and remains under $1.28 this morning. There was some good news for Johnson though, with strong growth numbers for July, and the signing of a free-trade agreement with Japan which is expected to boost GDP by 0.07% per year. China vaccineThe rush to find an effective vaccine for Covid-19 continues apace, with China's latest candidate approved for phase one human testing delivered via nasal spray rather than by painful injection. This would be the 10th candidate drug to reach this proving phase there as China builds a lead in treatment development. Outside the country, AstraZeneca Plc's CEO said the vaccine the company is developing could still be available by year-end, despite the pause in trials earlier this week. Markets mixed Global equities are having a relatively quiet Friday so far at the end of a week which has seen major indexes whipsawed as investors appear to become more nervous about valuations. Overnight, the MSCI Asia Pacific Index added 0.5% while Japan's Topix index closed 0.7% higher. In Europe, the Stoxx 600 Index was 0.1% lower at 5:50 a.m. with comments on euro strength and possible extra monetary stimulus from ECB chief economist Philip Lane doing little to boost sentiment. S&P 500 futures pointed to a higher open, the 10-year Treasury yield was at 0.685% and gold was little changed. Coming up...Headline U.S. inflation in August is expected to have accelerated to 1.2%, with the core reading holding at 1.6%, when the data is published at 8:30 a.m. The September WASDE report is at 12:00 p.m. and the latest Baker Hughes rig count is at 1:00 p.m. The U.S. August budget statement is released at 2:00 p.m. President Donald Trump and Joe Biden will both commemorate the anniversary of the Sept. 11 attacks near the town of Shanksville, Pennsylvania where one of the hijacked planes crashed in 2011. They will attend at different times to avoid a face-to-face encounter. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Emily's interested in this morningWhat do investors want from the Fed, exactly? It's clearly convinced the market interest rates are on hold for some time -- judging by the steady state of overnight index swaps spanning the next few years. But, given the recent twitching in the tail of the Treasury curve, there seems to be concern over the possibility of disappointment from the Sept. 15-16 meeting. For a market craving new information, the Fed can only really offer more variations on what it's already made clear -- rates are staying low for a long time. There will be a shiny new dot, that is, the FOMC's median projection for interest rates in 2023. But that's overwhelmingly expected to line up with the others at the zero bound.

If there's a catalyst for a possible Treasury selloff, it could come from the other updates in the summary of economic projections, given that committee members will probably have ratcheted up their estimates for growth from the last time around, in June, and lowered the path of the unemployment rate. It's already fallen almost a full percentage point below the fourth-quarter average rate of 9.3% published in June. Follow Bloomberg's Emily Barrett on Twitter at @notthatECB Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment