You can catch coronavirus twice — and the illness's effects on patients and the economy may last years. Meanwhile U.S. stocks hit an all-time high on treatment hopes. And China's big banks are on a hiring spree. Here are some of the things people in markets are talking about today. A man was infected with the coronavirus for a second time after recovering from an initial bout in April, in what scientists said was the first case showing that re-infection may occur within a few months. The 33-year-old's second infection was detected via airport screening on his return to Hong Kong from Europe this month. Among those who survive the illness, there is an expanding population of so-called long-haulers left with debilitating conditions long after "recovery." It's now known that SARS-CoV-2 will leave a portion of the more than 23 million people it's infected with a litany of physical, cognitive and psychological impairments, like scarred lungs, post-viral fatigue and chronic heart damage. What's still emerging is the extent to which the enduring disability will weigh on health systems and the labor force. That burden may continue the pandemic's economic legacy for generations, adding to its unprecedented global cost — predicted to reach as much $35.3 trillion through 2025. Here's how Bloomberg is tracking the virus. Asian stocks looked poised for modest gains after U.S. equities rose to a record high on virus treatment optimism. Treasuries retreated, and futures pointed higher in Japan and Australia, but slipped in Hong Kong. The S&P 500 notched another all-time high as optimism mounted that the virus wouldn't hamper growth. Exxon Mobil, Pfizer and Raytheon were kicked out of the Dow Jones Industrial Average as part of the stock benchmark's biggest reshuffling in seven years, actions that will boost the influence of technology companies that have dominated the 2020 stock market. The Nasdaq Composite closed at a record for a second consecutive session, and the dollar strengthened. Elsewhere, oil rallied and gasoline surged to a five-month high and gold traded below $1,950 an ounce. China's mega banks are ramping up their recruitment of fresh graduates as a record number enter the labor market, boosting employment even as lenders deal with plunging earnings and ballooning bad debt. The four biggest state banks kicked off their autumn campus hiring this month, instead of in November as in previous years. China Construction Bank plans to add 16,000 graduates this year, up from 13,000 last year, while Bank of China will increase its hiring by 15% to more than 10,000, according to their advertisements. "This is in direct response to the government's call to protect jobs," said Tang Jianwei, a Shanghai-based analyst at Bank of Communications's research institute. "Even though the big banks are facing pressure on their own earnings, they still need people to develop the business. Also it's important for them to assume social responsibility." TikTok and its Chinese parent company ByteDance are suing the Trump administration to challenge a ban on the fast-growing video app, bringing a geopolitical fight over technology and trade into a U.S. courtroom. Trump says TikTok is a security risk for user data. The company said the president's decision was made "for political reasons," is unconstitutional and violates rights to due process. While the ban doesn't take effect for weeks, it has escalated tensions between the world's largest economies. On Aug. 14, Trump ordered ByteDance to sell its U.S. assets and said the U.S. should receive a cut of the proceeds. Microsoft and Oracle have already shown interest, which argues TikTok poses no security threat. The rebound in Asia's best performing stock market since March is just getting started, according to money managers. Pakistan's central bank has been among the most aggressive globally in cutting interest rates this year. That's reduced the double-digit returns from fixed income and bolstered the bullish case for equities. "If rates remain at these levels for some time, they will continue to drive the market," said Ayub Khuhro, chief investment officer at Faysal Asset Management, whose assets have tripled to 35 billion rupees ($210 million) in the past year. Pakistan's KSE-100 Index is up 36% from the end of March. A slowdown in the rate of new infections coupled with measures to boost an economy that shrank for the first time in seven decades prompted the Dubai-based FIM Partners in July to make Pakistan its biggest exposure after the Philippines.

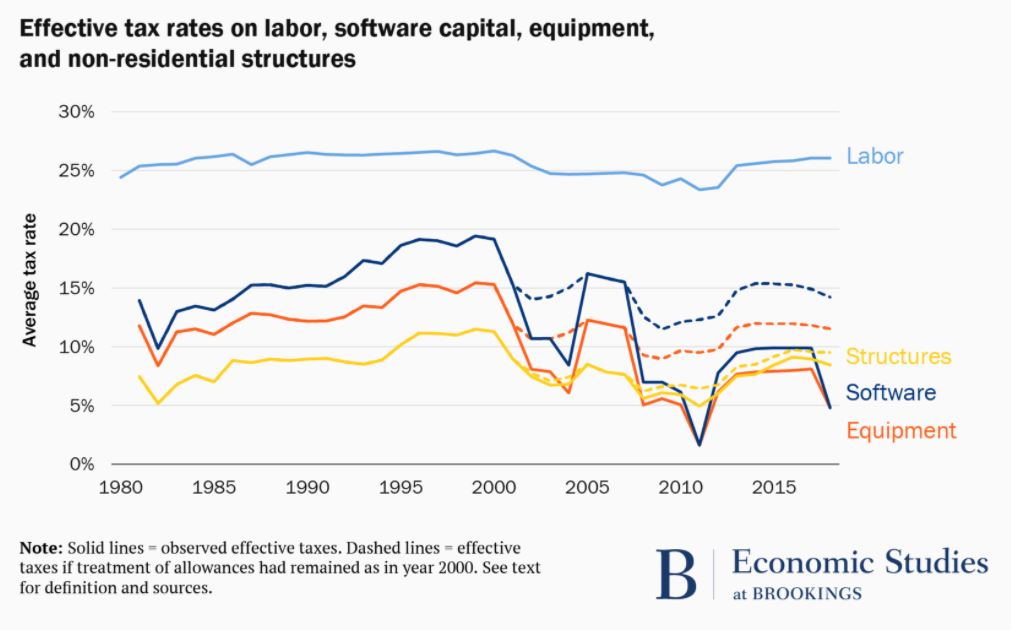

What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in this morningI find Modern Monetary Theory (MMT) fascinating and frustrating at the same time. It's a very interesting debate about the nature of money, but it leads us to the place we're arguably already in. MMT suggests that because the state has a monopoly on printing money the only limitation on debt issuance is inflation. The suggestion is that governments can borrow a lot more in order to fund social programs of all kinds so long as it doesn't spark price increases. In other words the limitation on debt issuance is grounded in politics, rather than the illusion of a "limited fiscal budget." But politics is and always has been the problem. It's pretty difficult to take a look at U.S. national debt — currently estimated at $26 trillion — and conclude that budgets have really been a binding constraint. The binding constraint is what U.S. politicians are willing to stomach and historically that process has been mired in bipartisanship.  Bloomberg Bloomberg Anyway, the limitations of MMT have been on my mind quite a lot lately as we ponder how the Covid-19 crisis and various policy responses are affecting the economy. As I've written in this space before, the crisis is leading to incredibly inequitable consequences for individuals but it's also benefiting the largest companies with the biggest monopoly power over labor. In other words, the balance of power is tilting even further towards capital and away from people. Where does MMT come into this? There's a perception that the theory can rectify that imbalance if the government uses its extra fiscal headroom to enact things like universal basic income or some sort of jobs guarantee. But what if the problem could be solved a lot more simply, or at least, a lot less divisively? Christopher Mims at the Wall Street Journal has an excellent piece out describing all the ways our current economic system has favored capital over labor — especially through tax rates that have encouraged capital investment over the hiring of humans. It begs the question of whether a more politically palatable option might be to overhaul the corporate tax rates rather than enact sweeping programs that can easily be portrayed as "socialist." As the coronavirus crisis exacerbates the dominance of capital over labor, it seems likely that taxes will be a first step in rectifying that imbalance. You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment