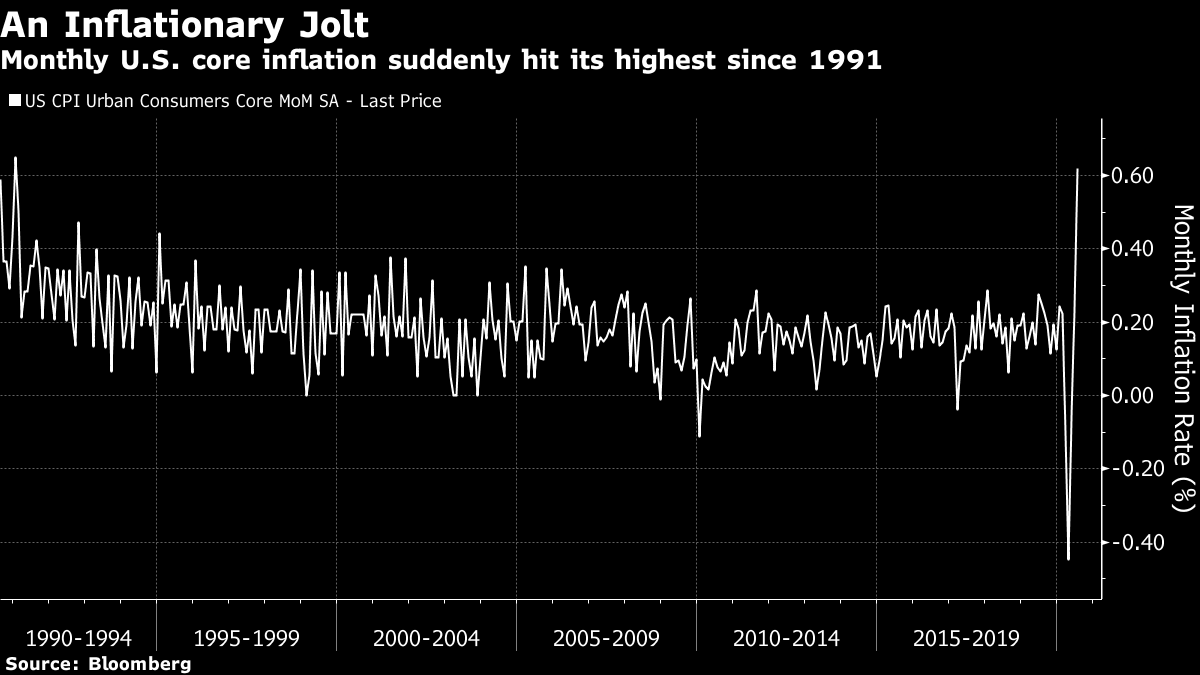

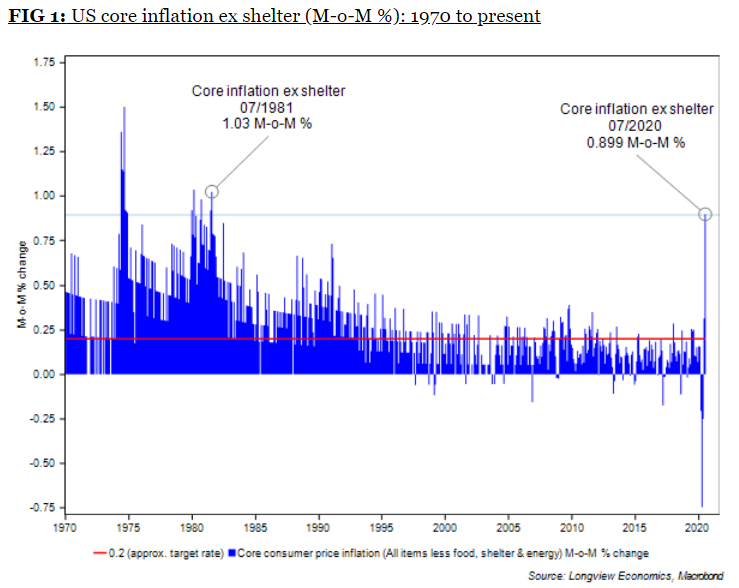

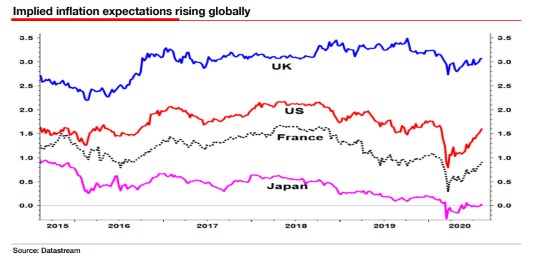

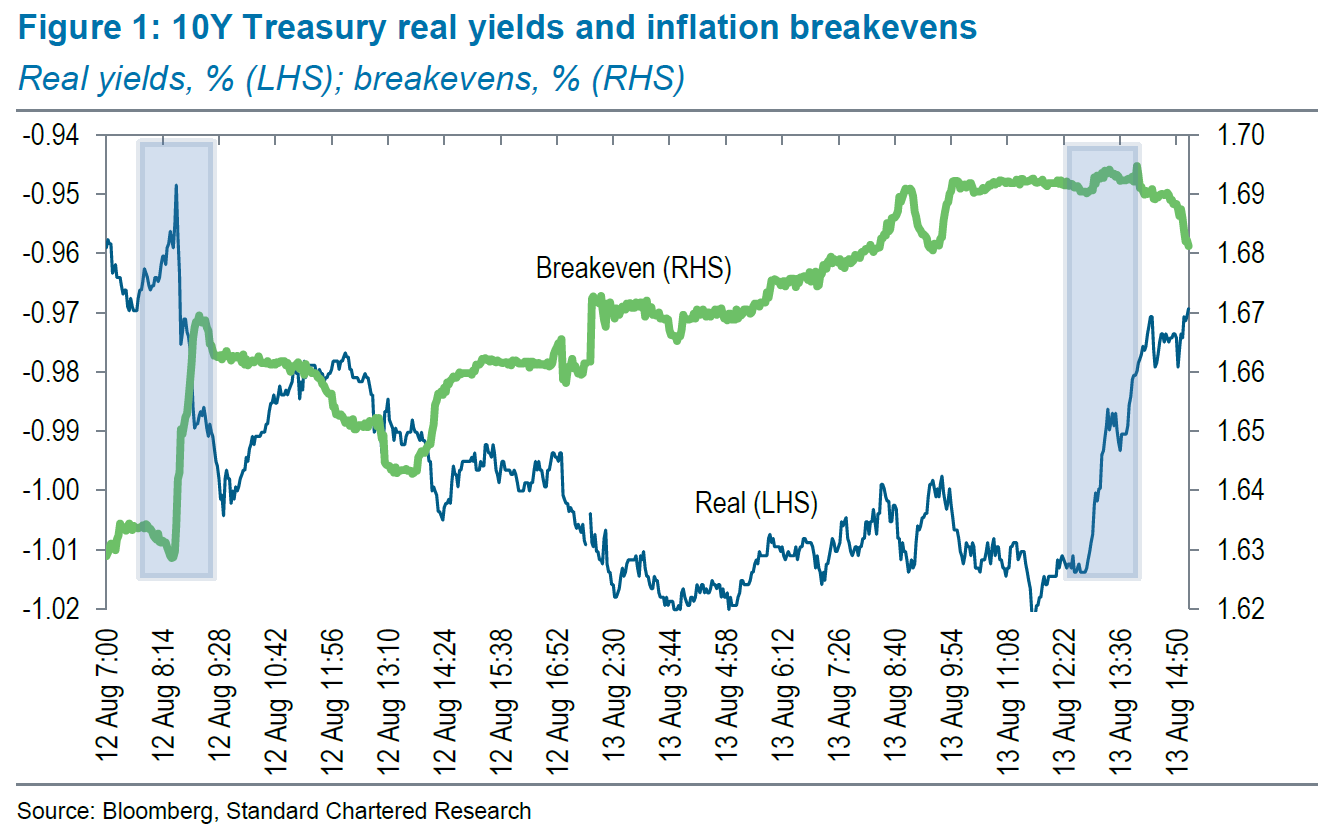

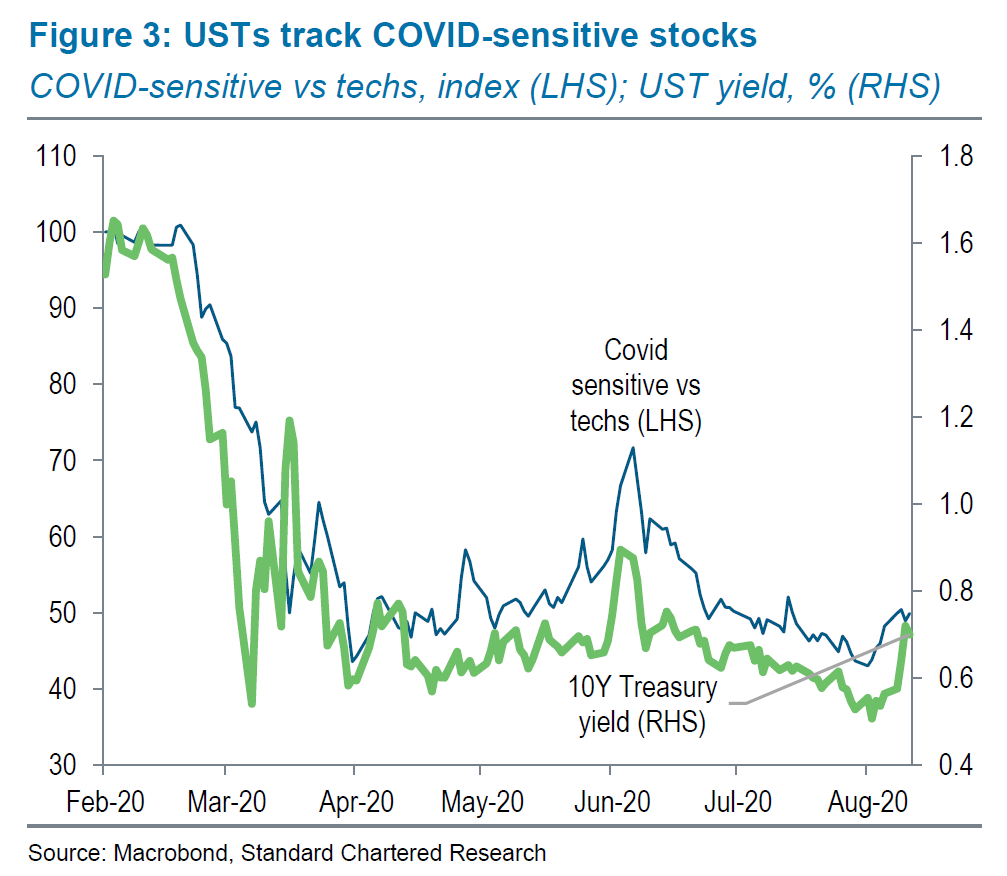

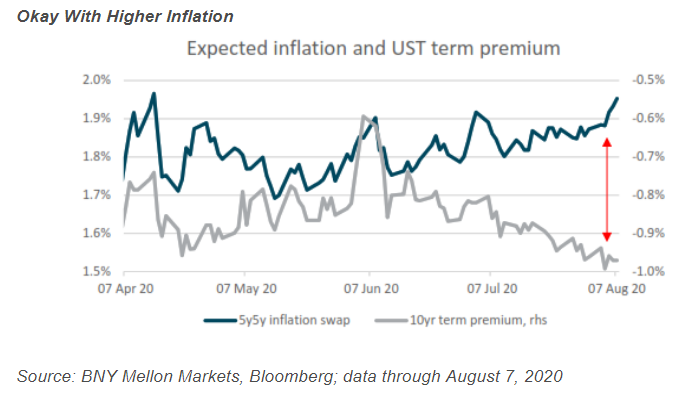

| Back in the city after a week in which I paid as little heed to the markets as I could, what exactly have I missed? The most startling item of economic news (a much higher U.S. inflation reading than anyone had expected) and the most startling market event (a sudden 10.2% fall for gold) tended to counteract each other. Isn't gold supposed to benefit from higher inflation? Meanwhile, the U.S. stock market remains agonizingly close to setting an all-time high, but comically unable to get there, as yet. So, let's try to reconcile what is going on. If we look at core U.S. inflation, excluding food and fuel, July's increase was a bolt from the blue, the highest reading since the very different environment of early 1991:  This seems all the more strange because the single biggest component of core inflation, thus defined, is shelter — which is calculated based on a sampling of the rents that people are paying. There is ample anecdotal evidence that urban rents are falling, so we should expect this element of core inflation to be falling. And indeed, if we exclude shelter costs, we get an even more deviant inflationary shock, with the highest reading since 1981, when the battle against stagflation was reaching its climax (as shown in the following chart from Longview Economics of London):  So this sounds like some very real inflation is happening in the basket of goods that excludes food, fuel and housing, and which should in theory be susceptible to changes in monetary policy. Indeed, Longview finds some possible early evidence of supply-chain bottlenecks next in the data — although some of this might dissipate if activity continues to return to normal: Food away from home, for example, (which is mostly restaurants, fast food chains etc.) has risen by +0.4%, +0.5% and +0.5% M-o-M in the past three months (recording two of the three strongest readings since the GFC); as consumers seek to avoid public transport, the cost of new and used vehicles were both up sharply last month (new vehicles +0.8% M-o-M, largest 1 month increase since May 2011; used vehicles were +2.3% M-o-M, largest single month increase since Jan 2010). Alternatively, this is an example of the classic form of inflation that would have been predicted by the arch monetarist Milton Friedman: There is much more money around, and so prices for the products that people want to buy get bid up. A sudden stop to economic activity on the scale that happened earlier this year will naturally exert deflationary pressure, and it is also natural for prices to rebound a little after a sudden stop, but there are some genuine inflationary pressures out there. This isn't a uniquely American phenomenon, although it has been more marked in the U.S. Inflation breakevens are rising across the developed world, as shown by this chart from Societe Generale SA's Albert Edwards:  Why should inflation rise this time when it failed to respond to the huge asset purchases made by the Federal Reserve and other central banks after the last crisis? This thread by Jens Nordvig of Exante Data LLC sums up the argument neatly. Last time around, asset purchases were coupled with government austerity. This led to rising asset prices and rising inequality, but not to price inflation. This time, with far greater fiscal expansion, the asset purchases will find their way into buying actual stuff. That could be inflationary. That at least is the inflationists' argument for why it could be different this time, which will be tested over the months and years to come. But now we come to the baffling question of how markets are responding. Inflation breakevens rose sharply in response to last week's consumer price index figures, but real yields were barely affected — investors didn't demand any extra compensation for taking the risk of investing over the long term. The following day, when there was a poorly received auction, there was a rise in yields, while breakevens were unaffected. This, according to Steven Englander of Standard Chartered Plc, shows that the bond market isn't particularly perturbed by possible inflation pressure, but rather by risks of over-supply of bonds:  What really drives the bond market at present, according to Englander, is progress in the fight against the pandemic. This following chart, also from Englander, shows how the stocks that are most vulnerable to Covid-19 performed relative to tech stocks, and compares this to 10-year Treasury yields. Clearly, yields tend to jump whenever there appears to be a let-up in the pandemic, as there was in early June, and again in the last two weeks:  Why would such a relationship hold? John Velis of Bank of New York Mellon Corp. suggests that it ultimately comes back to the Fed. Jerome Powell has driven home the point that the Fed will be moved by progress on the virus, and that little else matters for now. Beyond that, there has been plenty of Fedspeak around the notion of "average inflation targeting." This is the notion that rather than aiming to keep inflation at 2% (which is a long way above where it has been for a while), the central bank could instead aim to keep it at an average of 2%, meaning that it will happily allow it to overstep at times. On this basis, markets need not be that worried by an increase in prices and inflation expectations, because the rate needs to get well above 2% before there is any reason for concern. Significant progress in fighting the pandemic, however, suggests that the Fed can revert to normal practice a little earlier, and that rising inflationary pressure does, as usual, bring with it the threat of higher rates. That is what markets really care about. Ergo, the bond market doesn't care about a shockingly high core inflation number, but does care about signs of over-supply of bonds, or of some reduction in the growth of Covid-19 cases and deaths. To see this play out in bond market terms, look at the accompanying BNY Mellon chart, which tracks changes in expected inflation against the 10-year term premium (the extra yield that investors demand for lending to the government over longer terms). Higher expected inflation should lead directly to a higher term premium. It isn't doing so at present, and Velis contends that is because investors are already assuming that the Fed is targeting average inflation. The only thing that would shock them out of this would be a significant improvement in the fight against the pandemic.  This also, incidentally, explains the stunningly low level of real yields (yields minus breakevens). The 10-year real Treasury yield rose last week but remains at almost exactly minus 1%, a level never recorded before this year. If inflation can rise in the future without provoking an increase in rates from the Fed, then real yields will be lower. Real yields also have a relationship with gold, which staged a brief crash last week. Lower real yields make gold, which pays no yield, that much more attractive, so a brief correction in real yields helps to explain a brief correction in gold. That is what the recent drama looks like at this point. At no point did gold drop below even its 50-day moving average, suggesting that its short-term upward momentum remained unchecked, even by a fall of 10%. That correction bottomed shortly after the inflation number came out. The rebound since suggests that the upward trend is thoroughly intact:  With plenty of technical pressures underpinning gold's rally, some turbulence is to be expected, and is healthy. While investors believe that inflation is rising, and that the Fed isn't going to do anything about it, we can expect gold to remain strong. If the recent improvement in the Covid-19 figures proves to be enduring, however, that would pose more of a problem for gold prices. That's a trade-off that most of us would make. And that, I think, is what I missed last week. Survival Tips I'm just back from a road trip from one end of New York state to the other. We got to know a variety of auto mechanics in cities and towns across the state before the beloved family 1999 Subaru Outback finally gave up the ghost. It's good to know that a lot of people still show goodwill to a family in trouble — and indirectly, it was great to have a compelling reason not to think about financial markets. Beyond car trouble, the leitmotif of life in the last week has been waterfalls. The idea was to go to Niagara Falls and back. Niagara is extraordinary, but oddly artificial. As we discovered from reading the fascinating Inventing Niagara: Beauty, Power and Lies by Ginger Strand, the falls have in fact been controlled and molded by humans for decades, and the flow over them is even the subject of an agreement between the U.S. and Canada — they slow down at night when nobody is watching, so that more water is available for both countries' considerable hydroelectric power projects. There is also something dispiriting about how manufactured the environment around the falls has become. The Canadian side, from which you get the classic view of the falls, looks from a distance like the downtown of a large city. The impact of a natural wonder is greatly diminished by the fact that it faces an unapologetically built-up environment. The American side has been manicured and managed so that there is no sense of great excitement or discovery. The falls are indeed amazing but I have no desire to return. Neither, more tellingly, do any of my kids. But New York state is a series of ravines and gorges, punctuated by glorious waterfalls. They are well protected, but generally lie hidden amid forests. In several cases, particularly in the national parks around Ithaca, it is possible to swim at the base of a waterfall — something only the suicidal would try at Niagara. To these waterfalls, we hope to return again and again. Waterfalls have a remarkable effect on the soul. Sometimes, like Niagara, they are terrifying and awe-inspiring. At others, they calm and delight. And they have inspired a range of music. Let me suggest Waterfall by the Stone Roses, or Waterfalls by TLC, or the meditative Waterfalls by Paul McCartney. Or try Schubert's Gesang der Geister über den Wassern, based on a meditation by Goethe, as he watched the rapids pour over a waterfall. Maybe such pieces help us all to survive. Beyond that, if it's possible to travel, roads only slightly less well traveled than the path to Niagara can lead to delights in the presence of nature. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Hey, thanks for the information. your posts are informative and useful.

ReplyDeleteSteel Sector

Chalet Hotels

Ramkrishna Forgings Ltd

Rap Media Ltd