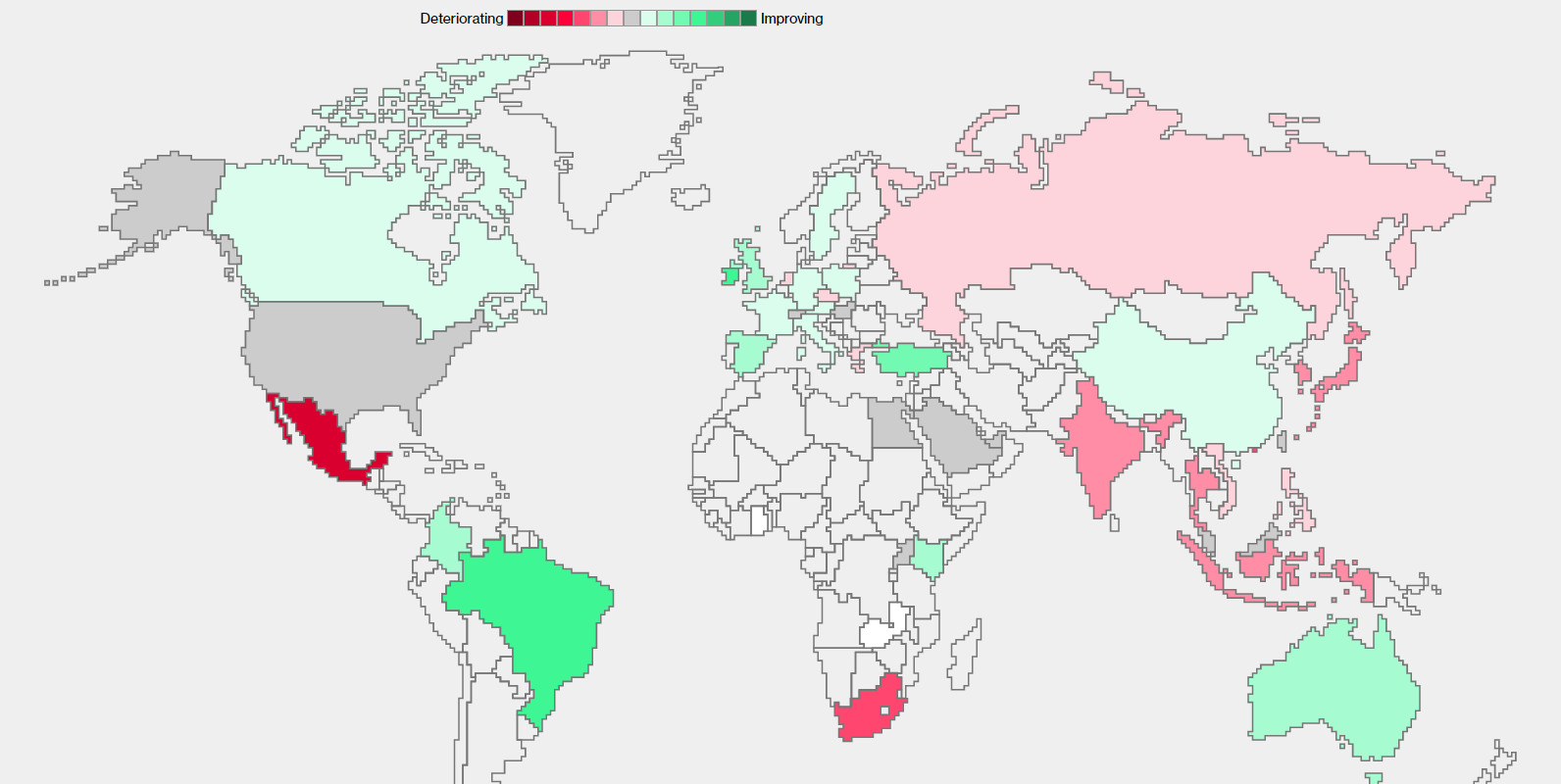

| Pompeo wants Chinese apps removed from U.S. platforms. Democrats demand more concessions on stimulus. And hedge funds are feeling the heat from market volatility. Here are some of the things people in markets are talking about today. In a possible hint of more to come, Secretary of State Michael Pompeo said the U.S. wants to see "untrusted Chinese apps" removed from app stores like those operated by Apple and Google. He also called for companies to limit availability of their apps on phones made by Huawei Technologies and to end the use of Chinese cloud providers. Pompeo's guidance stopped short of an ultimatum and isn't binding, but it represents an escalation in U.S. President Donald Trump's efforts to limit the spread of Chinese technology. Trump has already pledged to ban Chinese-owned video app TikTok from the U.S. by Sept. 15 unless its American operations are sold to a local company. Meanwhile, Instagram has sparked controversy by launching Reels, a TikTok copycat. Asian stocks looked set for a muted start after three days of gains. U.S. equities earlier climbed amid encouraging news on the vaccine front and speculation lawmakers are making progress on an economic aid package, while the dollar fell. Futures in Japan and Hong Kong were flat, while those in Australia edged higher. The S&P 500 Index rose to within 2% of its record closing high. Ten-year Treasury yields climbed. Oil rose after a government report showed a decline in U.S. stockpiles, while gold continued its ascent above a record $2,000 an ounce. U.S. Democrats are demanding more concessions from the White House if the two sides are going to meet their goal of striking a deal on new pandemic relief by the end of the week. But Senate Majority Leader Mitch McConnell and other Republicans put the blame on Democrats, saying they have refused to budge from their positions. White House Chief of Staff Mark Meadows and Treasury Secretary Steven Mnuchin told Republican lawmakers Wednesday that if a deal wasn't reached by Friday there would be no agreement, according to lawmakers. The White House has offered $400 per week in supplemental unemployment benefits through Dec. 14, but Democrats are insisting on $600 per week, according to people familiar with the details. Mnuchin and Meadows also put $200 billion in state and local aid on the table — far less than the $1 trillion Democrats were seeking. Renaissance Technologies, one of the industry's best performing hedge fund firms, is down 13.4% this year in its biggest fund open to the public —even though the U.S. stock market is surging. While the Renaissance Institutional Equities Fund gained 2.4% last month, it was still outpaced by equities for the year, a rarity in the four-decade history of the firm founded by Jim Simons. Its two market-neutral funds didn't fare any better. Amid market volatility this year, the firm has said it plans to find ways to improve the models that run its stock hedge fund after its biggest money loss ever in March's rout. The setback shows the turmoil wrought by the coronavirus crisis, which has stalled global commerce and roiled markets. Still, that hasn't stopped the hedge funds — the relentless rally in American equities is emboldening them, at a time when their own clients are getting worried. Chinese electric-car startup Karma Automotive is being accused of stealing vehicle plans from a U.S. company with which it discussed a joint venture. VLF Automotive, a niche carmaker co-founded by former General Motors executive Bob Lutz, filed a suit against Karma in California's Superior Court in June. VLF claims it shared its plans for a "luxury Humvee" with Karma last fall as part of a proposed partnership to produce the vehicle for the Chinese market, but Karma tried to cut it out of the deal. VLF is seeking at least $18.5 million in damages. The lawsuit comes as Karma tries to capitalize on the rally in shares of EV makers such as Tesla and Nikola. Karma told Bloomberg in early July it had raised a third of the $300 million it's seeking by selling stakes to private equity investors. What We've Been Reading This is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in this morning PMIs are turning into everyone's favorite economic punching bag at the moment and I'm afraid I can't resist joining in. The surveys are supposed to measure month-on-month changes, asking managers whether things have improved or worsened between, say, June and July. But responses have been skewed by recent dramatic events — it turns out people aren't good at measuring their own experiences to a month-on-month basis after going through big changes. On Monday, economists at Bank of America Merrill Lynch noted that "there is something seriously wrong with the way people are responding to these surveys ... it could be that some respondents are correctly filling out the survey — reporting that activity is up relative to the prior month — and others are incorrectly filling out the survey — comparing June activity to some kind of normal level rather than to May." Of course, the criticism hints at another shortcoming of the PMIs. That is, even if respondents correctly calibrate their responses to the survey questions, a PMI of 50 or slightly above is going to indicate stagnation or modest improvement at a much lower level of output than before the pandemic.  You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment