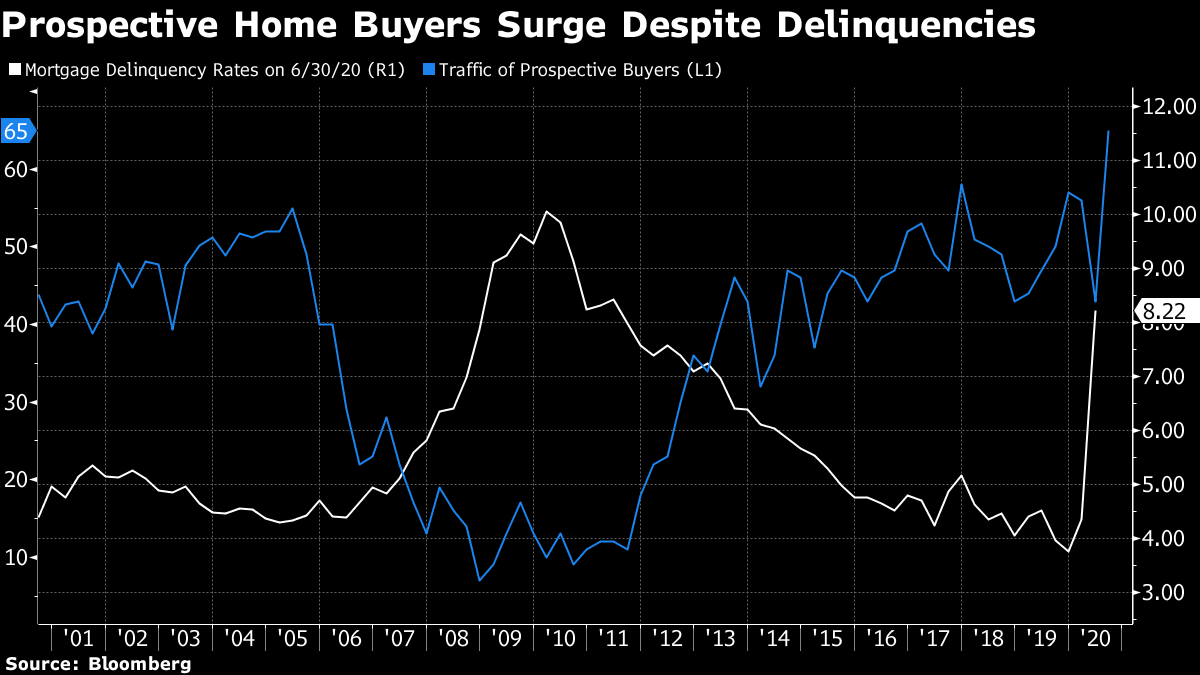

U.S. stocks rally in speediest return to a record ever. U.S. warns colleges to divest of Chinese shares. Asia's richest man takes on Amazon. Here are some of the things people in markets are talking about today. U.S. stocks completed their fastest-ever return to a record after a drop of at least 20%, surpassing February highs for the first time since the pandemic upended financial markets. The dollar fell to the lowest in more than two years, while Treasuries advanced. S&P 500 futures opened flat in Asia. The S&P 500 eked out a gain, capping a 52% rally from its March low. Technology shares pushed the gauge above its Feb. 19 closing record after failed attempts in three of the past four sessions. Homebuilders also rose as a report showed housing starts increased the most since 2016. Futures indicated a muted start in Asia as the Trump administration warned U.S. colleges to divest of Chinese stocks. Gold was back above $2,000 an ounce. In contrast to the buoyant moves in stocks, currency traders are anxious about the unknowns of the coming months and their impact on the dollar. The correlation between currency and stock volatility fell below zero this month to the lowest since 2009. The U.S. State Department is asking colleges and universities to divest from Chinese holdings in their endowments, warning schools in a letter Tuesday to get ahead of potentially more onerous measures on holding the shares. "Boards of U.S. university endowments would be prudent to divest from People's Republic of China firms' stocks in the likely outcome that enhanced listing standards lead to a wholesale de-listing of PRC firms from U.S. exchanges by the end of next year," Keith Krach, undersecretary for economic growth, energy and the environment, wrote in the letter viewed by Bloomberg. U.S.-China tensions are rising as the American presidential election looms: On Tuesday, President Donald Trump said he called off last weekend's trade talks with China and that Beijing's handling of the coronavirus is "unthinkable." Asia's richest man spent the early few months of the pandemic raising more than $20 billion by selling stakes in his technology venture. Now, Mukesh Ambani is on a shopping spree. The Indian billionaire is looking to acquire several local online retailers to help expand product offerings, people familiar with the matter said, as he races to build his e-commerce platform and compete against Amazon.com. Reliance Industries, Ambani's oil, retail and telecommunications conglomerate, is in various stages of negotiations to either buy out or purchase stakes in Urban Ladder, an online furniture seller, Zivame, a lingerie maker, and Netmeds, which delivers medicine, the people said. There's no certainty the deliberations may result in a deal, they added. Goldman Sachs and Malaysia have signed an agreement to finalize the $3.9 billion settlement over the 1MDB scandal, according to people familiar with the matter. The U.S. bank formalized the deal on Tuesday and must make a $2.5 billion cash payment to Malaysia within 10 days, said the people, who asked not to be identified as the information is private. The pact reached in July was a major step toward resolving the scandal surrounding 1MDB, a Malaysian state fund that's at the center of global investigations into corruption and money-laundering. It involved Goldman Sachs agreeing to pay $2.5 billion in cash and guaranteeing the return of $1.4 billion of 1MDB assets seized by authorities around the world, in exchange for Malaysia dropping charges against the bank. Singapore is blazing a trail in the global effort to replace Libor, becoming one of the first countries to auction debt linked to an alternative benchmark. The Monetary Authority of Singapore sold S$500 million ($366 million) of six-month notes with a spread over the compounded Singapore Overnight Rate Average on Tuesday. The country is adopting SORA as it moves away from the SGD Swap offer rate, which uses the London interbank offered rate in computation. The move is part of a broader global push to develop new benchmarks to replace Libor by the end of 2021, after trading informing the rate dried up and European and U.S. banks were found to have manipulated it for their own gain. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in this morningOne of the defining characteristics of the Covid-19-induced economic crisis is that it's playing out in very different ways depending on who you are. In capital markets, for instance, big companies have been able to sell lots of debt to eager investors while smaller firms are struggling for financing. But there are signs of it everywhere. If you're lucky enough to be employed and have some savings, then you may have been browsing real-estate listings hoping to snap up a bargain — data overnight showed U.S. housing starts jumping by the most since 2016. But if you've been laid off and don't have much of a cash buffer, then you may be struggling to make payments on your mortgage. Delinquencies continue to surge even as more people are expressing interest in buying a home, as the chart from my Bloomberg colleague Dan Curtis shows below. Similarly, if you have exposure to U.S. stocks through retirement plans or just a private investment portfolio, you're likely taking some comfort from markets being at all-time highs. If you don't, then the market probably feels pretty divorced from the real economy.  Of course, recessions are always going to result in varying experiences for different people and companies, but the propensity of the current crisis to create winners and losers seems extreme. Some industries are booming while others have been shuttered altogether. The schizophrenic nature of this economic experience might be one reason why fund management professionals are starting to turn bullish on the economy. The latest Bank of America survey shows the percentage of managers who think we're in a recession is shrinking rapidly — down to just 53% from as much as 90% just a month or two ago. Meanwhile, the number of managers who think we're in the early stages of a fresh economic cycle is beginning to climb. If you have two very different economic data sets, you might be inclined to believe the one that most closely reflects your own experience. You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment