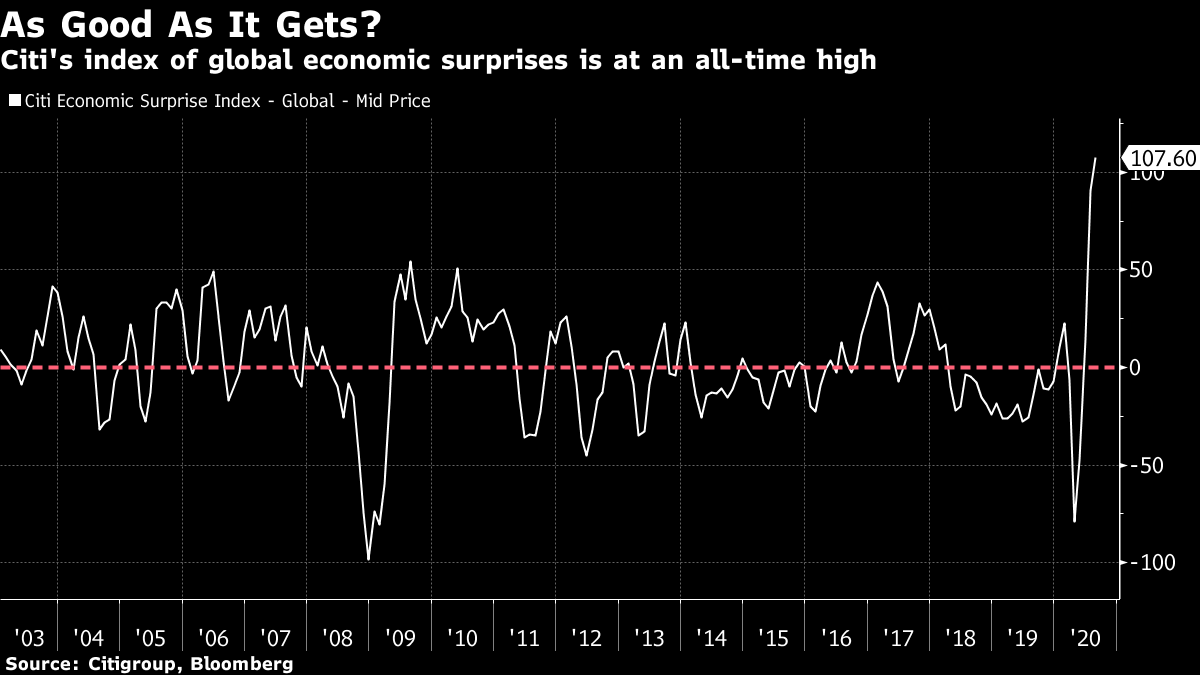

South Korea warns of a "massive" second virus outbreak as U.S. infections slow. The markets look for guidance as the Federal Reserve holds its annual economic policy gathering remotely. Alibaba investors swap U.S. shares for Hong Kong stock. Here are some of the things people in markets are talking about today. The South Korean government is studying the need to raise social-distancing restrictions to the highest level as officials warn the country is at the risk of a "massive nationwide outbreak." An additional 397 new virus cases were reported on Sunday, the highest number since March 7. A quarter of those cases were reported outside of Seoul's metropolitan area. Infections have exceeded 300 for three days. This comes as cases in Europe and Asia are on the rise again, while they are slowing in the U.S. India marked a grim milestone with 3 million infections. The global pandemic passed 800,000 deaths and 23 million cases. President Donald Trump announced that a new treatment involving blood plasma donated by people who've recovered from the disease has received emergency use authorization. Here's how Bloomberg is tracking the virus. The dollar was steady in early trading and stocks in Asia looked set for a muted start to the week, as investors monitored a mixed global picture for the coronavirus and looked ahead to Federal Reserve Chair Jerome Powell's policy speech on Thursday. The greenback was steady against most G-10 peers as currency markets opened. S&P 500 futures nudged up at the open. Equity-index futures signaled a small decline when Japan begins trading, while South Korean assets will be closely watched as that country considered further restrictions to halt an infection flareup there. U.S. shares ended Friday with a fourth week of gains and tech shares set a fresh all-time high. Several of Alibaba Group's biggest investors have converted billions of dollars in U.S. shares for Hong Kong stock, in part to avoid potential U.S. sanctions and de-listings of major Chinese technology companies. Temasek, Baillie Gifford and Matthews Asia are among the major shareholders that have swapped stakes in the Chinese e-commerce giant to take advantage of new rules easing the switch following Alibaba's listing in Hong Kong last year. The shifts are a sign that the Trump administration's fierce rhetoric against Chinese tech firms is prompting investors to take steps to avoid the potential fallout. At the same time, as Chinese companies seek more dual listings in Hong Kong, the moves threaten to drain liquidity of the New York shares. China's banking regulator pledged its backing for Hong Kong as a finance hub and reiterated a commitment to opening up the Chinese financial sector amid a deepening standoff with the U.S. China will provide support for its financial institutions who are doing business in Hong Kong while complying with regulations and offering services to residents and companies, the China Banking and Insurance Regulatory Commission said in a statement on its website on Saturday. Tensions between the U.S. and China over Hong Kong have sparked tit-for-tat sanctions on politicians and officials on both sides that have left global banking institutions walking a tightrope between the two world powers. The rehiring of temporarily laid-off workers will continue to bolster the U.S. labor market's recovery in the months ahead, but Goldman Sachs expects almost a quarter of those layoffs to become permanent. In the early months of the pandemic, employers shed more than 22 million people from their payrolls. The staggering figure had a small silver lining: The majority of those layoffs were billed as temporary. When state economies began to reopen, the rehiring of many of those workers helped drive the labor market's rebound in May, June and July. With more than 9.2 million unemployed still on temporary layoff, "the labor market seems poised for additional large job gains later this year," Joseph Briggs, an economist at Goldman Sachs, wrote in a research note on Friday. Meanwhile, here's one part of the U.S. where wages are soaring. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in this morning"As Good As It Gets" is a 1997 romantic comedy starring Jack Nicholson as an obsessive-compulsive misanthrope. It might also be an apt description of the current state of economic data. Deutsche Bank's George Saravelos points out that Citigroup's global index of economic surprises is at an all-time high. The fact that economic data have often surprised to the upside despite massive shutdowns mandated by Covid-19 containment measures is one reason why markets have arguably been able to rally so far. But far from being a sign of encouragement for global markets, investors should be asking how long that level of positivity can be maintained — especially as the summer ebbs away. Per Saravelos: "The critical difficulty is that as the weather turns less warm, it will be more difficult to manage economic activity in closed spaces. Q4 is unlikely to be a repeat of the last few months."  You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment