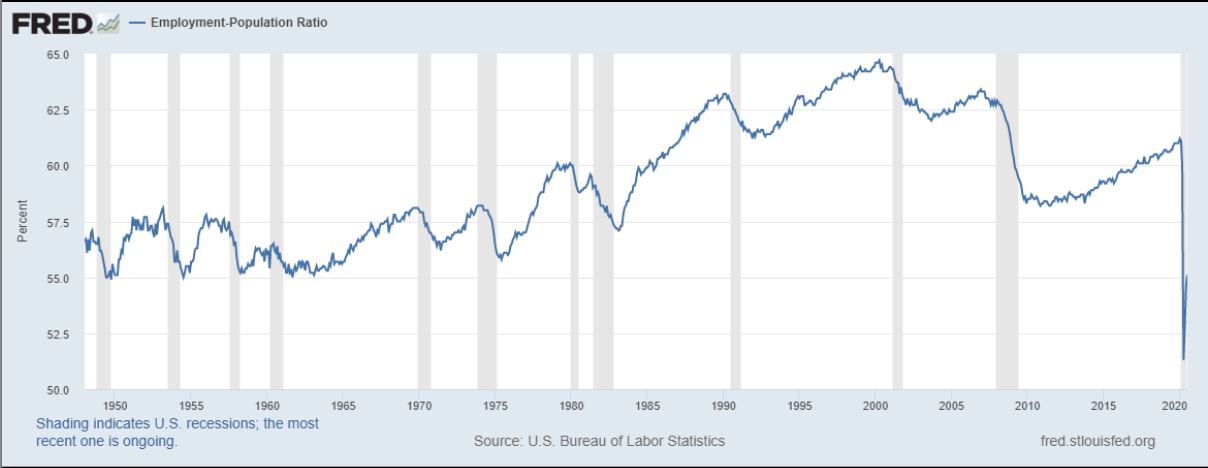

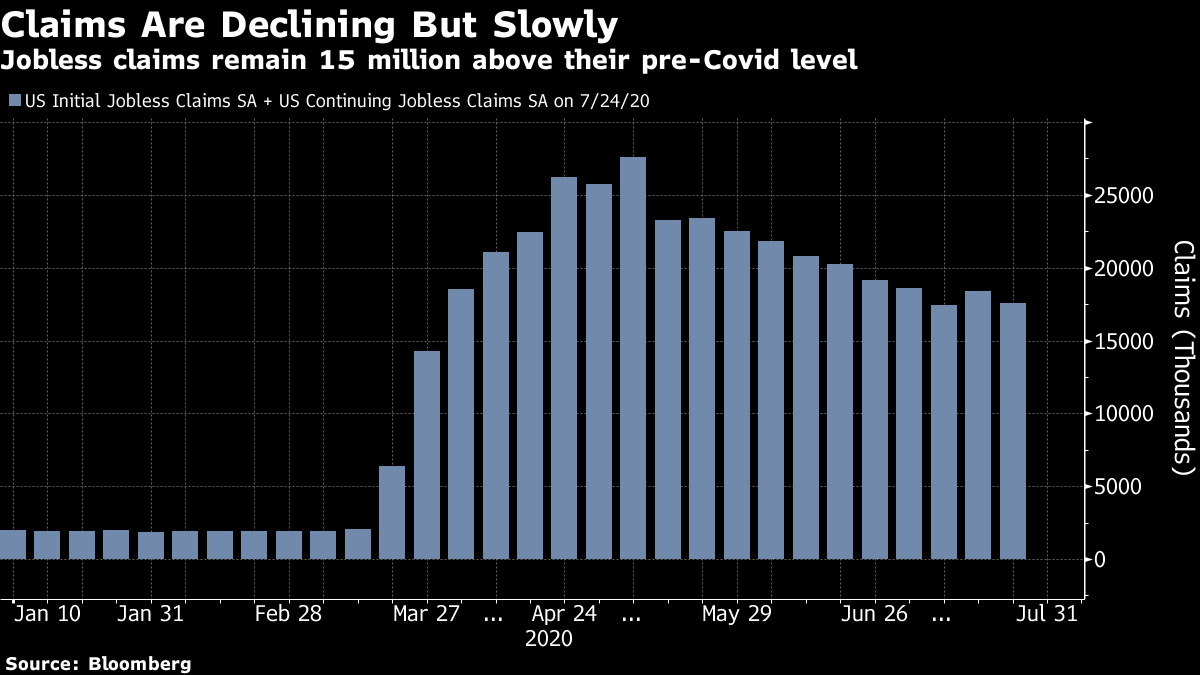

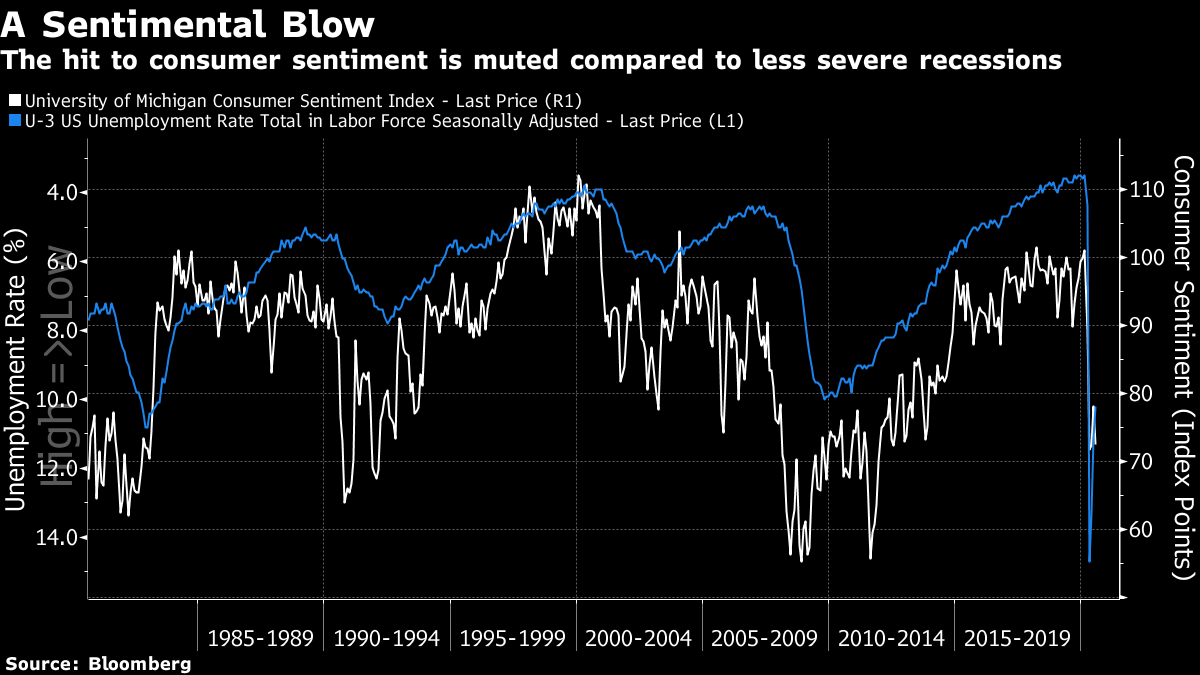

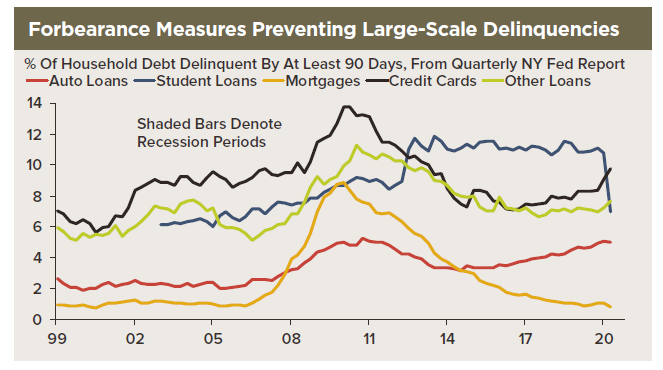

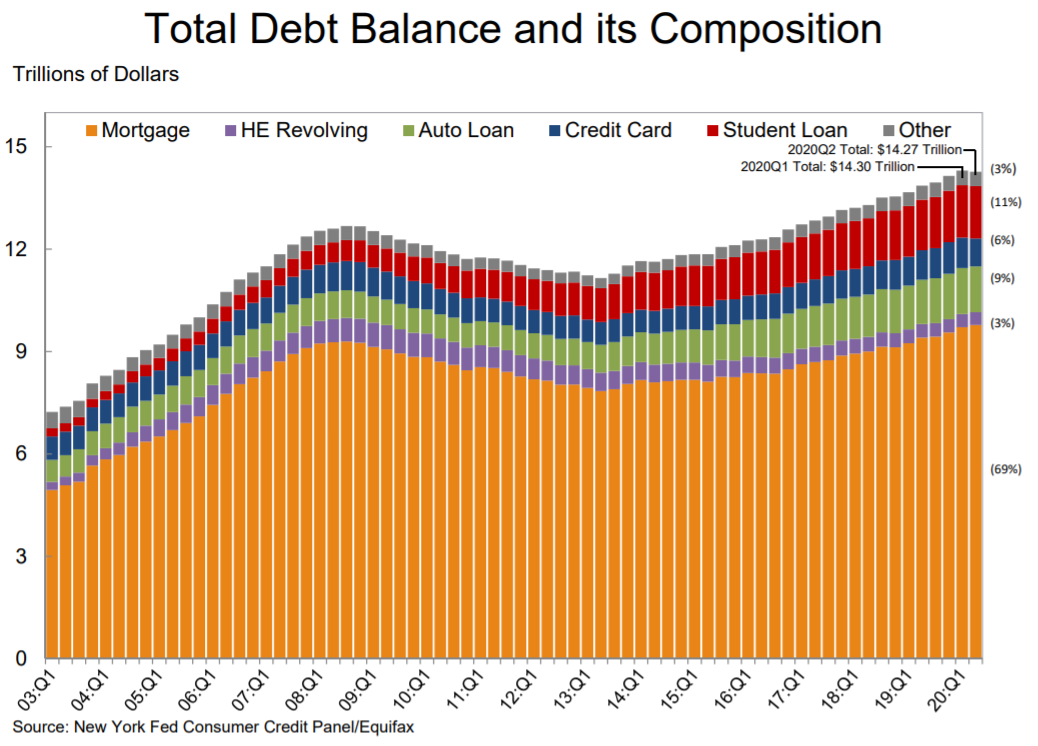

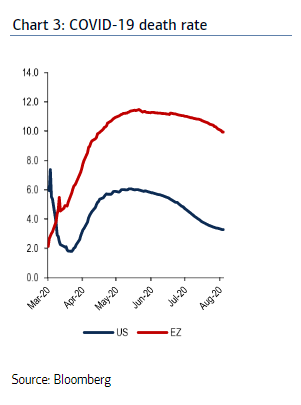

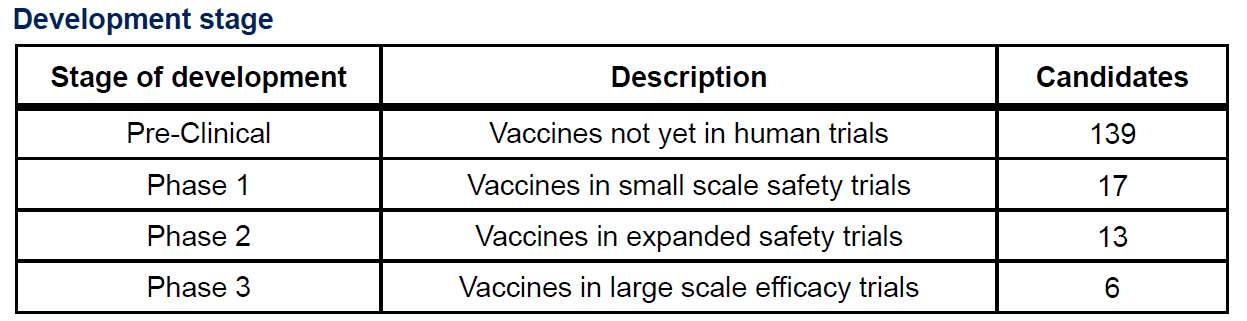

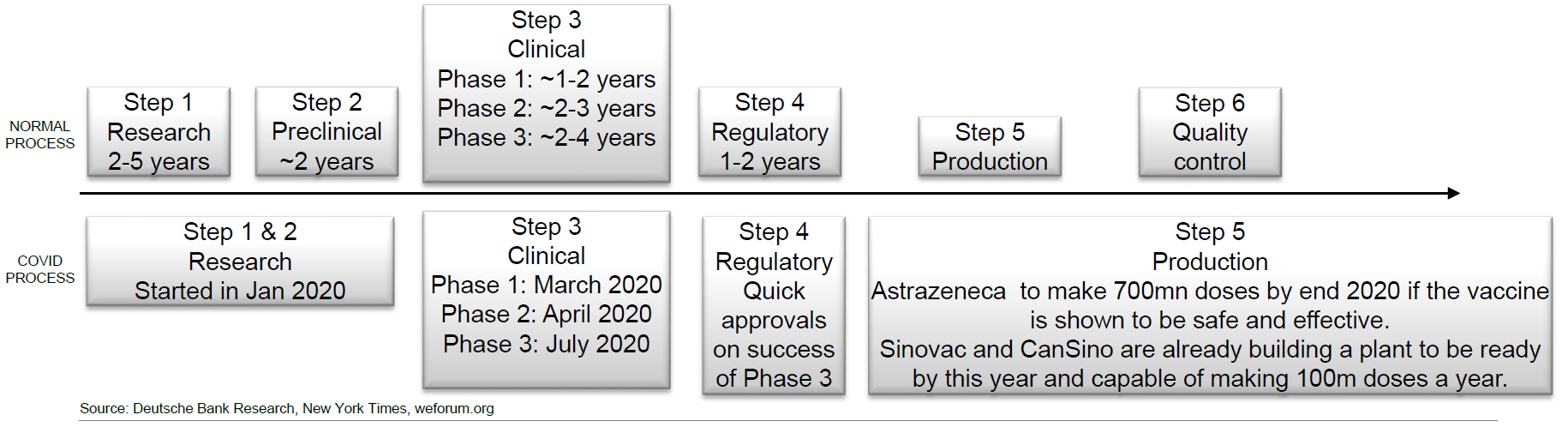

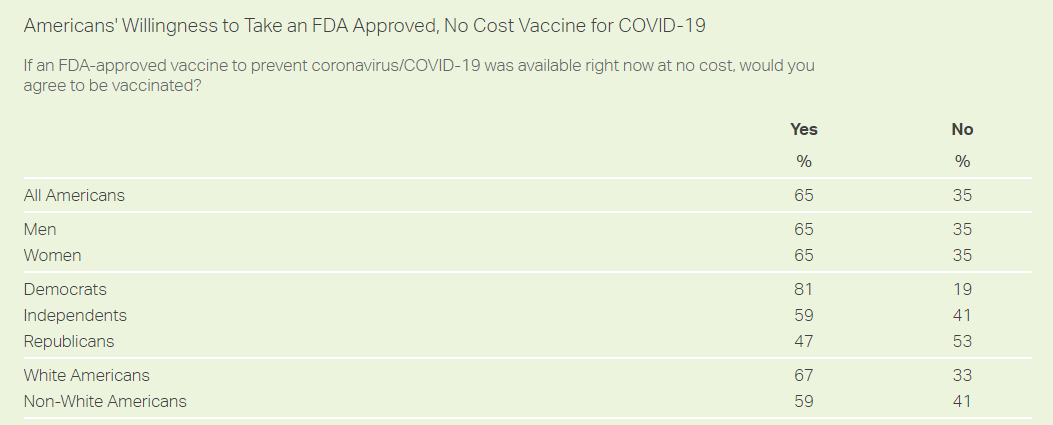

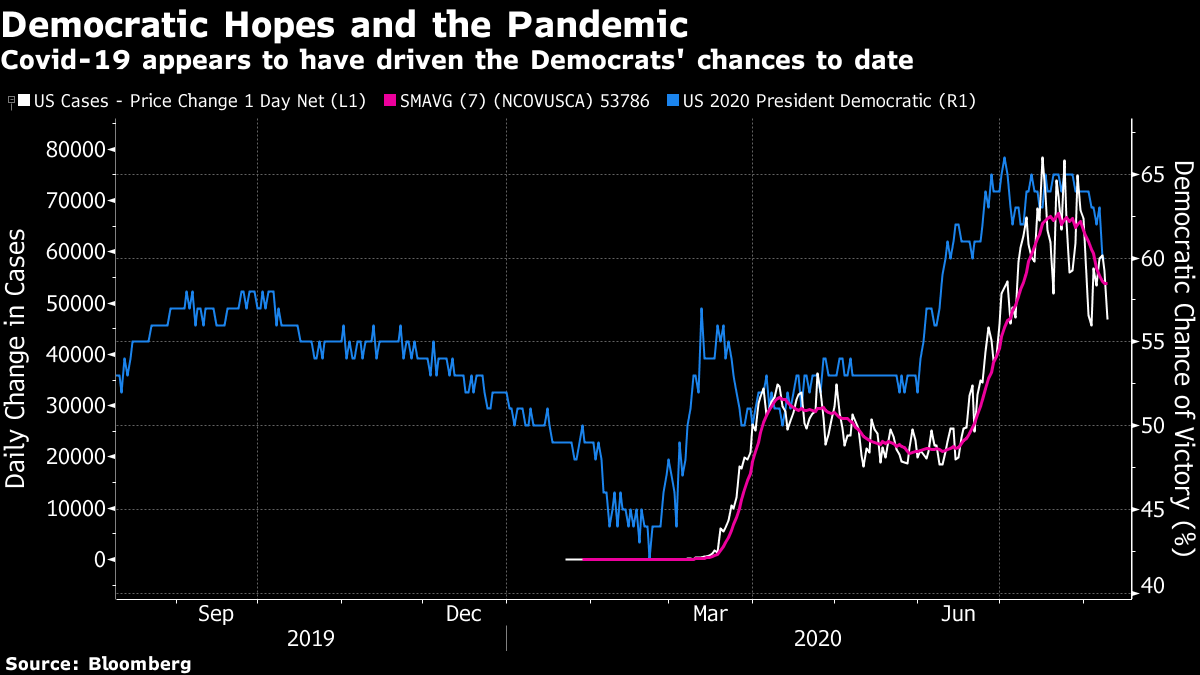

Known Unknowns What follows is dedicated to Donald Rumsfeld and to Athanasios Vamvakidis, foreign exchange strategist at BofA Securities Inc. Rumsfeld, a former U.S. defense secretary, bequeathed to humanity the endlessly useful concept of "known and unknown unknowns." It turned out that there were far more unknowns in Iraq than he had suspected. Meanwhile, Vamvakidis is arguing that the market consensus the dollar is in a prolonged downward trend is down to complacency about "seven known unknowns." This is how he explains his point: In the short term, we are concerned the consensus is too optimistic on the global economy; too optimistic on a vaccine; too pessimistic on the COVID-19 situation in the US compared with that in Europe; and complacent about the US elections. In the longer term, we disagree with the view that the EU Recovery Fund sets a precedent; we are concerned that the consensus is focused too much on the deterioration of the US debt and is complacent about similar trends in the rest of the world; the consensus expects the Fed to keep policies loose for a long time, but may be missing a possibility that the ECB may need to keep policies loose for even longer. His points are well made. I'd like to adapt them a little: How many Americans are really unemployed? There's no need to allege nefarious intent by the Bureau of Labor Statistics. The concept of whether someone has a job or not has arguably never been harder to measure. The rebound in the employment rate owes much to what the BLS itself says could be over-counting, and to a large number of people leaving the "workforce," meaning that they are no longer looking for work. If we look at employment as a proportion of the total population aged 18 and over, the picture looks much worse:  The measure isn't ideal, as it includes those who are voluntarily unemployed because they are retired, and so the apparent employment rate will worsen as the elderly make up a larger share of the population. The rises in the 1960s and 1970s were driven more by women moving into the workforce than by a buoyant economy. Even so, the fact that a higher proportion of the population has no paid job than at any time since the war (bar the early months of the pandemic), is disquieting.  How much stimulus will American politicians agree on? This remains very much unknown, more than a week after the deadline for initial Covid assistance to expire. Donald Trump's dramatic intervention is unlikely to resolve the uncertainty anytime soon, given the extent of opposition to his executive orders. The key political issue is that the president has ordered continuing payments of $400 per week, down from the original $600, for people rendered jobless — and $100 of this has to come from states. As they are suffering deep revenue shortfalls already, and had been expecting more help, it is highly unlikely that they will pay. That would mean support dropping to $300 per week, which would potentially have a huge impact on consumer spending and defaults. The possibility of job losses would also rise. The election, less than three months away, adds to the complexity. Republican senators up for re-election in November will be reluctant to face the electorate after failing to reach a deal. And Democrats in the House know that they must not overplay their hand. In past tussles over government shutdowns, Democrats have generally been able to make Republicans take the political blame; in the current febrile atmosphere, they cannot take this for granted. In short, everyone should know that they don't know how this will end; the range of possible outcomes is wide. Just how much difference did the first stimulus make? There is so much noise that little is clear. But one or two indicators suggest it made a big difference. For one, look at the Michigan Consumer Sentiment survey. It took a drastic hit from the pandemic — but remained well above the lows from the GFC, despite much greater damage to employment. Prompt action to cushion the blow may have had more of an effect on confidence and spending patterns.  While we can never know the counterfactual, it might also have affected attitudes to the job market. This point from Daniel Clifton of Strategas won't have passed Republican senators by — just possibly, these payments might have deterred a few workers from seeking employment: The sharp drop in unemployment claims [last week] could be a sign that the expiration of the additional $600 per week benefit could lead to improvements in the labor market. Following the financial crisis, just the reduction in the number of weeks eligible for unemployment claims led to significant improvements in job creation. If we continue to see a downtrend in claims, this will embolden Republicans that the high benefit level is impeding the labor market. This may force Democrats off the demand that $600 per week remain in place through 2020 as part of future stimulus negotiations. Could this effect really be significant? It's a little hard to believe, though the payments were supposed to have an impact. Now we come to the critical issue of debt. News of corporate bankruptcies continues to trickle out. Meanwhile, the New York Federal Reserve's latest report on credit suggests official attempts at forbearance may have made a big difference. Credit-card delinquency continues to rise, but there has been remarkably little impact on the quality of mortgage debt:  The total debt balance actually decreased in the second quarter. Admittedly, the decline was tiny, and owes much to slowing spending. Still, as my Bloomberg Opinion colleague Brian Chappatta points out, credit-card balances fell by $76 billion in the quarter, the biggest drop on record. This suggests that the federal programs made a difference — households not only retrenched spending, but also wisely took advantage of government largesse to reduce outstanding debts. The implication is that the risk of a secondary economic crisis driven by insolvency would be great if Congress and the White House cannot thrash out a deal.  How much worse is Covid-19 in the U.S. compared to Europe? The answer could be critical for the future of the dollar, which has weakened significantly over the period in which Covid has come under control in Europe. It's hard to doubt that the pandemic has been less damaging to Europe, though it's questionable whether the gap is as wide as it first appears. During the president's notorious interview with Axios, he presented a chart that showed the U.S. leading the world in deaths as a proportion of cases. This isn't the most relevant or important measure, but the point was correct. This chart from BofA's Vamvakidis compares the U.S and euro zone:  How to explain the gap? In part, it is because medics have grown better at keeping Covid patients alive as time goes by, while the great growth in European cases came earlier when the disease was less well understood. It is also possible that the EU did a worse job of protecting the elderly. While there might be something to both these explanations, a more powerful one would be that the Americans are testing more and identifying more cases — and that there are more cases in Europe than is currently realized. If that is true, the European response to Covid-19 may not be as successful as it appears. If Europe's disquieting resurgences of Covid turn into a more serious wave over the next few months, it will also knock away a key reason for dollar weakness. When will the vaccine arrive? Listening to politicians in the U.S., one theme recurs. Mitch McConnell, Republican leader in the Senate, Nancy Pelosi, the Democratic speaker of the House, and the president's economic adviser Larry Kudlow have all referred to providing aid "until we get a vaccine." The unspoken assumption is that the economy will need some kind of support until a successful vaccine can be identified and mass-produced. That is a problem. Talking to experts in the field for this piece, many said they were braced for the first four or five vaccine candidates to fail. Those that succeed might need booster or extra shots; and ramping up production is difficult, particularly as supply chains stretch across countries. Jim Reid of Deutsche Bank AG offers this handy summary of where different efforts have reached:  This is a massive global project. If it is successful in delivering a vaccine by the end of the year, it will have upended all previous experience. Here is Reid's summary of the usual vaccine process compared with the Covid-19 effort:  Special measures to tide the economy through could have to stay in place for a long time. That leads to another question: Will enough people take it to make a difference? The faster the vaccine is produced, the greater will be doubts among the public over whether it is safe to take. Hesitancy spreads far beyond the small but growing group of vaccine opponents. It also spreads beyond the U.S. Here is some polling evidence I cited last week: A recent poll in Canada found that a third of Canadians would wait, and try to make sure there were no side effects. In the U.S., a Politico/Morning Consult poll found 64% of Americans saying they were prepared to wait and wanted developers to take their time. In the U.K., a poll by YouGov found about 6% of Britons would definitely not get vaccinated, while 10% would "probably not," and 15% weren't sure. Since then, Gallup has published a new poll on the U.S. that suggests coming up with an effective vaccine will be at best only the first battle in a much lengthier campaign to immunize the population. Here are the key findings:  More than a third of Americans wouldn't take a vaccine now even if it were free and approved. Remarkably, a majority of Republicans wouldn't be prepared to take a vaccine. But this isn't solely about right-wing distrust of government. Non-white Americans, statistically at greater risk from the virus, are also skeptical, with 41% saying they wouldn't take it. Such numbers are far too high to establish the necessary level of immunity in the population to end the pandemic. They also suggest that opposition to a vaccine is so high that any attempt to make it compulsory would be a political non-starter. Building immunity will be a lengthy campaign. This looks as though it will make it very hard for the U.S. to bring the pandemic under control. In Europe, where vaccine hesitancy is less widespread, and in Asia the vaccine may have a much greater effect much more quickly. Which party will control U.S. politics next year? I suggested last week that the chance of Trump's re-election was growing, and this wasn't reflected in markets. Uncertainty itself would be enough to raise volatility. Judging by the responses, which generally suggested that I had taken leave of my senses, many people are working on the assumption that we already know who is going to win. I think betting markets have it right that Biden is the favorite, but by no means a prohibitive one:  The winner of the next presidential election is still a known unknown. So is the identity of the Democrats' nominee for the vice-presidency, still. Whoever is chosen, many will be disappointed. Survival Tips A programming note: I am on vacation for the next week. A change of scenery is good, and a family road trip can be a lot of fun. But do your best to avoid car trouble. The plan was to be at Niagara Falls by the time this newsletter appeared. Instead, I am finishing it in Utica, New York, not a well-known tourist spot, while we wait for a mechanic to look at the vehicle on the morrow. Have a good week. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment