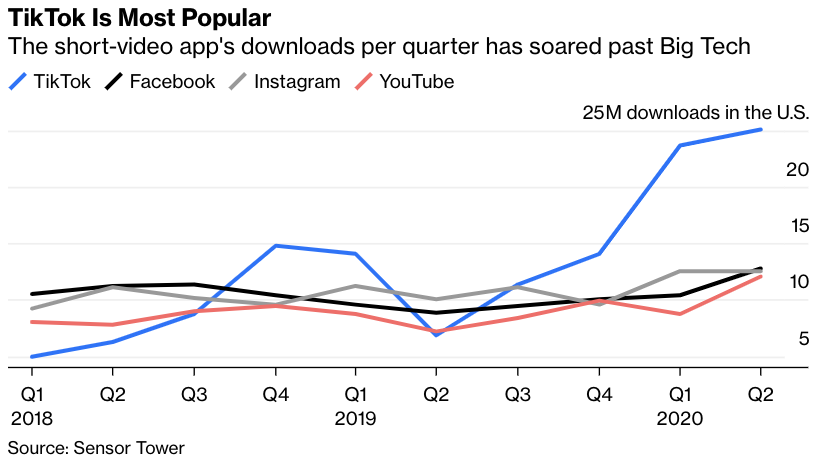

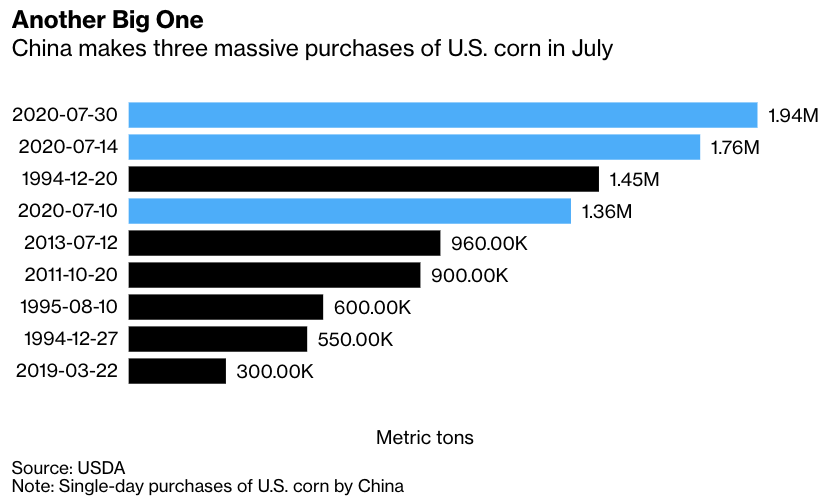

| If tensions between the U.S. and China are set to divide the world in two, it looks increasingly like those lines will be drawn around technology. TikTok is an evocative example. Threatened with a ban from the U.S. market, the Beijing-based owner of the wildly popular video app has sought to create of a version that's acceptable to American authorities – potentially owned by Microsoft – while maintaining one that is not. If Bytedance, TikTok's creator, is able to hash out an agreement to sell its U.S. business to Microsoft, it would then kick off the complicated process of untangling the technology behind the app along geographic borders. How that would be done is as yet unclear.  It's not a unique dilemma. Telecommunications carriers in the U.K. face a similar challenge after the British government, following plenty of lobbying from Washington, ordered them to remove all equipment produced by China's Huawei Technologies from their networks. That dilemma could also become less rare. U.S. Secretary of State Michael Pompeo this week introduced a "Clean Network" initiative that would push to sever American technology ties with China. More companies, both U.S. and Chinese, could find themselves in precarious positions if that proposal were to gain momentum in Washington. That's not to say, however, that this technological divide is being perpetuated by the U.S. alone. Chinese leaders have long espoused the notion of "cybersovereignty," which argues that governments should be allowed to set the rules for the internet within their own borders. Such rules have kept many of America's largest tech companies out of China. Imagine how Beijing might react if instead of just buying TikTok's operations in the U.S., Microsoft were to acquire the app globally, including the version within China that's named Douyin. It seems entirely reasonable for governments to have security concerns about how data on their citizens is collected, stored and used. The issue is whether addressing those concerns necessitates pulling a digital iron curtain across the world. Visiting Taiwan Seldom does U.S. Health and Human Services Secretary Alex Azar generate global headlines with his travel schedule. He did this week when it was announced that Azar would be the most-senior American official to visit Taiwan in four decades. Beijing was not pleased. Ruled separately since a civil war put the Communist Party in power on the mainland in 1949, Beijing views Taiwan as Chinese territory that should be unified with the mainland and has threatened to take the island by force if necessary. Any U.S action that fortify Taiwan's de facto independence have sparked sharp rebukes from Beijing. Indeed, it was not until President Donald Trump affirmed American support of the "One-China" policy, which acknowledges China and Taiwan are part of the same country, that Xi Jinping agreed to their first conversation in 2017. If Azar's trip signals a new willingness by the White House to use Taiwan as leverage, it could significantly ratchet up tensions. Trade Deal Senior American and Chinese officials are expected to meet later this month to review progress on their first-phase trade deal. Signed just six months ago, the question is whether the pact still makes sense today. After all, the world has changed dramatically since January. Tensions between the U.S. and China have surged, due in no small part to Covid-19. The signals out of Beijing though suggest China is keen to maintain the deal. The country has recently sped up its purchases of American farm goods, for example. The White House's thinking, though, is somewhat less clear. The last time senior officials from both sides spoke by phone in May, they pledged to jointly create favorable conditions for implementing the agreement. But shortly thereafter, President Trump wondered aloud during an interview if the deal was still worth keeping.  Belt Tightening Reining in salaries at China's state-owned companies was a trend before the coronavirus, when it was driven by Beijing's desire to stamp out any signs of lavishness across officialdom. Covid-19 has added a financial incentive. Tax cuts and fiscal stimulus designed to buffer the economy against the pandemic have drained government coffers and left officials looking to raise revenue. One way Beijing is looking to do so is by paying its bankers less. Financial institutions owned by the central government, including China's largest commercial bank, biggest investment conglomerate and sovereign wealth fund, have been told to cut wages. And while the specific amounts are unclear, some firms could see salaries reduced by 30% on average. That will make it challenging to retain talent, especially as the opening of the country's financial services industry brings in a wave of foreign players eager to hire. Testing Boost It's become increasingly clear during the pandemic that the more testing a jurisdiction does, the more effective its efforts against the virus tend to be. This is where Hong Kong has run into problems. The city has only been able to run about 10,000 tests a day, or about half the pace of places such as the Australian state of Victoria, which like Hong Kong is also facing a new wave of infections. In that context, it makes sense for Beijing to offer help, which it did this week by sending a team that pledged to increase testing capacity to as much as 200,000 samples a day. That's a 20-fold boost and a not-so-shabby public-relations move. Activists in Hong Kong though were quick to raise concerns that authorities could use the tests as a pretext to collect DNA, an allegation the city government quickly denied. For all the change Covid-19 has thrust on Hong Kong, it looks like the virus will have little impact on the city's divided politics.  Technicians process Covid-19 tests at a Hong Kong laboratory on Friday, July 31. Photographer: Roy Liu/Bloomberg What We're Reading And finally, a few other things that caught our attention: |

Post a Comment