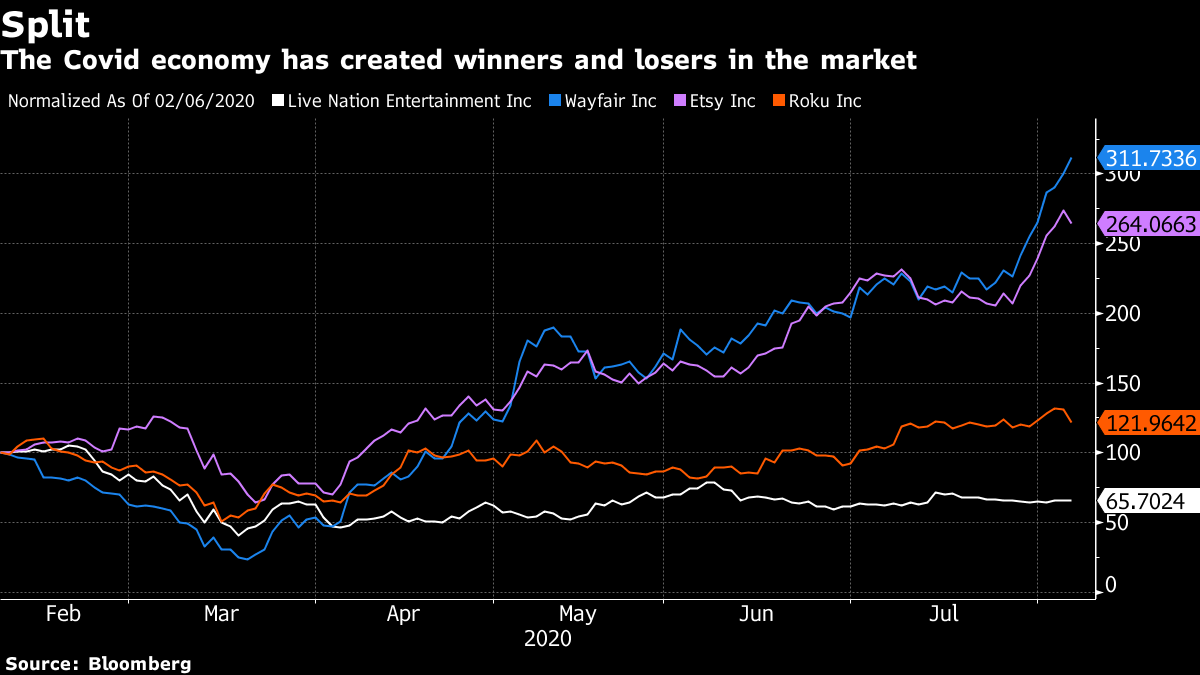

| The U.S. moves to tighten disclosure requirements for Chinese listings. A hedge fund outperforms 98% of its peers thanks to one stock pick. And China's hottest tech stocks are set to move twice as much. Here are some of the things people in markets are talking about today. A U.S. panel recommended tightening the disclosure requirements for Chinese companies listed on American exchanges, following mounting concerns about the potential exposure of investors to fraud. The group, known as the President's Working Group on Financial Markets, has not established exactly how the new rules will be enforced, but the final consequence would be delisting, according to a senior Treasury official. One of the big issues includes an almost two-decade-old dispute over China's refusal to allow the inspectors from the Public Company Accounting Oversight Board to review audits. Currently listed Chinese companies would have until Jan. 1, 2022, to come into compliance, while firms seeking a new listing will need to adhere to the new rules, officials told reporters Thursday. Asian stocks looked set for a mixed open Friday as investors weighed hopes for an agreement on a stimulus package from Washington against continued U.S.-China tensions. Shares closed higher on Wall Street and the dollar retreated. Futures were little changed in Japan, dipped in Australia and pointed higher in Hong Kong. The S&P 500 gained for a fifth day, with Apple Inc. leading the charge as it reached a record. Applications for U.S. unemployment benefits unexpectedly fell last week to the lowest since March, offering a ray of hope for the economy. Gold extended gains amid speculation interest rates will stay low for longer, while Treasuries ticked higher. Oil futures fell for the first time in a week. A prescient investment in an Australian data-center operator has helped a Sydney-based hedge fund outperform most of its rivals this year. The Alceon High Conviction Absolute Return Fund has gained 13% so far in 2020 and is beating 98% of its peers. The stock was NextDC, one of the fund's first picks back in 2017, and it's been a main driver behind returns during the coronavirus pandemic, portfolio manager Daniel Chersky said. NextDC has surged 82% this year amid increased demand for data storage services. While the current health crisis has highlighted the industry's importance in the digital age, the shift toward cloud services still has decades to play out, Chersky said. Get ready for 20% moves in some of China's most volatile and sought-after equities. Stocks on the Nasdaq-like ChiNext board will be allowed to rise or fall at twice the current 10% cap as soon as mid-August. Two firms started offering new shares on the venue Tuesday, and it normally takes two to three weeks for those stocks to start trading after prospectus releases. The changes — which won't yet apply to main boards in Shanghai and Shenzhen — mean the $1.4 trillion ChiNext can serve as a testing ground for whether Beijing can loosen its tight grip on trading without unleashing chaos. In a market that often sees daily moves of 5% or more, greater volatility will test an official narrative swinging from encouragement to urging restraint. From China's Luckin Coffee to Singapore's commodity trading firm Hin Leong, a spate of company scandals in Asia is fueling a hiring boom for corporate investigators as investors around the world brace for more corporate malfeasance. In times of economic downturn, more instances of fraud tend to come to light and individuals are also under greater pressure to perpetuate the wrongdoing, according to Chris Fordham, managing director at Alvarez & Marsal's disputes and investigations team in Hong Kong and China. The company hopes to increase the disputes and investigations team headcount from around 35 to 75 in the next two to three years. More than half of the increase will likely be in mainland China, where governance and murky accounting among firms are growing areas of concern for international investors as the nation opens up its capital markets. What We've Been Reading This is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in this morning One of the themes I keep returning to is the pandemic's ability to create both winners and losers in business and investing. As Ben Emons at Medley Global Advisors notes: "Markets have learned there is a split in the economy between services to stay at home and traditional services to reopen." That dynamic was on full display this week, when a bunch of companies in the U.S. unveiled their second-quarter earnings on a single day. Businesses associated with stay-at-home services like online shopping or video streaming — things like Etsy, Wayfair and Roku — all beat expectations on Wednesday. Meanwhile companies associated with going out — like Live Nation Entertainment — did even worse than expected. The question is how much businesses on the wrong side of the coronavirus economy can adapt to the new environment and how quickly.  That "winners and losers" dynamic is also apparent in other parts of the market, of course. In real estate, for instance, multifamily housing has performed surprisingly well in recent months — largely thanks to additional money provided in the CARES Act that helped people pay their mortgages — while commercial real estate has fallen off a cliff, as retailers go bankrupt and offices close. That leads me to an even bigger question for investors at the moment: At what point does a softer economy start eating into consumers' spending power and begin to hit even the outperforming businesses and market segments? You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment