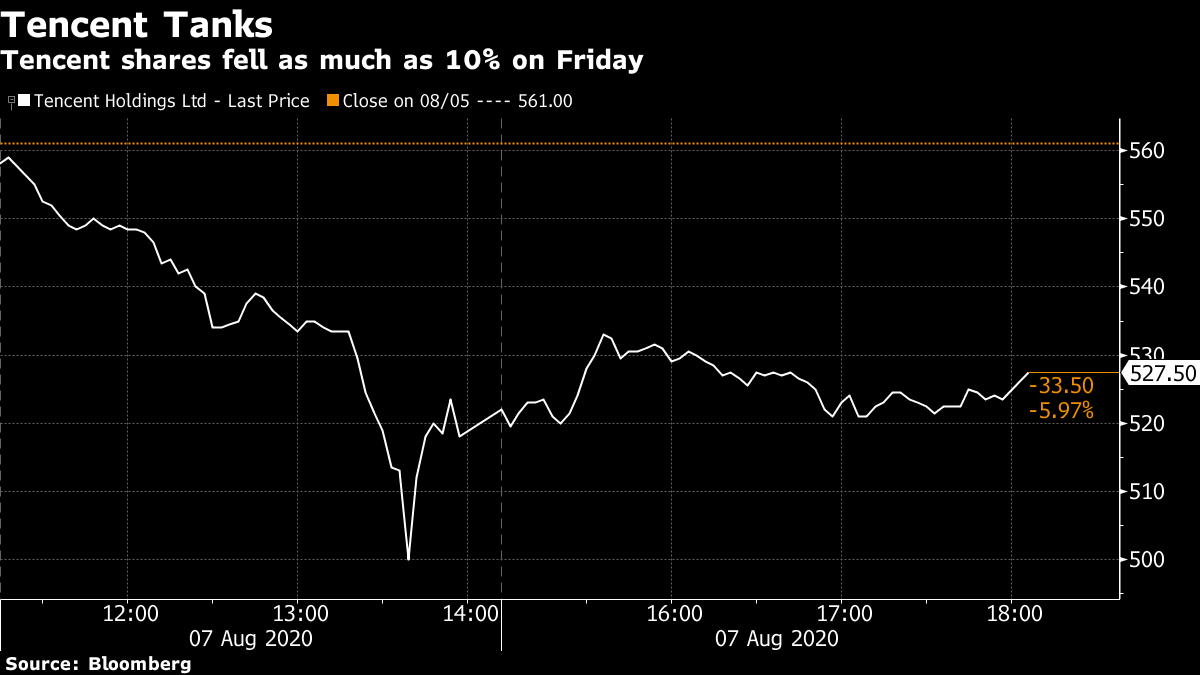

| The U.S. passes 5 million Covid-19 infections. Hong Kong accuses America of "doxxing'' the city's chief executive, Carrie Lam. Markets are off to a muted start to the week. Here are some of the things people in markets are talking about today. The U.S. passed 5 million Covid-19 infections after adding 1 million new cases in barely more than two weeks. Cases and deaths slowed in Florida and Arizona, while the positive-test rate in Texas hit a fresh record. U.S. Treasury Secretary Steven Mnuchin and House Speaker Nancy Pelosi signaled readiness to resume negotiations on pandemic relief without setting a date. Italy reaffirmed plans to open schools in September, a message that was echoed by the U.K. government, even as new cases there rose to more than 1,000. Paris will mandate outdoor face coverings on its busiest streets starting Monday. Microsoft founder and billionaire philanthropist Bill Gates said it's "mind-blowing" that the U.S. government hasn't improved its Covid-19 testing. Hong Kong's privacy chief criticized the U.S. Treasury Department for "doxxing" Chief Executive Carrie Lam and other officials by releasing their personal information as part of its sanctions on them. "The disclosure of the data of the persons concerned by the U.S. Department of the Treasury is obviously excessive and unnecessary," Acting Privacy Commissioner Tony Lam said in a statement, adding that using or reproducing the addresses, passport numbers and other data could be a crime. "It amounts to doxxing." The U.S. said Friday it is placing sanctions on 11 Chinese officials and their allies in Hong Kong over their roles in curtailing political freedoms in the former U.K. colony. Beijing imposed a national security law that has undermined the city's autonomy and infringed on the rights of residents, it said. Meanwhile, the U.S., U.K., Australia, Canada and New Zealand said they are "gravely concerned" by the Hong Kong government's decision to postpone legislative elections and bar pro-democracy candidates from participating. Currency markets began the week in a muted fashion and stocks looked set to open mixed, with investors weighing uncertainty over the prospects for more U.S. stimulus. The dollar was steady against all G-10 peers in early Monday trading. S&P 500 futures dipped at the open Monday. Asian-equity index futures pointed to small declines in Hong Kong, while Australian contracts edged up. Japan is shut for the Mountain Day holiday and Treasuries won't trade until the London open. Oil rose. U.S. President Donald Trump signed four executive orders related to coronavirus economic relief, including expanded unemployment benefits, a temporary payroll tax deferral, eviction protection and student-loan relief. Investors are grappling with an unclear timeline on stimulus proposals, with neither side giving a firm date for discussions to restart during interviews on Sunday political talk shows. After months of protests and Covid-19 restrictions, Hong Kong's biggest property tycoons are feeling the pinch. With the virus preventing tourists from coming and the national security law threatening Hong Kong's status as a financial hub, the fortune that property moguls have amassed is suddenly shrinking. To make matters worse for them, the city's financial secretary urged landlords to offer tenants concessions on rents — some of the world's highest — to ride out a crisis that a resurgence of coronavirus cases is now taking to unchartered territory. While seven of Hong Kong's real estate tycoons still sit atop $107 billion combined, the impact of the recent events is clear: They've lost $7.7 billion this year as their properties got hit by the double whammy of political unrest and a virus outbreak that no one could have predicted. Warren Buffett is betting on brighter prospects for Berkshire Hathaway, which spent a record $5.1 billion buying back its own stock in the second quarter, and may have kept that higher pace going in July. The billionaire investor sought to seize on a bigger discount to the S&P 500 during a quarter when the conglomerate's operating businesses held up better than expected. Buffett said in early May that he was keeping cash high to be prepared for any direction the pandemic might turn and wasn't overly attracted to buybacks. But as he searched for undervalued assets to spend billions on, he gravitated to his own firm's shares. What We've Been Reading This is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in this morning On Friday, the Trump Administration dealt a major economic blow to China, issuing an executive order that bans American citizens and companies from "transactions" with Tencent, which owns the WeChat app, and ByteDance, which owns the social media app TikTok. The language used is broad and it's still unclear precisely what "transactions" means. While many are focusing on how the order will affect people and companies in the U.S., its impact within China will be a big thing to watch.  For instance, it seems plausible that once the order comes into effect U.S. companies operating within China will no longer be able to use WeChat, increasing the complexity of doing business in the country by taking away access to the most common messaging platform. A key question will be whether app sales within China also get affected. As Bloomberg Opinion columnist Tim Culpan points out: "Even though Chinese smartphone brands dominate their domestic market, iOS and Android remain the dominant platforms and Apple and Google cover almost the entire global ecosystem with their respective app stores." Needless to say, restricting the ability of Chinese residents to download or update the WeChat app on their iPhones could be a negative for Apple's sales in the country. The broadest interpretation of the order suggests U.S. companies might be prohibited from advertising on Chinese apps altogether, which would potentially curb sales for even more multinational companies. Then there are the symbolic and social repercussions of the move given WeChat's centrality to daily life in China. The Great Firewall makes outside communication difficult and plenty of people use WeChat — one of the few approved messaging platforms — to speak with friends and family living abroad. Over the weekend, social posts warning Chinese users to say their goodbyes to loved ones in America were circulating, underscoring concerns about the U.S. having effectively cut off this communications channel. "WeChat might soon be banned in the U.S. It will be like 40 years ago, when post and international phone cards were the only ways to talked to loved ones," read one. We know that Trump enjoys building walls. He arguably just drove the biggest wedge yet between the U.S. and China. You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment