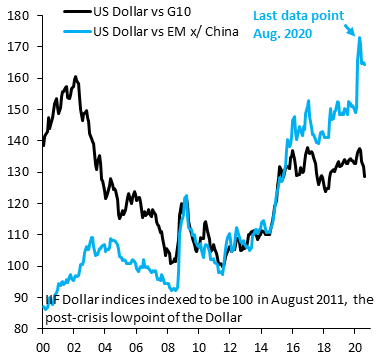

The U.S. and China plan to reschedule the postponed trade-deal talks. Fed minutes from July show their hesitation to offer guidance. And Singapore's top stock is up almost 5,000% since the start of the year. Here are some of the things people in markets are talking about today. The U.S. and China plan to reschedule trade-deal talks postponed from last weekend aimed at reviewing progress at the six-month mark of the agreement between the world's two biggest economies, according to a person familiar with the matter. While the date hasn't been set, the review will take place soon, the person said. The video-conference call between Chinese Vice Premier Liu He, U.S. Trade Representative Robert Lighthizer and Treasury Secretary Steven Mnuchin never made it on to official public calendars in Washington or Beijing, even as the South China Morning Post reported it was first planned for Aug. 15. On Tuesday, President Donald Trump said he called off the talks, raising questions about the future of a deal that is now the most stable element in an increasingly tense relationship. Adding to troubles, Trump is threatening to slap TikTok-style sanctions on more Chinese companies and Alibaba may be next in line. Still, growing competition at home is the e-commerce giant's bigger challenge for now. U.S. central bankers backed off from an earlier readiness to clarify their guidance on the future path of interest rates when they met in July, according to minutes released Wednesday. "With regard to the outlook for monetary policy beyond this meeting, a number of participants noted that providing greater clarity regarding the likely path of the target range for the federal funds rate would be appropriate at some point," the minutes showed. It's a subtle change from the previous set indicating policy makers were keen to sharpen their so-called forward guidance "at upcoming meetings." Since the last meeting a number of Fed officials have indicated there is less need to offer new guidance so long as the coronavirus pandemic is significantly holding the economy back. The Federal Open Market Committee next gathers on Sept. 15-16. Asian stocks looked set for a cautious start Thursday after the dollar climbed and U.S. equities retreated in the wake of the FOMC's minutes. Futures ticked lower in Japan, Australia and Hong Kong. The S&P 500 erased gains as the Fed noted the coronavirus crisis would "weigh heavily" on economic activity. The greenback advanced after a five-day rout, gold tumbled and Treasuries slipped as policy makers panned yield-curve control. Elsewhere, oil slipped from a five-month high as the OPEC+ alliance urged members to adhere to limiting output as the coronavirus pandemic threatens a demand recovery. China's brokerages are tapping the capital markets for funds at a record pace to expand their businesses and feed a world-beating stock rally. At least 10 securities firms listed in the mainland market have this year raised a combined 79.6 billion yuan ($11.5 billion) from private-share placements and the highest number of rights issues in a decade. Companies are also tapping the bond market, with bond issuance by listed securities companies hitting a record 784 billion yuan in the first seven months of this year. Brokerages need these funds to develop their margin trading businesses at a time when leverage is near the highest levels since the 2015 boom-and-bust. A flood of initial public offerings has also spurred their needs for greater capital strength. The frenzy coincides with China's efforts to boost stock trading. Private bankers in Hong Kong and Singapore had their wings clipped by the pandemic, thwarting their pursuit of millionaires in a region where wealth is growing faster than anywhere else. Relationship managers in two of the world's largest centers for cross-border money management haven't been able to freely travel to China and around Southeast Asia to meet new prospects. The shrinking pipeline is an increasing worry, say executives and relationship managers. Already, the likes of UBS and JPMorgan have seen the growth of new money in Asia take a hit. Within the wealth business of UBS, Asia contributed just $200 million to its $9.2 billion net new money in the second quarter, down from $1.1 billion a year earlier. JPMorgan's number of new private banking clients in Asia dropped more than 10% in the first half from a year earlier, even as brokerage activity increased more than 50%. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in this morningI hate analyzing currencies. Seriously. Everything in currencies is relative. It's like talking to that one person who must always insert their own respective experience into conversation. "I once stumbled onto a wild bear while hiking," you'll say. "Oh yeah, I remember this one time I fended off a herd of man-eating mountain goats with nothing but a toothbrush and peanut butter," this annoying person will retort. Because everything in currencies is relative, moves in individual currencies cannot be judged on their own merit but must instead be evaluated through their relationship with another. So it is with the U.S. dollar, where a rapid decline in the value of the greenback has become a big talking point in markets (the Bloomberg Dollar Index fell 10% over the past few months).  Bloomberg Bloomberg Robin Brooks, chief economist at the Institute of International Finance points out that the dollar's performance looks pretty different depending on what you're measuring it against. The dollar has fallen versus G10 currencies, it's true, but it's been strengthening against a basket of emerging market ones. This is the exact opposite of what you'd want to see for the global economy given that a stronger U.S. currency tends to be bad news for emerging markets, where trade and increasingly debt liabilities are dollar-denominated. Meanwhile, as Brooks points out, a declining dollar ends up acting as an extra dose of deflation at precisely the wrong time for the developed countries that arguably need deflation the least. You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment