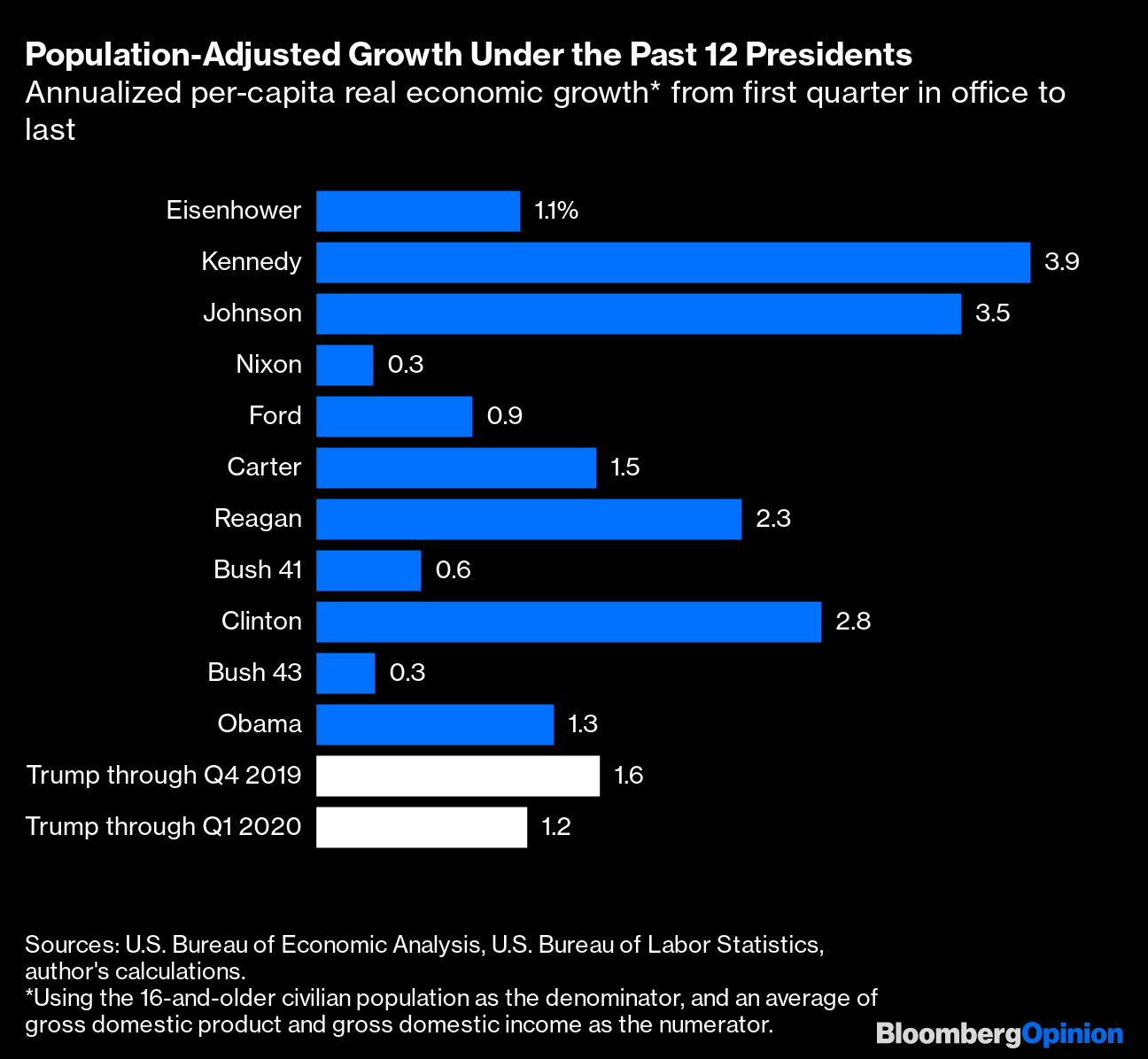

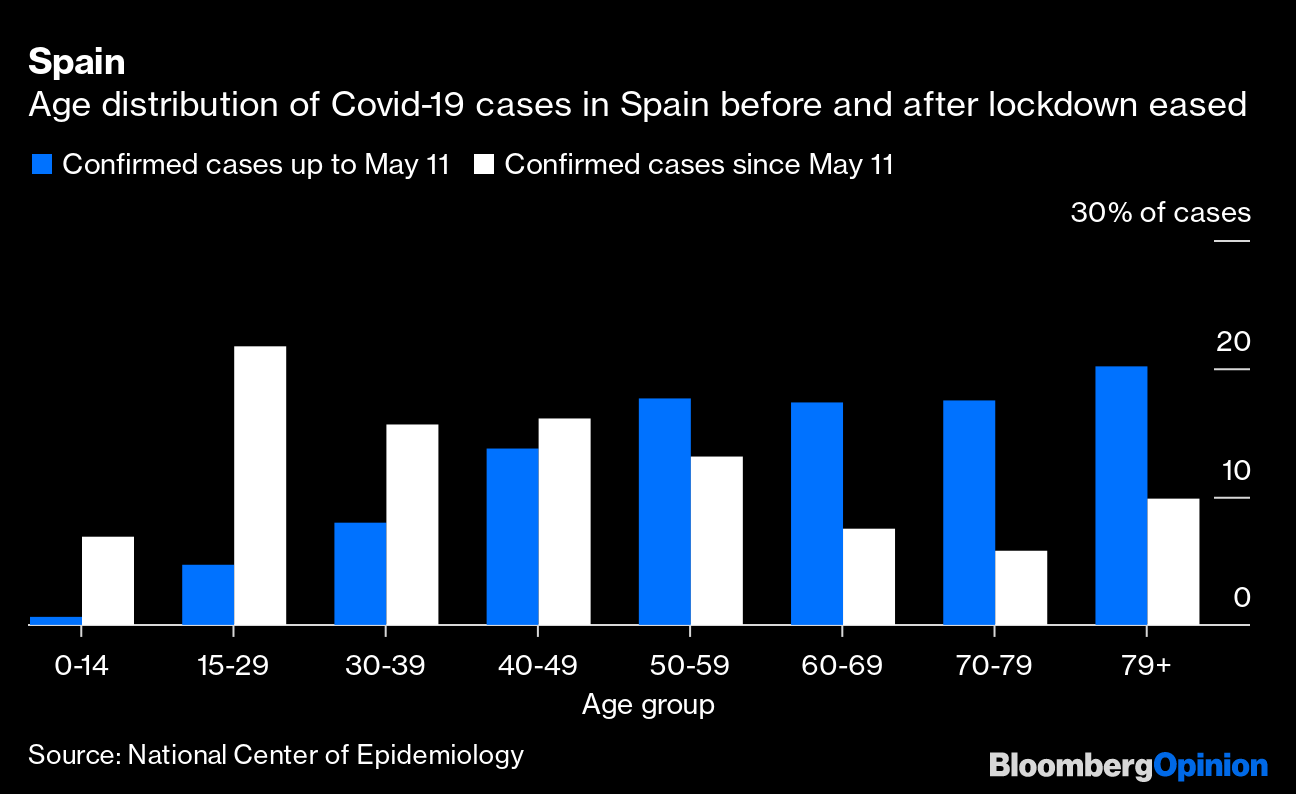

| This is Bloomberg Opinion Today, a fractional stock portfolio of Bloomberg Opinion's opinions. Sign up here. Today's Agenda Recession? Pandemic? Fill Your Boots This must be the weirdest economic crisis in history. Millions are unemployed, sickened by Covid-19, or both, and millions more are still hiding from the pandemic. But financial markets are a wonderland where all of the prices rise all of the time. The day of reckoning may never come, but the potential tab just keeps getting higher. First, you've got these new legions of day traders, armed with little buckets of money and even bigger buckets of time, led by such visionaries as Captain Dave "Stocks Only Go Up" Portnoy. Today it's easier than ever for these traders to empty their money buckets into the abyss, thanks to a thing called "fractional" stock trading, notes Jared Dillian. Do you have just five (5) dollars to rub together? You're in luck: You can now buy a fraction of one (1) stock. You wouldn't want to miss out on this chance to get as rich as Dave Portnoy, would you? Actually, maybe, yes, you would. "Someone who has only $5 to invest," Jared writes, "should not be putting that money into stocks; they should be buying food." Pah, who has time to eat when there are stocks to buy? The good news is, all this hunger for stocks is encouraging companies to issue more of it, writes Chris Bryant. Not long ago, companies only ever vacuumed up equity with stock buybacks and such. Now heavily indebted businesses struggling through the pandemic see a way to raise cash without further wrecking their balance sheets. Maybe with your five dollars you could buy part of a stock in a mall landlord or an airline. I'm sure they'll be fine! Of course, bond prices just keep soaring to infinity too, making it also a great time to borrow. Italy, once one of Europe's weakest credits, just sold a bunch of long-dated bonds in the dead of summer at rock-bottom interest rates, notes Marcus Ashworth. It's a sign of the flood of borrowing to come in the fall. Meanwhile, Apple Inc., with its much higher credit rating, is about to borrow again for the second time this year, at rates that will probably be lower than the U.S. government got not long ago, writes Brian Chappatta. Investors will gobble it up, of course, but it will be yet another block on a market Jenga tower that's already many stories tall. Further Stock-Market-Reckoning Reading: Big Tech has forgotten how to innovate, usually the first sign of impending decline. — Tae Kim Time to Upgrade the Safety Net Adding to the disconnect between the markets and reality is the fact that an estimated 6 million Americans are now short on cash because Congress let extra unemployment benefits expire a couple of weeks ago. The country's unemployment system, held together with spit and chicken wire over the years, is buckling under the strain of the pandemic. The next president and Congress have to modernize and strengthen it, writes Bloomberg's editorial board. This will include putting more of it in the hands of the federal government, and also making sure it's resilient enough to not need help from Congress in every downturn. Also high on the next president's to-do list will be fixing America's busted health-care system, which has also not acquitted itself well in the pandemic. Americans still pay far too much for merely adequate care. A relatively quick, relatively popular fix would simply be to extend Medicare to every American, writes Noah Smith. This isn't the "Medicare for All" you always hear about. It's simpler and cheaper and keeps private insurance in the mix, Noah writes. Vaccines Aren't the Only Answer We're all waiting around for a vaccine to end the Covid-19 nightmare, but Bill Gates warns it will be many, many more months before we can just pop over to the CVS for a shot. That's plenty of time for millions more people to get sick. Along with Operation Warp Speed for vaccines, the U.S. government should also be frantically looking for better Covid-19 treatments, writes Rena Conti. It could pay drugmakers to test generics that could be repurposed to treat coronavirus patients. And no, that doesn't include hydroxychloroquine. Further Coronavirus Reading: Behavior alone can't account for differences in how Covid-19 spreads. — Faye Flam Telltale Charts Despite Trump's claims to the contrary, his economic performance before the pandemic was nowhere near the best in history, writes Justin Fox.  Europe's coronavirus rebound owes mainly to partying young adults, writes Lara Williams.  Further Reading Here are the two Black women most likely to be Joe Biden's first Supreme Court nominee. — Noah Feldman Biden's White House would look a lot like former President Barack Obama's. — Jonathan Bernstein Trump squabbling with Europe over government help Airbus got years ago makes no sense any more. — Brooke Sutherland Inflation numbers use outdated models that don't capture pandemic-era price increases. — Shuli Ren The UAE made peace with Israel because it recognizes Israel is a reliable partner. — Eli Lake American universities should open up branches in India to tap a growing talent pool. — Tyler Cowen ICYMI Trump said he would block money to the Postal Service so it can't process mail-in ballots. An antibody study found 3.4 million people in England had SARS-CoV-2. Shenzhen claims Brazilian chicken wings tested positive for the coronavirus. Kickers Air pollution is much worse than we thought. Thieves are making big money stealing cardboard. ADHD-like behavior is linked to entrepreneurialism. Young children would rather explore than get rewards. Note: Please send cardboard and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment