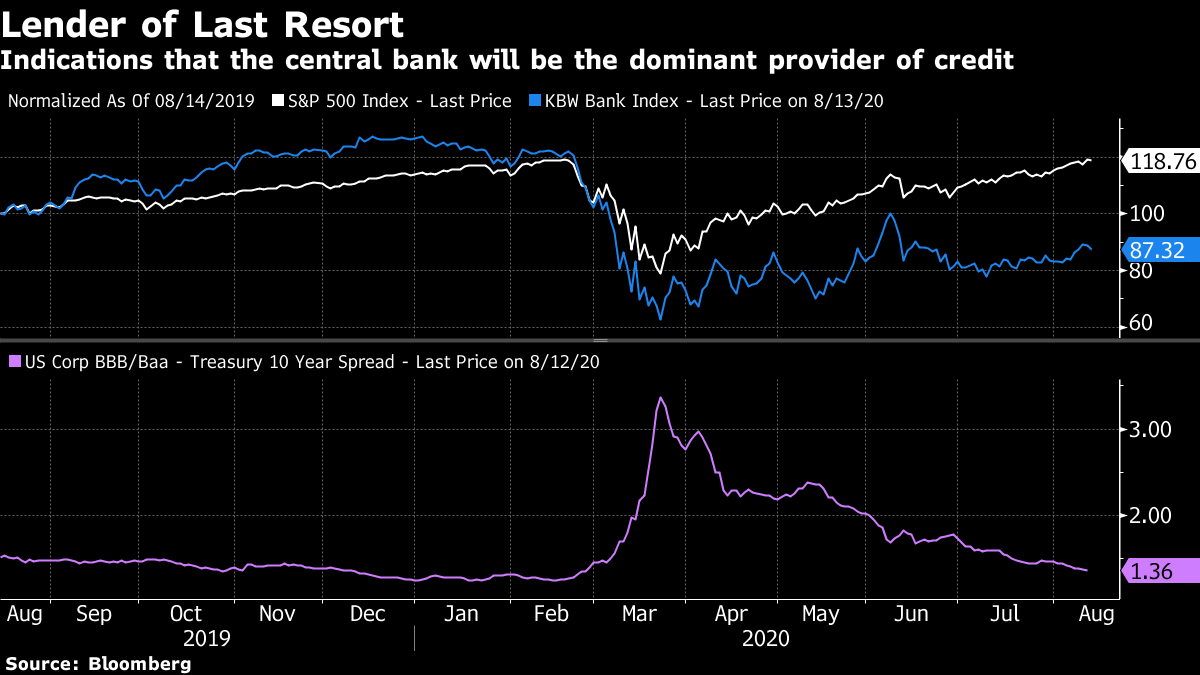

India is set to keep out Huawei and ZTE out of its 5G networks. Apple sparks a lawsuit by removing Fortnite from the App Store. And Japan's economy is on course for a record decline. Here are some of the things people in markets are talking about today. China's Huawei and ZTE are set to be kept out of India's plans to roll out its 5G networks as relations between the two countries hit a four-decade low following deadly border clashes. The South Asian nation will apply recently amended investment rules that cite national security concerns in placing curbs on bids from some neighboring countries, people familiar with the issue said. The Ministry of Communications will restart pending discussions on approvals for 5G trials by private companies including Bharti Airtel, Reliance Jio, and Vodafone Idea that were delayed by the nationwide lockdown, but the process to auction 5G may spill into next year, according to the officials. India's decision echoes actions by the U.S., U.K. and Australia, which have raised red flags about Huawei and ZTE's links to the Chinese government. Asian stocks looked set for a muted start Friday after a lackluster U.S. session as investors mulled the stalemate in stimulus negotiations and parsed signs of an economic recovery. Treasury yields rose to an eight-week high after the government sold a record amount of 30-year bonds. Futures were little changed in Japan, Australia and Hong Kong. S&P 500 futures were also flat and the Nasdaq Composite Index closed in positive territory. Trading volume was about 20% below the 30-day average. Gold resumed its advance, and the dollar slipped against a basket of its peers. Elsewhere, oil fell the most in nearly a week as investors assessed the International Energy Agency's reduced forecasts for global oil demand, in part due to a slowdown in air travel. Apple removed Fortnite from the App Store on Thursday, prompting a lawsuit by the game's creator, Epic Games. The moves escalate a dispute between the two companies that had been brewing in recent weeks. The cause? Apple requires applications with in-app payments to be billed through the company, which takes a 30% cut of revenue, similar to Google's store. On Thursday morning, Epic Games told customers it would begin offering a direct purchase plan for items in the popular game on both Apple and Google platforms, circumventing the fees. Epic said it would pass on the savings to customers, offering discounts of as much as 20% on its own plan. This isn't the first time Apple has faced heat over its payment system — the company's already facing scrutiny from officials in the U.S. and Europe over a slew of antitrust complaints. Japan's pandemic-hit economy shrank last quarter by the most in records going back to 1955, official data is set to show Monday, with a resurgence of the virus threatening to slow a fragile recovery now underway. Analysts see gross domestic product contracting at an annualized pace of 27% in the three months through June. That means the world's third-largest economy will have declined in size for three straight quarters, hit first by trade wars and a sales tax hike, then by the virus.The cratering of Japan's economy follows grim readings from other major countries reeling from the impact of Covid-19. The U.K. contracted 20.4% last quarter. The U.S. shrank by nearly a third. South Korea has overtaken China to lead Asia in sales of socially responsible bonds this year, as global issuance of debt to fund the fight against Covid-19 surges. Borrowers in Korea have sold $11.9 billion of environmental, social and governance notes so far this year, the most in the Asia-Pacific region, followed by Japan with $9.5 billion and China with $9 billion, Bloomberg-compiled data show. China was Asia's biggest issuer of such debt from 2016 to 2019, but Korean policy makers have introduced steps that may fuel more interest in sustainable debt, with President Moon Jae-in's government announcing green "New Deal" projects last month to cut carbon emissions and foster environmentally friendly industries. The National Pension Service, which oversees 749 trillion won ($631 billion), said it will boost socially responsible investment, prompting other investors to follow the trend. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in this morningThere's a chart I like to think about when considering the future role of the Federal Reserve in the U.S. economy. It features an indicator of financial repression (as measured by the spread of BBB-rated corporate debt over Treasuries) compared to the performance of U.S. bank stocks (the KBW Bank Index versus the broader S&P 500). Spreads on corporate bonds are touching fresh lows of the cycle while banking stocks have largely been moving sideways and most definitely have been underperforming the broader index. In other words, whatever's happening in credit, it is not coming courtesy of banks. Instead, it's almost certainly coming courtesy of a central bank that has stepped in to act as the lender of last resort and sparked an almighty compression in risk premiums as investors scramble for yield.  There are a couple things to consider here. The big one is whether all credit is created equal: Does it matter if credit is coming from a central bank or a private lender? Can the economy grow with just one of those things, and what will that economy actually look like? On that note, it's worth taking a moment to read this article by my Bloomberg colleague Sally Bakewell. She points out that central bank stimulus has sparked a boom in the corporate bond market, allowing the largest companies to tap financing at ultra-low borrowing costs. Meanwhile, smaller firms haven't enjoyed the same access to credit. The risk of course is that the longer central bank-intermediated financial repression goes on for, the more likely it is that the big get bigger and the smaller get smaller thanks to uneven access in credit. The Fed might be the lender of last resort, but it's not necessarily a lender creating a level playing field. You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment