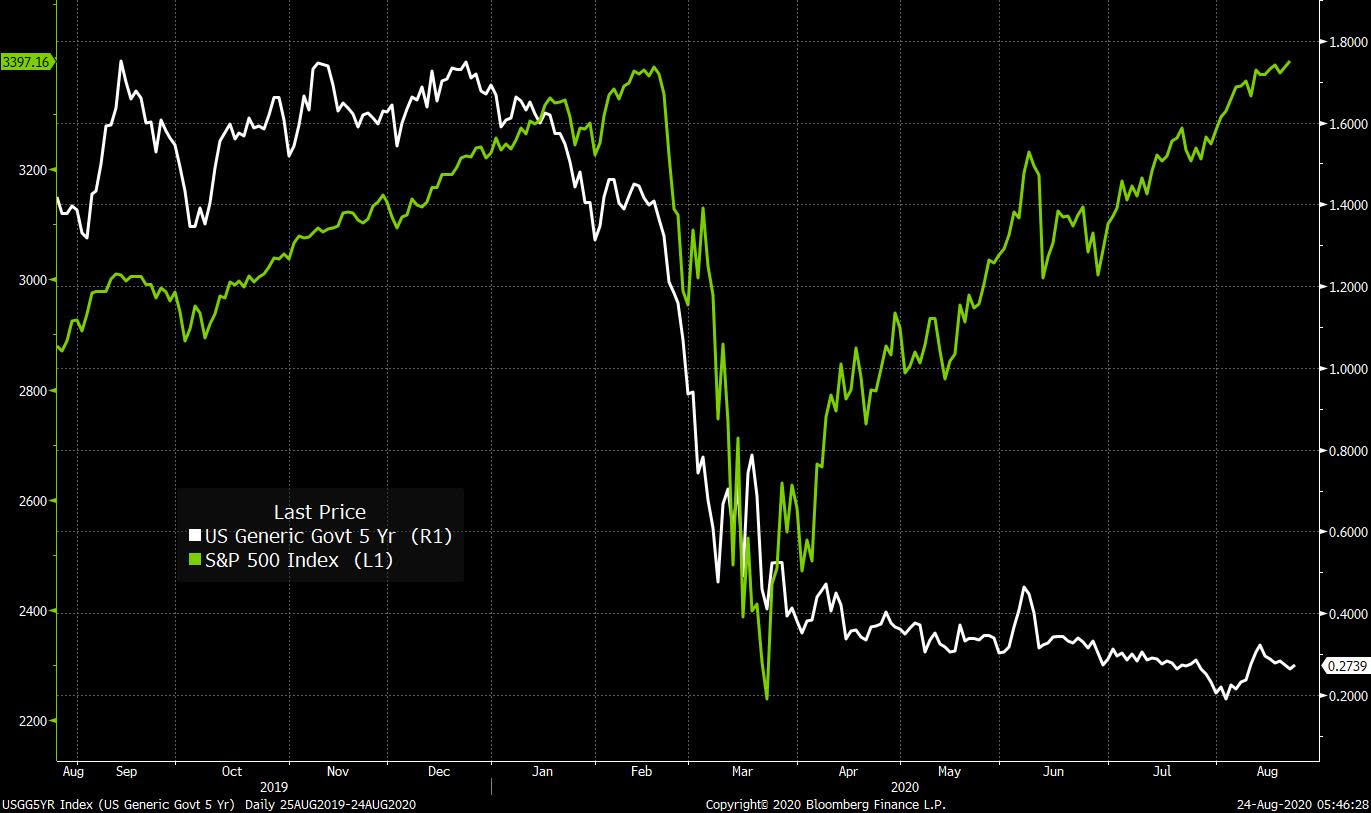

Trump seeks revival as convention begins, Gulf coast faces double blow, and TikTok set to sue. Renewal President Donald Trump will be in Charlotte, North Carolina for the start of the Republican National Convention today as he seeks to revive his campaign for a second term. He is scheduled to speak on each of the four nights, a departure from the norm where the candidate typically only speaks to accept the party nomination. With the pandemic proving one of the biggest drags on his popularity, Trump is now promoting blood plasma treatment, which the U.S. Food and Drug Administration cleared for use yesterday. Marco, LauraThe double threat from Tropical Storm Marco and Tropical Storm Laura has already shut 58% of oil and 45% of natural gas production in the Gulf of Mexico. Marco is set to make landfall in Louisiana later today, while Laura is expected be upgraded to a hurricane tomorrow and may eventually make landfall in Texas. While the double hit will mean a longer than usual halt to crude production from offshore platforms, the price of oil has risen little as investors remain concerned about the resurgence of the coronavirus in parts of Asia and Europe. Lawsuit TikTok could file a lawsuit against the Trump administration as soon as today over the executive order banning transactions with the app in the U.S. The president is expected to make his "tough on China" stance a center point of his speeches at the RNC. Tencent Holdings Ltd.'s shares jumped the most in a month after officials are said to have reassured American businesses that its WeChat app won't be as broad as feared. While the deterioration of relations between the world's two largest economies remains a concern for investors, the current standoffs still show little sign of causing the end of the trade deal between the nations. Markets rallySigns of progress on treatments for Covid-19 and no further worsening of Sino-U.S. relations are helping maintain the market rally. Overnight, the MSCI Asia Pacific Index added 0.9% while Japan's Topix index closed 0.2% higher. In Europe, the Stoxx 600 Index had rallied 1.8% by 5:50 a.m. Eastern Time in a broad rally led by cyclical shares including energy, chemicals and basic resources. S&P 500 futures pointed to more gains at the open, the 10-year Treasury yield was at 0.643% and gold rose. Coming up...It is a fairly quiet morning on the economic data front, with most investors waiting for Federal Reserve Chairman Jerome Powell's address at the Jackson Hole symposium on Thursday. At 8:30 a.m. today the Chicago Fed National Activity Index for July is published. U.S. Postmaster General Louis DeJoy testifies before the House Oversight Committee later. Earnings today include Palo Alto Networks Inc. What we've been readingThis is what's caught our eye over the weekend. And finally, here's what Joe's interested in this morningIn February and March, the stock market crashed and interest rates plunged at the same time. Since then, the S&P 500 has staged a V-shaped recovery, while yields on U.S. Treasuries have actually continued to grind lower. Sometimes you hear people talk about how the Treasury market is the "smart" market. Stocks are depicted as the playground for Robinhood traders and passive 401K buyers, while fixed-income players are supposedly smart and sophisticated and have a better understanding of the real state of the economy. And so you get people talking about how the two markets supposedly disagree, how depressed rates signal that the rebound is a mirage, and that equities are out to lunch.  Well, this formulation is nonsense, and the two lines aren't in opposition to each other. They just reflect different things. Whereas the S&P 500 is reflective of the perceived earnings potential of the 500 companies that are in the index, the Treasury market is reflective of the future path of Federal Reserve moves. The Fed has strongly signaled that it will be disinclined to hike rates for a long time, and that it won't snuff out a recovery at the first whiff of inflation. And so that depressed white line in the above chart is simply reflecting the expectation that over the next several years, the Fed will not be hiking. Of course that could change if the economy unexpectedly booms or inflation starts raging and the Fed adopts a new approach. But at the moment, the white line just reflects the signal from the Fed. And the green line also is taking into account that same signal, as investors bet the Fed won't prematurely slow things down. But either way, there's no disagreement: Just two markets reflecting a different set of fundamentals Joe Weisenthal is an editor at Bloomberg. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment