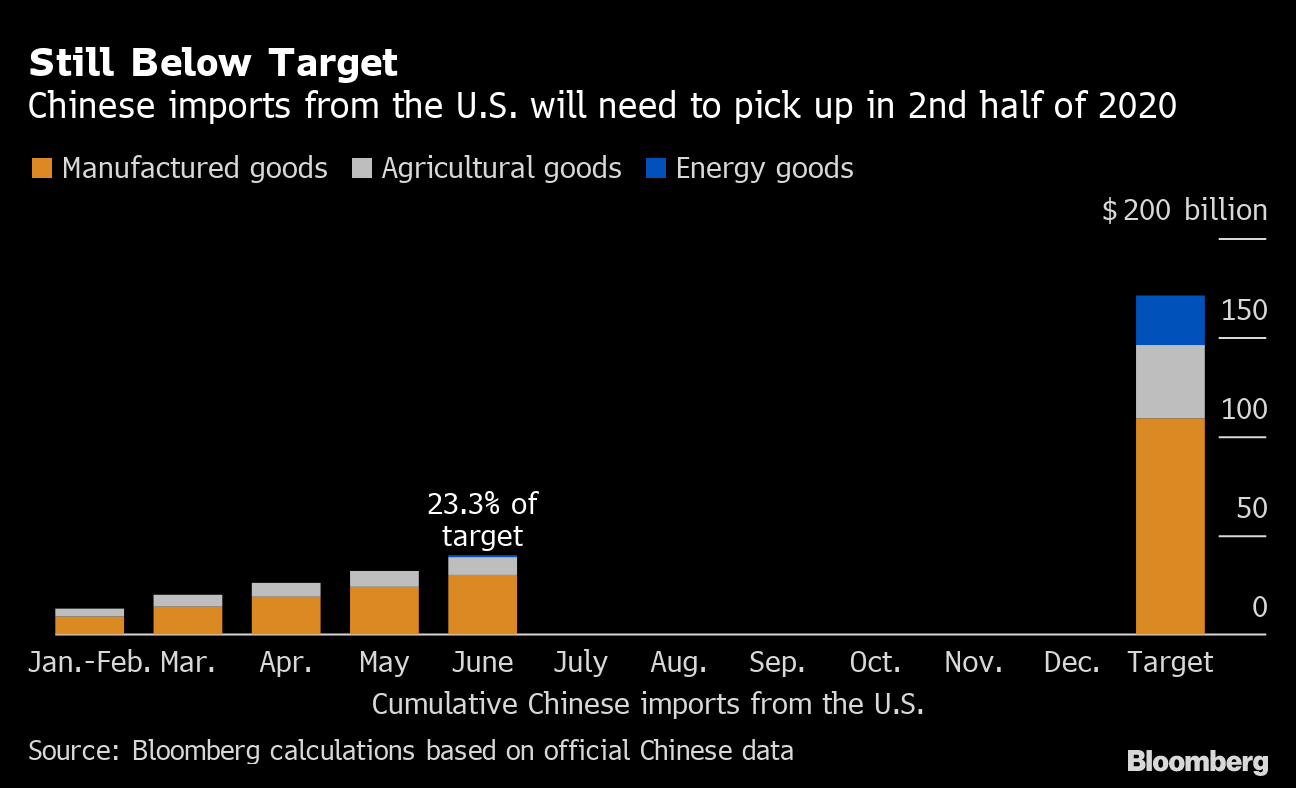

| Trump's executive actions criticized, U.S-China relations take another blow, and Twitter looks at TikTok. Stimulus Lawmakers in Washington from both sides of the aisle criticized the four executive actions announced by President Donald Trump on Saturday that would defer payroll tax and continue expanded unemployment benefits. Trump made the move in response to the failure of Republicans and Democrats to come to an agreement on a new stimulus package after the deadline for talks passed on Friday. While both sides remain trillions of dollars apart on the size of the package, House Speaker Nancy Pelosi said she hopes talks will resume soon, while Treasury Secretary Steven Mnuchin said he would listen to any Democrat proposal. Sanctions China said it will sanction 11 Americans in retaliation for the U.S. move on Friday which saw a similar number of Chinese officials, including Hong Kong Chief Executive Carrie Lam, sanctioned over their role in curtailing freedoms in the city. No members of the Trump administration are on today's list announced by China. There was further evidence of a crackdown in Hong Kong this morning when police raided the offices of the largest pro-democracy paper there, arresting media tycoon Jimmy Lai. Banks in the city risk falling foul of the controversial national security law by suspending accounts linked to those sanctioned by the U.S. on Friday. TikTok, Twitter Twitter Inc. held early preliminary talks about a potential combination with TikTok's U.S. operations, Dow Jones reported, citing people familiar with the matter. Twitter, which canned its own short-video sharing app, Vine, several years ago, may face less antitrust scrutiny as it is much smaller than other potential bidders such as Microsoft Corp. The fallout for Tencent Holdings Ltd. from the potential ban on WeChat continued, with the company's two-day market value loss hitting $66 billion. The banning of WeChat would have much wider implications than the move against TikTok as it has been integrated so much into Chinese life, both home and abroad. Markets mixed Global equity markets get the week off to a relatively subdued start, with China-U.S. tensions dominating the headlines while the timeline over further stimulus remains unclear. Overnight the MSCI Asia Pacific Index was flat while Japan's Topix index closed down 0.2%. In Europe, the Stoxx 600 Index was 0.2% higher at 5:50 a.m. Eastern Time with banks the best performing sector. S&P 500 futures pointed to a small rise at the open, the 10-year Treasury yield was at 0.557% and oil gained. Coming up... U.S. job openings data for June published at 10:00 a.m. is expected to show a decline in positions from May. Chicago Fed President Charles Evans speaks later. Health and Human Services Secretary Alex Azar's trip to Taiwan, which China sees as provocation, continues. Duke Energy Corp., Barrick Gold Corp. and Occidental Petroleum Corp. are among the companies reporting results today. What we've been reading This is what's caught our eye over the weekend. And finally, here's what Lorcan's interested in this morning Seven lifetimes ago on January 15 2020 President Donald Trump signed the U.S.-China trade deal, an agreement he said at the time is a "big, beautiful monster." The back-and-forth negotiations, which had pretty much lasted most of Trump's presidential term to that point, had been one of the biggest macro factors driving volatility in global equities. However, since the deal had been signed, other events have taken over investor attention. The president himself has changed his tune on the agreement, saying recently that he doesn't "feel the same about the deal." It is probably unlikely then that the review of the deal due this week, as directed by the text of the accord, will command the same attention that it would in a non-Covid world. However, it could well be a very important moment for markets. Should the U.S. look through China's failure to hit import targets for the last six months, relying on the excuse of the coronavirus shutdown, and allow the deal to continue as is, it would provide some relief for investors growing increasingly concerned about the rapidly rising tensions between the world's two largest economies.  In the unlikely event that the review leads to a walking back of the agreement, we may find that trade issues will once again dominate market moves, as they have throughout Trump's presidency. Follow Bloomberg's Lorcan Roche Kelly on Twitter at @LorcanRK Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment