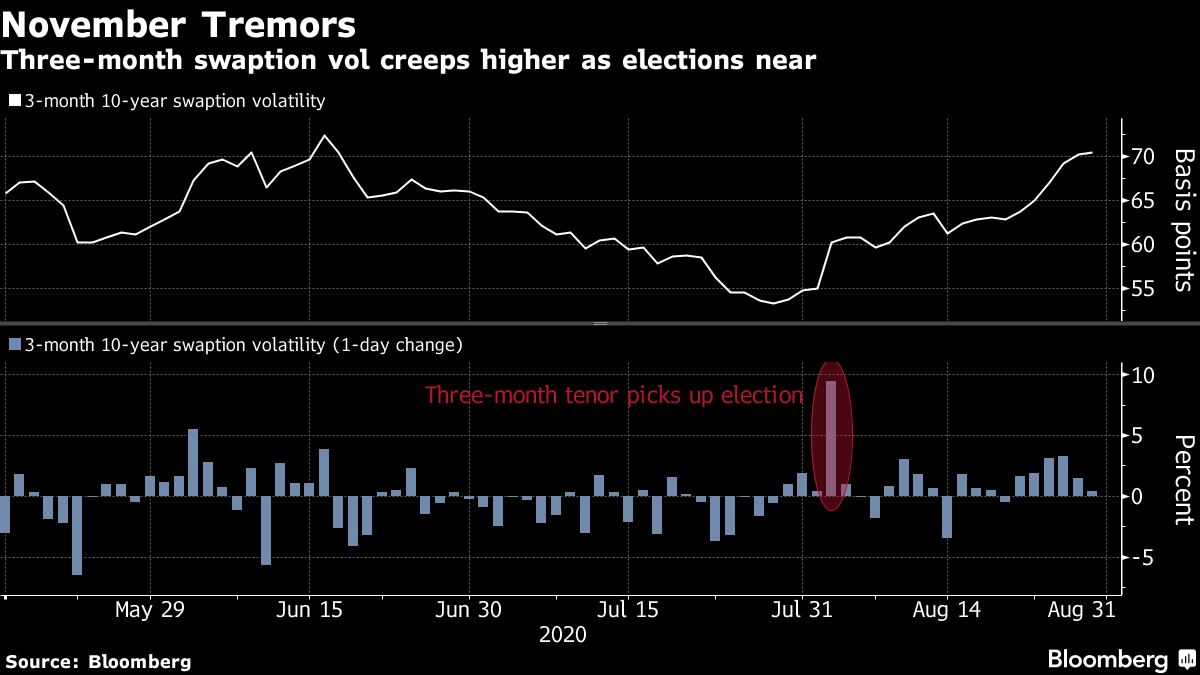

Trump pitches for second term, Japan's Abe announces resignation, and Fed policy shift raises heat on ECB. Attacks, promises President Donald Trump accepted the Republican party nomination for presidency in a speech from the White House's South Lawn which was a mixture of attacks on his opponent and promises to spur more growth. The 71-minute speech largely sidestepped the coronavirus pandemic which has left 180,000 Americans dead. As is the norm with political speeches, he cherry picked economic data to paint his administration in the best light, while misrepresenting the positions of his opponent. According to the RealClearPolitics average of national polls Trump trails Joe Biden by 7.1 percentage points. Abe steps downJapanese Prime Minister Shinzo Abe announced he is resigning to undergo treatment for a chronic illness, ending his run as the country's longest-serving leader. Stocks in Tokyo sank and the yen strengthened on reports of the announcement, as investors were surprised by the move. The moves, while dramatic, seem unlikely to turn into a major selloff as few drastic policy changes are anticipated from his successor. It is unclear when the vote to select a new leader would take place. Fed, ECBFederal Reserve Chairman Jerome Powell's outlining of the bank's new approach to setting monetary policy yesterday has been met with some investor skepticism. With inflation remaining stubbornly low, few seem to believe the Fed can engineer an overshoot of their 2% target any time soon. One place the move will be felt in the more immediate term is across the Atlantic at the European Central Bank where a policy review is also underway. The Fed move could help President Christine Lagarde push for a similar policy for the euro area, allowing the ECB to stay more accommodative for longer. Markets mixedDisparate national drivers mean there is a real mixed bag of performances from global equity benchmarks. Overnight the MSCI Asia Pacific Index added 0.1% while Japan's Topix index closed 0.7% lower in the wake of the Abe news. In Europe, the Stoxx 600 Index had slipped 0.1% by 5:49 a.m. Eastern Time with banks by far the best performers. S&P futures pointed to a higher open, the 10-year Treasury yield was at 0.75% and gold rebounded. Coming up...U.S. personal income and spending data for July is at 8:30 a.m. with wholesale and retail inventories, and an update to the PCE deflator also at that time. The latest University of Michigan Consumer Sentiment number is at 10:00 a.m. The weekly Baker Hughes rig count is at 1:00 p.m. The Jackson Hole symposium continues. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Emily's interested in this morningThe national conventions are done, so 'tis the season. Though you wouldn't know it given the lack of balloons. It's a mug's game, predicting the market impact of an election. Exhibit A is the surprise victory of President Donald J. Trump in 2016. The stock market rapidly digested the implications of promised tax cuts and deregulation and marched higher, flouting the somber predictions of the few who'd bothered to contemplate such a turn of events. That last doozy hasn't prevented Wall Street from churning out note upon note about the implications of a Trump win, a Biden win or a blue wave. And when it comes to the bond market, they tend to couch their views in what these scenarios mean for the central bank, which is by far the strongest hand in what happens to interest rates. Like most, Bank of America has streamlined its scenario analysis by jettisoning the quaint notion of bipartisanship, and considering the upshot of gridlock versus a sweep of both houses. Gridlock implies limited fiscal stimulus, meaning the Fed "could become significantly more engaged with yield curve control or larger QE purchases, or purchases further out the curve -- or all of these" to offset the government's reduced appetite for spending, according to Ralph Axel. That could mean much wider long-end spreads. The case for tighter spreads would be a Democratic sweep, implying a bigger fiscal response with less action from the Fed. While they're leaning toward the tighter scenario, "the risk/reward has turned less favorable with the recent fiscal impasse, which not only threatens less Treasury supply, but substantially larger Fed QE."  For its part, Goldman is looking at rates market conditions rather than the outcome. They suspect this year's event could be more than usually tumultuous, and while a jump in volatility is now detectable in the three-month swaptions spanning election night, the market may be too complacent about the weeks after. The market isn't yet reflecting the more prolonged ructions that typically come with a switching in the governing party, or a clean sweep of Congress, according to rates strategist William Marshall. Moreover, thanks to the Fed having anchored the front end of the Treasury curve, he reckons any volatility is likely to hit the 5-to-10-year stretch more than the 2-to-10 year that's typically taken the brunt. Follow Bloomberg's Emily Barrett on Twitter at @notthatECB Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment