| Trump mulls executive action, TikTok saga continues, and global cases top 18.2 million. Executive action President Donald Trump said he may take executive action to impose a moratorium on evictions and enact a payroll tax holiday. The White House is also exploring whether he can act unilaterally to extend enhanced unemployment insurance payments that, like an eviction moratorium, were part of stimulus legislation enacted in March but have now expired. Meanwhile Federal Reserve officials resumed warning about the economic fallout should Congress fail to extend stimulus plans. Removing support "would be a pretty traumatic move," Richmond Fed Chief Thomas Barkin said. Clock ticks Microsoft Corp.'s quest to buy TikTok's U.S. operations took a weird turn as President Donald Trump insisted any sale would have to include a substantial payment to the U.S. It's not clear where Trump would get the authority to extract a payout. That along with Trump's insistence that any deal be struck by Sept. 15 drew a strong rebuke from Chinese state media, which called the potential sale "theft." The drama did little to hurt technology stocks: The Nasdaq 100 soared to a fresh record on Monday as traders bought companies poised to outperform in a stay-at-home economy. Virus latest Global cases topped 18.2 million as the rate of infection jumped in Germany and Poland. On a more positive note, California and Arizona reported fewer new cases after battling a surge in infections last month. Kosovo's Prime Minister was the latest European leader to self-isolate after contracting the disease. Covid-linked deaths in Iran may be triple the official tally, the BBC has reported, while experts warn that India hasn't properly recorded fatalities. Markets mixed Markets are mixed as investors await news on U.S. stimulus plans before the Senate leaves on an extended break Friday. Overnight, the MSCI Asia Pacific Index added 1.7%, while the Topix gained 2.1%. In Europe, the Stoxx Europe 600 Index fell 0.4% as of 5:57 a.m. Eastern Time. S&P 500 futures were down, the 10-year Treasury yield was at 0.538% and gold was lower. Coming up... June factory orders are expected to show a downtick, while durable goods orders numbers are anticipated to come in line with the prior month when the data is released at 10:00 a.m. Vulcan Materials Co., LendingTree Inc., Exelon Corp., Cinemark Holdings Inc. and KKR & Co. Inc. are among firms reporting earnings. What we've been reading This is what's caught our eye over the last 24 hours. - London traders hit $500 million jackpot when oil went negative.

- Record heat sets off a cascade of suffering in Baghdad.

- On diversity, Silicon Valley failed to think different.

- China says it can boost Hong Kong virus testing by 20 times.

- The Fed's stocks policy is exuberantly asymmetric.

- Killer Mike wants to save America's disappearing black banks.

- Argentina says it reached debt deal.

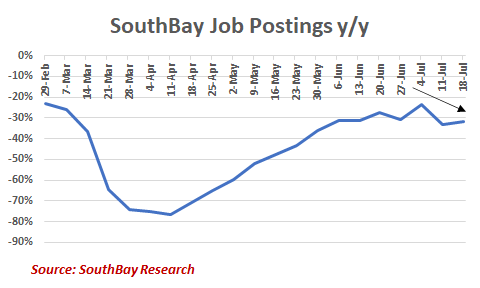

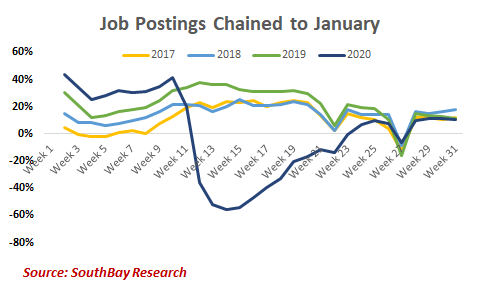

And finally, here's what Joe's interested in this morning The July Non-Farm Payrolls report comes out Friday. Economists are looking for the unemployment rate to fall to 10.5% from 11.1% and the creation of 1.5 million new jobs. For some context on what's going on in the labor market, I talked with Andrew Zatlin of SouthBay Research, who keeps his own proprietary data of small, local business job openings. He likes paying close attention to mom & pop-style small businesses (eateries, salons etc.) since they're the most sensitive to real-time changes in the economy. Large companies hire and fire slowly and often have the financial ability to ride out downturns without adjusting payrolls. Small businesses see the shifts faster. The owner is often right in front of the customer, and the decision to hire and fire is directly related to cash flow.

Their situation is not good. To start, you can already see that total job postings on a year-over-year basis have started to roll over after peaking in early July.  Another way to view this is that job openings are actually at a fairly "normal" level right now compared to trends in previous years. But that's after plunging into such a massive hole during March so you would hope to be seeing a lot more catch up. We're not.  Certain cities are particularly representative of the problem. For example, at its worst moment, job openings in Phoenix plunged about 70% from its year-ago levels. That quickly jumped to 39% upon the initial reopening, and by late June, listings were only down 2% year-over-year. However, with the virus spike, openings are down in the teens. It's a similar story in Tampa. Ditto Austin, TX, which had been getting better up until July 4, and now its job openings are down over 20% from a year ago. As for sectors, not surprisingly, the worst-performing category has been HR. The best-performing category he tracks has been security, as even shuttered businesses need security on some level. Longer term, he still sees knock-on weakness for white-collar workers, even if and when there's more normalization for the directly-exposed service industry. Though not in the above indices, large tech job openings are way down, he told me. The issue with the labor market remains straightforward: There are a dearth of job openings due to the virus, and among the businesses who hire and fire the fastest, there has been a clear weakening trend again over the last month. Joe Weisenthal is an editor at Bloomberg. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close |

Post a Comment