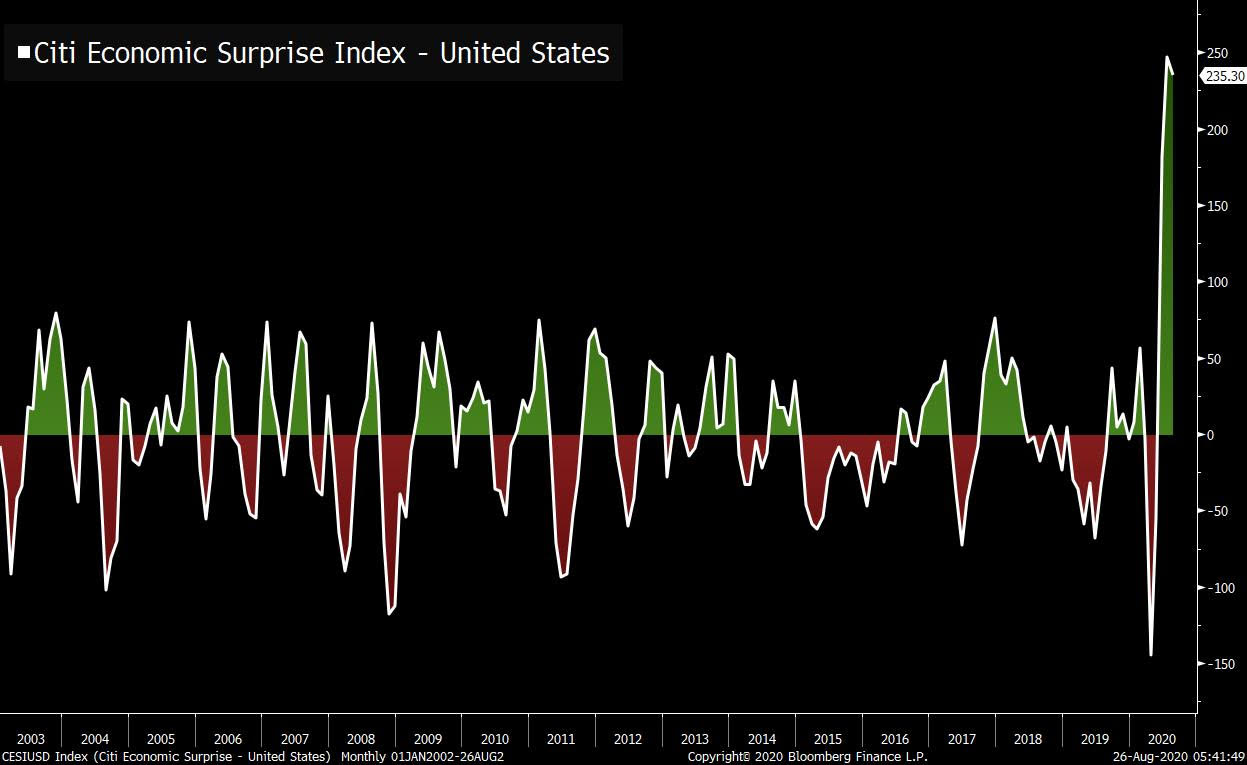

Laura set to make landfall as category 4 hurricane, more positive news on trade, and Republican National Convention continues. Category 4 Laura is now expected to strengthen to a category 4 hurricane, producing a life-threatening storm surge, extreme winds and flash flooding when it makes landfall over eastern Texas and Louisiana later today. It may inflict as much as $18 billion in damages and keep some of America's largest oil refineries shut for months. Oil is holding steady close to five-month highs with investors expecting any impact to supply from the hurricane to be short-lived. Soy There was more positive news on U.S.-China trade as the Asian nation is set to purchases record amounts of American soybeans this year, according to people familiar with the matter. Markets breathed a sigh of relief after the trade deal passed the six-month review earlier this week, with both sides signalling they were happy with how it is progressing. While there may be plenty of anti-China rhetoric at this week's Republican National Convention, the reality is the U.S. needs to tap into the vast and growing demand of Chinese consumers. Convention Speaking of the RNC, there was more optimism on display in yesterday's speeches. White House economic adviser Larry Kudlow emphasized the most positive aspects of the economic recovery from the Covid-19 shutdown, touting stock market levels as well as rebounds in housing sales and manufacturing. First lady Melania Trump, speaking from the Rose Garden at I'the White House, struck a more conciliatory tone than many of the speeches so far to delegates, calling for national unity in response to the coronavirus toll. Vice President Mike Pence and soon-to-be-retired White House counselor Kellyanne Conway are among today's speakers. Markets very quietGlobal equity investors are taking a moment to pause for breath after pushing stocks to new record highs. Overnight the MSCI Asia Pacific Index added 0.2% while Japan's Topix index closed 0.1% lower. In Europe, the Stoxx 600 Index was 0.3% higher at 5:50 a.m. Eastern Time with some rotation into cyclical stocks. S&P 500 futures pointed to little change at the open, the 10-year Treasury yield was at 0.716% and gold was lower. Coming up...U.S. durable goods orders are expected to continue their robust recovery when July data is published at 8:30 a.m. Oil traders are expecting a fifth straight week of American inventory decline when official numbers are released at 10:30 a.m. Mexico's central bank publishes its quarterly inflation report at 1:00 p.m. The Republican National Convention continues. Dick's Sporting Goods Inc., National Bank of Canada and Eaton Vance Corp. are among the companies reporting results. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningEconomic data in the U.S. is beating expectations on a level that may be unprecedented. Citigroup's U.S. Economic Surprise Index, which attempts to measure economic data relative to forecasts, is at its highest level ever. It's in a whole different ballpark than past cycles. And it's not just the U.S. As Bloomberg's Michelle Jamrisko notes, the same is true on a global level.  Now the important thing to understand about this measure is that it's inherently mean reverting, and there's a simple reason for that. As economic data starts to improve, or beat forecasts, economists will naturally start getting more optimistic, and start hiking their future estimates. Eventually the economists do catch up with the reality, and so the data no longer surpasses expectations. And if they overshoot in their optimism, the line starts going down again, and then the cycle happens again in reverse. So the important thing to think about is that a surprise index is as much a measure of actual data as it is a measure of the human beings on Wall Street whose job it is to come up with forecasts for things like Jobless Claims, Non-Farm Payrolls, Housing Starts, and New Home Sales and Manufacturing PMIs and all that stuff we talk about every day. There is a sense, therefore, in which this is a sentiment measure. How do economists feel? Do they believe the data they're seeing? So when you see a chart like the above, it's saying that economists have largely been in disbelief at the pace of the recovery, failing to mark up their forecasts adequately with the pace of the recovery so far. And it's reasonable to think that in a situation like this that disbelief has been pervasive not just among economists but among investors overall. This whole recovery period has been met with fear and skepticism and confidence that another shoe is about to drop, whether due to second waves, policy failures, or anything else. And so you see in the stock market where there's almost never been a pause in this rally, or a chance to buy the dip, because so many people have been so much on the wrong side of this. And so a chart like the above, showing just how much economists have underestimated this rally, is a nice indicator of how overly skeptical people have been. Joe Weisenthal is an editor at Bloomberg. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment