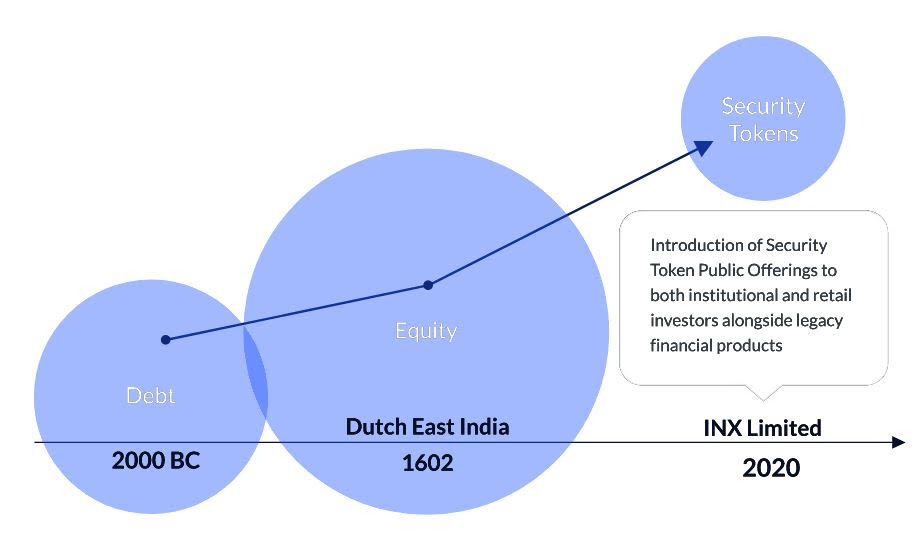

U.S. and China signal progress on trade, Laura set to make landfall as a hurricane, and Jack Ma's blockbuster IPO. Deal holdsAny fears that the worsening relations between China and America would threaten their bilateral trade deal have been put to rest for now. U.S. Trade Representative Robert Lighthizer and Treasury Secretary Steven Mnuchin spoke with Chinese Vice Premier Liu He yesterday evening, with both sides reaffirming their commitment to the accord. While Chinese purchases of U.S. goods have fallen far short of the pace required to meet the targets outlined in the agreement, there has been progress on other commitments. LauraTropical Storm Laura is poised to become a hurricane before making landfall in Texas and Louisiana on Thursday. The system's onset has already shut 82% of oil and 57% of natural gas production in the Gulf. Meanwhile, Tropical Storm Marco has lost so much power, it's likely to fall apart in approaching the coast. Oil futures remained undisturbed by the potential hit to production, with a barrel of West Texas Intermediate for October delivery broadly unchanged at $42.60, while gasoline futures rose on fears of supply disruption. Big Ant Billionaire Jack Ma's Ant Group filed for an initial public offering in Hong Kong and Shanghai with the listing likely to be one of the biggest in years, possibly topping Saudi Aramco's record $29 billion debut. Ant is targeting a $225 billion valuation based on an IPO of about $30 billion, making the company more than twice the size of Wall Street's biggest securities players. The firm continues to concentrate its expansion in Asia, with Jack Ma's promise to create 1 million jobs in the U.S. now a distant memory. Markets riseThe positive news on U.S.-China trade took one more potential risk off the table for investors and they reacted by doing what they have done for months now and bought more stocks. Overnight, the MSCI Asia Pacific Index added 0.4% while Japan's Topix index closed with a 1.1% gain. In Europe, the Stoxx 600 Index was 0.5% higher at 5:50 a.m. Eastern Time, with better than expected German survey data adding to the buoyant mood. S&P 500 futures pointed to another session in the green, the 10-year Treasury yield was at 0.682% and gold was lower. Coming up...The Republican National Convention kicked off yesterday with tributes to President Donald Trump and warnings of what a Joe Biden presidency would do to America. It continues today with first lady Melania Trump, Secretary of State Michael Pompeo, Eric Trump and Tiffany Trump among the speakers. On the data schedule, we get June house prices at 9:00 a.m., with July new home sales and August consumer confidence at 10:00 a.m. San Francisco Fed President Mary Daly speaks later. Salesforce.com Inc., Medtronic Plc and Best Buy Co. Inc. are among the companies reporting results. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningYesterday I came across a chart in a new crypto token offering, and I joked that it reminded me of one of those infamous Softbank charts. Here it is. It's got such grandiose implications -- a new asset class as historic as the Dutch East India Company! -- while also not saying much at all. You see, once there was debt. Then there was equity. And now finally finance has reached now heights with this security token offering called INX. But what is INX? And what does the chart mean? And what is the y-axis?  Photographer: Weisenthal, Joe Photographer: Weisenthal, Joe I talked on the phone with Douglas Borthwick, who is the Chief Marketing and Business Development Officer at INX, and the first thing he explained is that there's no actual y-axis. It's really whatever you want it to be. He says the chart is just supposed to show "over time how things have changed."

Ok, so how is it a new kind of security that's different than debt or equity? According to Borthwick, INX is a new crypto trading platform that's launching a fully regulated, audited token IPO. The token, he explained to me, entitles the owner to 40% of the firm's cumulative adjusted net operating cash flow. So to the chart above, technically it's not equity, because it entitles the holder to a specific, pre-defined share of the cash flows. It's not just the residual "what's left over" which is what goes to equity. And of course it's not debt, because it could theoretically allow a holder to get part of the upside. As Borthwick put it, "this is an IPO of the cash flow... it's not an IPO of the equity." Also the token has a utility component, as traders on the INX platform will be able to theoretically use their tokens to get discounts on coins, and the usage of these coins in trading would shrink the overall float, leaving more cash flow to the remaining token holders. In addition, the hope is that by having the traders on the platform also as token holders and thus beneficiaries of the upside, they'll form a community and evangelize INX and the token. So we'll see how it goes. The IPO of the coin is today, and they're trying to raise $117 million, selling 130 million coins at 90 cents each. It will be an interesting process to watch. At the end of the call I asked him once again about the Y-axis, and he assured me it can "be whatever you want." Joe Weisenthal is an editor at Bloomberg. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment