U.S. virus cases approach 6 million, China's recovery continues, and TikTok tales takes another turn. Not going awayCases of coronavirus in the U.S. are on the cusp of passing 6 million as the outbreak accelerates on college campuses. With some universities sending students home after an outbreak, public health experts are now saying it would be better for ill students to stay on campus rather than return to their communities. While the virus has a much lower fatality rate among younger people, there is evidence of long-term health effects from exposure to the disease. Airlines continue to be one of the industries hardest hit by the pandemic and major U.S. carriers are pulling out all the stops to try to get people to fly again. Better data, worse debt China's emergence from the coronavirus shutdown continued, with a gauge of economic activity showing the services sector at its strongest level since 2018 while the expansion of the manufacturing sector remained intact. There are some caveats over the performance as tensions with the U.S. continue to be elevated both in trade and political relations. On the domestic front, the country's biggest banks posted their worst profit decline in more than a decade as bad debt provisions jumped. TikTokThe sale of the U.S. operations of ByteDance Ltd.'s TikTok video sharing app, which has drawn the attention of a diverse range of suitors, has just had another roadblock thrown in front of it. On Friday, China asserted authority over any sale of the prized asset, meaning the company is required to seek Beijing's approval of any deal. The Trump administration's Sept.15 deadline on a sale of the American operations added to China's move means any deal may now be very difficult to reach. Markets riseThe relentless rally in global stocks is not showing any signs of stopping today with most gauges across the world adding to gains. Overnight the MSCI Asia Pacific Index slipped 0.7% while Warren Buffett's interest in Japanese stocks helped drive the Topix index to a 0.8% gain. In Europe, the Stoxx 600 Index was 0.4% higher at 5:55 a.m. Eastern Time, with the U.K. closed for a holiday. S&P 500 futures pointed to another session of gains today, the 10-year Treasury yield was at 0.723% and gold was unchanged. Coming up...It's a fairly quiet start to the week on the eco-data front, with only Dallas Fed Manufacturing activity at 10:30 a.m. for U.S. investors. Federal Reserve Vice Chair Richard Clarida and Atlanta Fed President Raphael Bostic speak later. Zoom Video Communications Inc. is among the companies reporting earnings. What we've been readingThis is what's caught our eye over the weekend. And finally, here's what Joe's interested in this morningIf you're interested in further understanding the Fed's new framework, then check out the latest episode of the Odd Lots podcast. In it, Tracy Alloway and I had the pleasure of interviewing Minneapolis Fed President Neel Kashkari, and although it was recorded just before Chairman Jerome Powell gave his Jackson Hole speech, we were able to discuss the general thinking behind the Fed's new strategy.

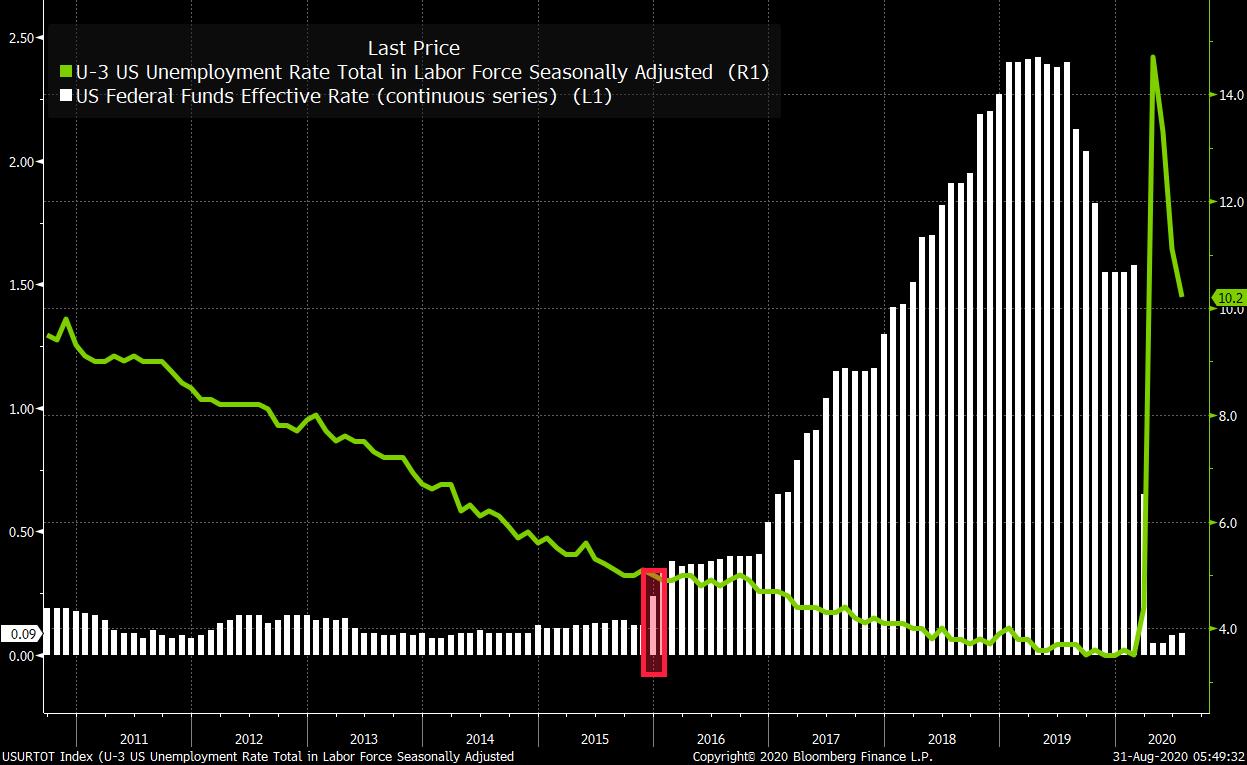

While many people say that the problem for the Fed is that inflation has consistently come in beneath its 2% target, that's not really it. The real issue is that it has consistently underestimated how strong the labor market could get, without triggering inflation. In the wake of the Great Financial Crisis, the Fed's first hike came at the end of 2015 when the unemployment rate was still at 5%. Over the next few years, the unemployment rate just kept falling without triggering sustained inflation, indicating that there was far more "slack" left in the labor market than they had appreciated back in 2015 when they first raised rates.  So how does the Fed avoid repeating this? This is what the new framework sets out to do. And as Kashkari puts it in our discussion (the relevant section begins around the 14 minute mark) the answer is, basically, to take the inflation mandate seriously. Instead of hiking rates when the models say you should anticipate inflation just because the unemployment rate has fallen below some number, the Fed actually wants to see the inflation first. This is the basic idea. During his tenure at the Minneapolis Fed, Kashkari has earned a reputation as a dove. As he noted on our podcast, he says all of the hikes were mistakes, and he didn't support any of them. The hope is that by formalizing an Average Inflation Target, such that the Fed will let inflation overshoot at times to make up for the periods of undershooting, that they don't repeat past mistakes. Check out the whole interview here or any of the other platforms on which Odd Lots can be found. Joe Weisenthal is an editor at Bloomberg. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment