U.S. and China eye trade talks, Fed issues warning and Europe grapples with virus surge. Talking againChina and the U.S. have agreed to hold a call soon to discuss the progress of their trade deal, according to the commerce ministry in Beijing. The comments Thursday didn't announce an exact date, or elaborate further. The two sides had previously been expected to talk this past weekend as a review was scheduled six months since the trade deal went into effect. Talks between the U.S. and China continue regularly at lower levels, according to Greg Gilligan, chairman of the American Chamber of Commerce in China. Meanwhile TikTok's Chinese owner is proposing to settle consumer privacy litigation that has exposed it to hundreds of millions of dollars in damages as it prepares for a possible acquisition under threat of being shut down in America. Fed guidanceThe Federal Reserve minutes yesterday showed a subtle shift in its commitment to an extended period of ultra-loose monetary policy, hitting stocks along the way. Its July meeting minutes fell short of laying out a path for rate liftoff and also seemed to suggest yield control isn't in the offing. The previous set of minutes indicated policy makers were keen to sharpen their so-called forward guidance at upcoming meetings. Guidance would have included rough criteria for zero rates targeted around inflation, unemployment, or both. The lack of clear bars to cling to came with warnings about "considerable risks" to the economy in the medium term, damping the ebullient stock mood. Bond traders reacted to language that said many policy makers judged that yield curve control is not warranted and wouldn't help much if it were attempted. Virus updateSpain is once again Europe's epicenter of the pandemic after recording the highest number of daily infections since April, while Germany added more than 1,000 new cases for a third consecutive day. France reported its biggest increase in new coronavirus cases since early May. The rise in recent weeks has been blamed on social gatherings and travelers, but officials are reluctant to pursue strict lockdowns as seen in the initial peak of the pandemic. New York's positive-test rate fell to the lowest since the virus began. As a reminder, global cases stand at more than 22.4 million with deaths passing 787,000. Markets downStocks are falling on pandemic worries and the Fed's continued caution. Overnight, the MSCI Asia Pacific Index was down 1.6% at 5:48 a.m. Eastern Time, while Japan's Topix index dropped 0.9%. In Europe the Stoxx 600 Index was 1% lower led by industrial companies. S&P 500 futures pointed to a weaker open, the 10-year Treasury yield was at 0.65% and gold was flat. Coming up...Initial U.S. jobless claims land at 8:30 a.m., with consensus projections for 920,000 claims for the week ended Aug. 15, down from 963,000 the previous week. San Francisco Fed President Mary Daly discusses the future of work at 1:00 p.m. Alibaba Group Holdings Ltd., Estee Lauder Cos Inc. and BJ's Wholesale Club Holdings Inc. are among companies reporting earnings. What we've been readingThis is what's caught our eye over the last 24 hours. - Apple's next trillion won't come so easily.

- Hangover cure successfully tested on drunk subjects in Finland.

- For firms that got Citi's $900 Million, it's a shot at payback.

- Wearable tech enters the fight against Covid-19.

- Market jitters show how much Fed medicine matters.

- Tech execs rally behind Harris as known quantity for VP pick.

- Despite rule changes, baseball games go longer than ever.

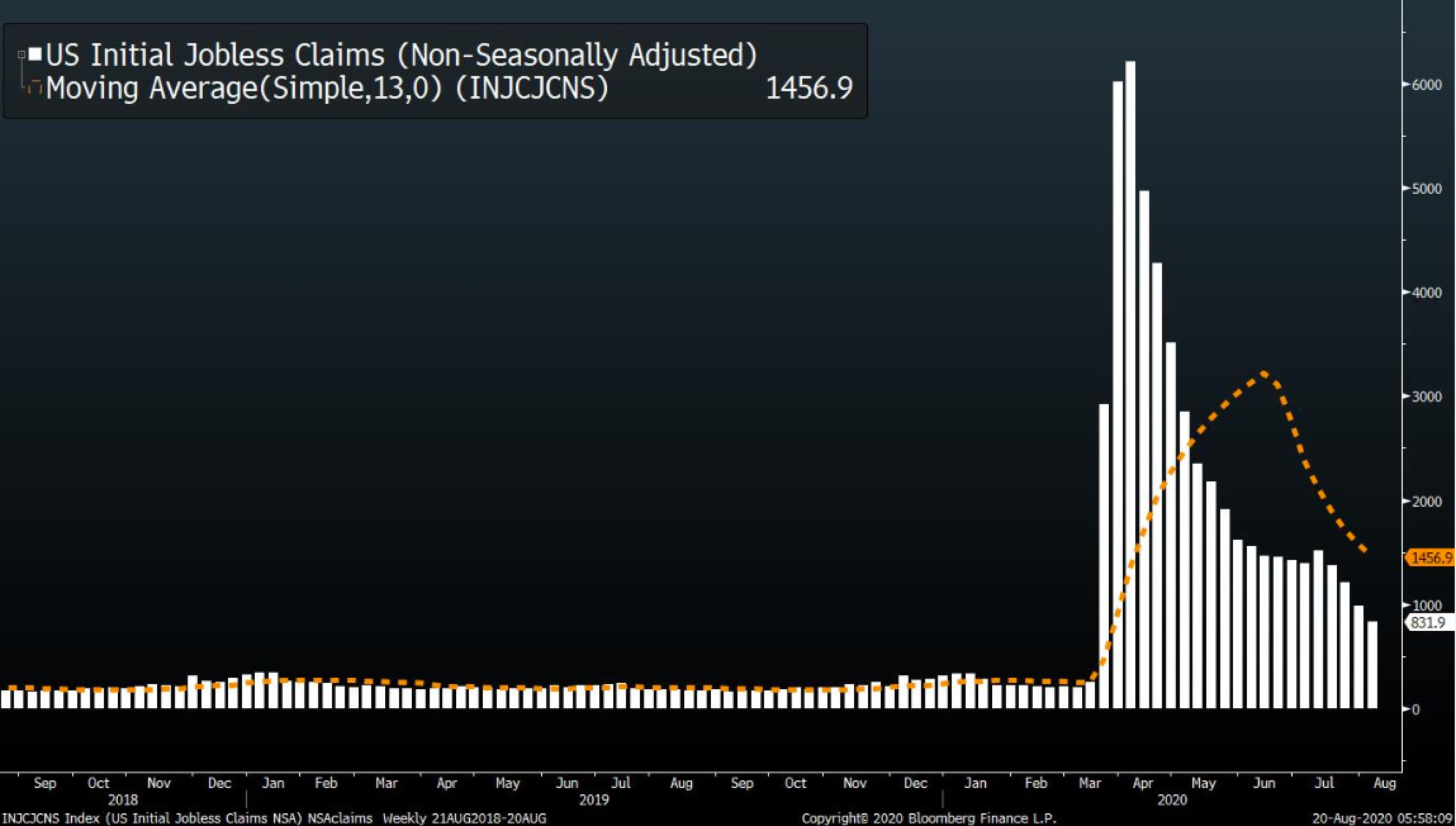

And finally, here's what Joe's interested in this morningThe U.S. economic recovery has had many speed bumps thrown in its way: Inconsistent health policies on the national and state level, lockdowns, reopenings, reopening reversals, second waves and disruptions to fiscal support. However, by and large, the economy has continued to trend in the right direction ever since late March/early April when the market bottomed. This can be seen in a range of official metrics, as well as alternative datapoints such as card spending, restaurant dining, air travel and so forth. It hasn't been pretty, and in many cases the shapes look nothing like a "V", but there's been improvement nonetheless. Today at 8:30 a.m. we get the latest installment of Initial Jobless Claims, and if you look on a non-seasonally adjusted basis, we've seen almost non-stop sequential improvement since early April. While the absolute levels are still awful, the important thing is the downward trend continues.  Joe Weisenthal is an editor at Bloomberg. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment