| Deal on virus aid inches closer, U.S.-China trade discussions in focus, and Beirut explosion aftermath. Close yet far A deal on virus-relief drew closer as the White House and Democrats both made concessions, even though they remain far apart on some key issues. U.S. Treasury Secretary Steven Mnuchin says the plan is for negotiators to agree by the end of the week. The support package of at least $1 trillion can't come soon enough as a surge of coronavirus cases across the country threatens jobs and the last installment of aid dries up. The Senate is scheduled for an August break on Friday and the House is already out. But lawmakers could be brought back to vote on 24 hours notice. Monthly payroll data due Friday will be closely watched amid fears the recovery is flagging. Talking again Contentious talks on the geopolitical front are also on the horizon, as the U.S. and China prepare to assess their phase-one trade agreement. Delegates led by U.S. Trade Representative Robert Lighthizer and Chinese Vice Premier Liu He are clearing their calendars for a discussion to take place on or around Aug. 15, six months after the agreement took effect, people briefed on the matter said. The latest Sino-American clash has revolved around Chinese music video app TikTok, which President Donald Trump has threatened to ban from the U.S. market unless an American company buys it by Sept. 15. Microsoft is in talks with the U.S. government to address perceived national security issues in the purchase of the company. Beirut blast A massive explosion in Beirut killing dozens and wounding thousands continues to shock the world. Army personnel and rescue workers sifted through mountains of rubble from the blast that flattened Lebanon's main port, looking for survivors. Officials blamed highly explosive materials equivalent to 1,800 tons of TNT that had been stored at the port for years, without saying what triggered the blast which was heard as far away as Cyprus. "It is a destroyed city, people lying on the streets, damage everywhere," Beirut Governor Marwan Abboud told reporters near the scene. Markets up Markets were boosted by the prospect of a deal on virus-aid and rapprochement between the U.S. and China. Overnight, the MSCI Asia Pacific Index added 0.5%, while the Topix closed little changed. In Europe, the Stoxx Europe 600 Index climbed to a one-week high, up 0.7% as of 5:43 a.m Eastern Time. S&P 500 futures were pointing up, the 10-year Treasury yield was at 0.526% and gold continued its ascent above a record $2,000 an ounce. Coming up... Investors will be looking for signs of economic recovery in the U.S. when Markit PMI services and composite numbers are published at 9:45 a.m. Trade balance data for June is due at 8:30 a.m. Earnings highlights include CVS, Humana, Regeneron, Fitbit, Teva, Sarepta Therapeutics, and Noble Corp. What we've been reading This is what's caught our eye over the last 24 hours. - More bailout cash won't stop wave of credit card defaults.

- Gargling won't help beat the virus.

- China's assertiveness is becoming a problem for its friends, too.

- Why shouldn't retirement savers buy ESG stocks?

- An urban planner's trick to making bike-able cities.

- If we can't go to Spain, Greece will do nicely.

And finally, here's what Joe's interested in this morning People are so used to saying that the stock market is disconnected from the real world, it's just completely treated as a fact that doesn't even need to be backed up. You can just say it's all about the Fed, or the money supply, or people on Robinhood, or rich people propping it up, and almost nobody questions it. However, the disconnect doesn't really stand up when you start looking at things on a sector-by-sector basis. As Barry Ritholtz notes in a recent Bloomberg Opinion column, some of the sectors that you would have expected to get crushed by the pandemic are... doing exactly that: Getting crushed. Department stores, he notes, are off 62%. Airlines are down 55%. Resorts and casinos down 45%. This all sounds about right for a pandemic. The fact that the S&P 500 is actually a little bit higher on the year at this point is because it's dominated by big tech stocks, and, well, the big tech companies are doing phenomenally well at business. It turns out that when you have billions of people around the world changing their behavior, staying home and looking at the internet on their phone and computer, that's really good for internet, phone, and computer companies.

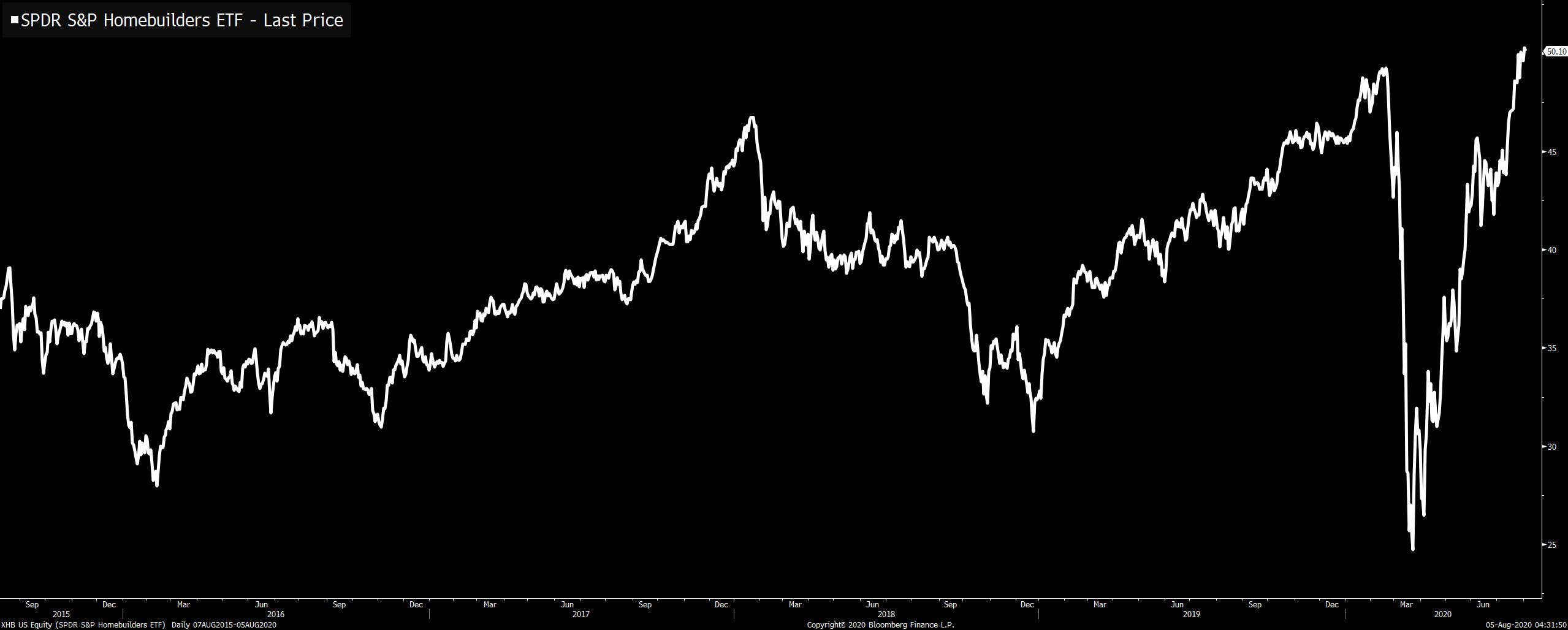

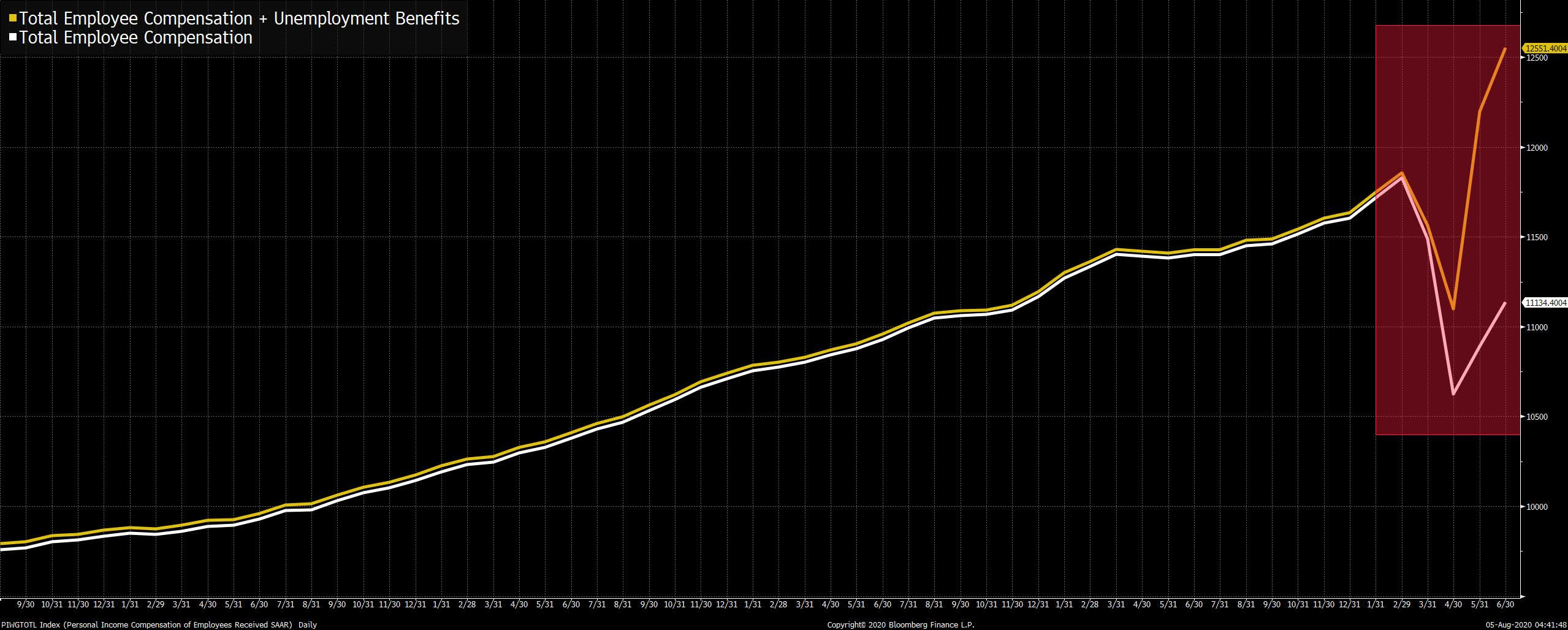

For what it's worth, it's not just tech that's great. Things like homebuilders have also seen a V-shaped recovery, amid a boom in people flocking to the suburbs. Not a lot of people would have predicted that the crisis would lead to a housing boom, but it has, and it's reflected in the stock market.  The other big factor contributing to the seeming "disconnect" is that there is a weird situation where up until this week, basically, incomes have been disconnected from wages, due to the expansion of unemployment insurance in the CARES Act. Here's the chart, which I've gone back to a few times, showing the difference between total household income when you include the unemployment insurance expansion (yellow line) vs. total household income when you just look at labor income. This has allowed the economy to operate at a higher level than you'd expect, just given the soaring levels of unemployment.  The disconnect can basically be chalked up to two things: 1. The wide divergence in performance of different sectors, with big tech companies doing phenomenally well and 2. The unusual divergence between employment and actual income. Joe Weisenthal is an editor at Bloomberg. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close |

Post a Comment