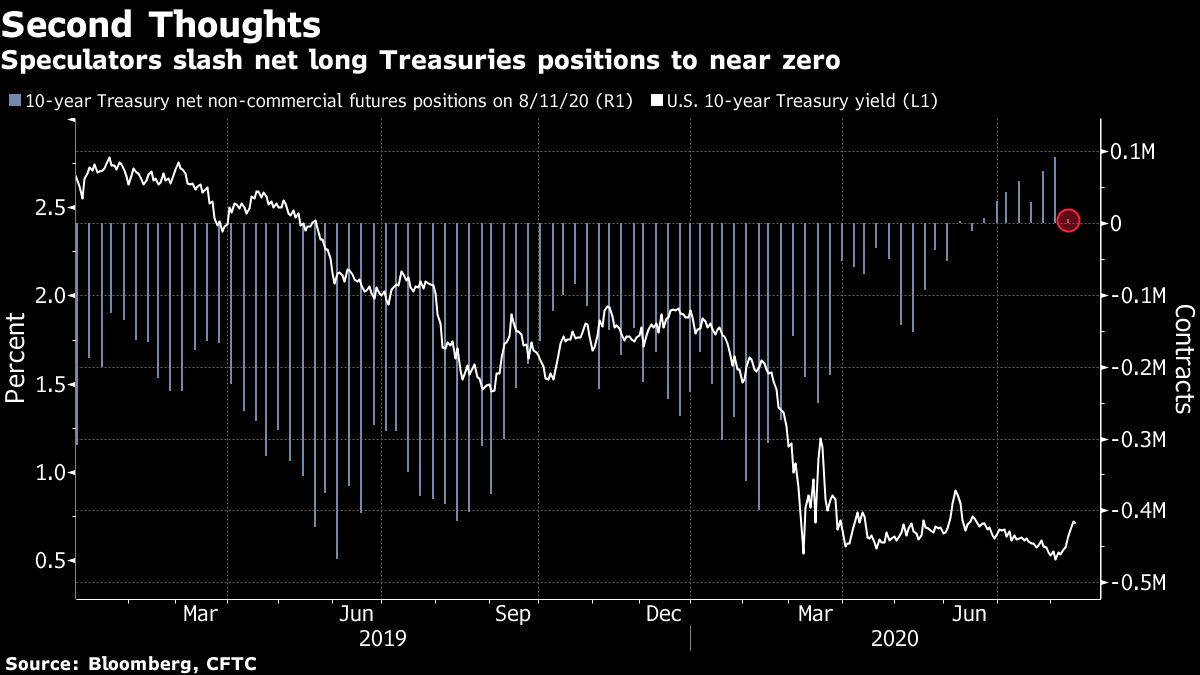

| Want the lowdown on what's moving European markets in your inbox every morning? Sign up here. Good morning. A return of tough measures to combat the virus, Lukashenko seeks Russian help, and Microsoft may want TikTok's U.K. operations. Here's what's moving markets. Setbacks Amid local spikes in Covid-19 cases, Italy and Spain told nightclubs to close again while Italy also mandated the wearing of masks wherever social distancing can't be ensured during the day. France's public health agency warned that all of the country's Covid-19 indicators are trending upward. Elsewhere, New Zealand Prime Minister Jacinda Ardern decided to delay the country's election by four weeks amid a renewed flare-up of the coronavirus in the island nation. Australia suffered its deadliest day since the start of the pandemic. Stampede The U.K. housing market saw a surge in activity last month as Londoners sought to flee the city after lockdown and a tax break encouraged buyers, Rightmove data show. Prices hit unseasonal record highs in seven regions, but a drop in London pulled down the national average to a 0.2% decline. The stampede out of cities could get even stronger in the coming months as almost two-thirds of British businesses expect all or some of their employees to work remotely for the next year. Russian Boots Russian President Vladimir Putin offered potential support to Belarus after leader Alexander Lukashenko appealed for his help in the face of unprecedented protests that have been met with a brutal police crackdown. Russia is ready to provide assistance to Belarus in "resolving the problems" that arose after the presidential election a week ago, the Kremlin said. Hundreds of thousands of protesters gathered peacefully in the center of Minsk, the Belarusian capital, and rallied in cities across the country on Sunday, calling for Lukashenko's resignation and the release of detainees. TikTok U.K. Microsoft Corp. is interested in buying the popular music video app TikTok's U.K. operations, expanding beyond the U.S., Canada, Australia and New Zealand units that are already under discussion, Fox Business Network reported, citing a banker it didn't identify. The U.K. government said in early August that it has no plans to block the ByteDance platform in the country. TikTok is sitting on a plan to move its headquarters from the U.S. to London as it waits for a public statement of support from the British government, the South China Morning Post reported last week. Coming Up… Pharma M&A is back, with Sanofi's $3.4 billion deal to buy Principia Biopharma Inc. It's a light schedule for corporate news otherwise, with Danish hearing aid maker Demant A/S and U.K. packaged food company Cranswick Plc set to report earnings. Thunderstorms in many European cities are forecast to bring some much-needed relief from the heat. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morning It seems hedge funds have seen a ghost in the U.S. bond market, albeit one closer to the size of Slimer than the Marshmallow Man. Speculators have slashed their net long positions in benchmark Treasury futures by 94% -- from the highest since November 2017 -- to near neutral levels, according to the latest Commodity Futures Trading Commission data. While the size of the bullish bets were by no means extended, the move came in a week that saw the 10-year yield climb about 15 basis points amid a surge in sovereign debt supply and better-than-expected economic data. Neutral is an understandable position to have in the global risk-free asset at the moment. While there are a number of reasons for yields to push higher -- heavy issuance, rising inflation expectations, optimism about a vaccine -- the sword of Damocles wielded by the Federal Reserve hangs ready to crash down on any rapid spike. And interestingly there were signs of institutional buyers of Treasuries last week as yields rose -- particularly in Asia. The consensus seems to be for 10-year yields to trade in a range between 0.5% and 1%, and they closed more or less in the middle on Friday. I can see why there's a reluctance to bet big either way.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment