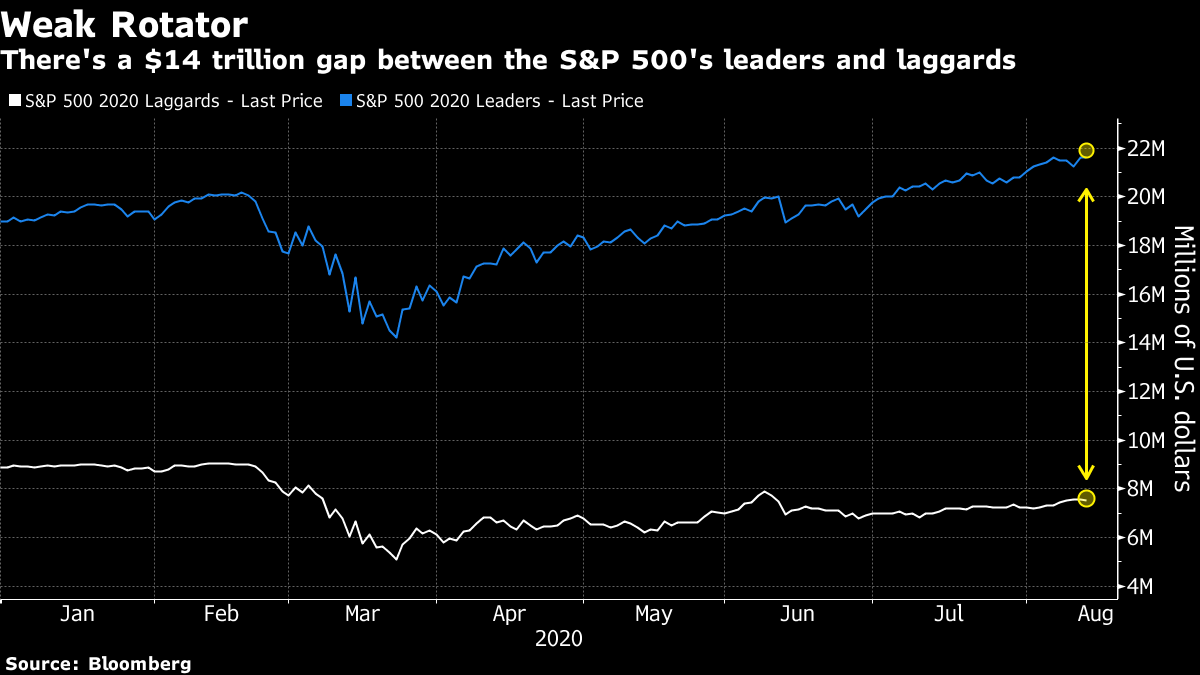

| Want the lowdown on what's moving European markets in your inbox every morning? Sign up here. Good morning. The U.K. is adding more countries to its quarantine list, Daimler AG is paying up and China's recovery continues. Here's what's moving markets. Travel Troubles Travel is getting trickier because of the pandemic. The U.K. added France, the Netherlands and Malta to its list of countries from which people arriving have to quarantine for 14 days, a move likely to cause dismay among holidaymakers and anger from the countries involved. And Prime Minister Boris Johnson said England can resume the paused easing of lockdown rules, with theaters, casinos and beauty parlors allowed to reopen -- but warned of tougher penalties for breaking social-distancing restrictions. Meanwhile, New Zealand recorded 12 new confirmed local cases and new infections in South Korea almost doubled from a day earlier. Daimler Settlement Daimler AG will pay more than $2 billion to settle U.S. diesel-emissions issues in the latest fallout from years of closer regulatory scrutiny on vehicle pollution. Although the expenses add to Daimler's financial headwinds triggered by the Covid-19 pandemic, the amounts are minor compared with the larger-scale emissions violations that have cost rival Volkswagen AG more than 30 billion euros. Daimler says it fully cooperated with U.S. authorities, whereas VW officials initially lied to EPA and California regulators. China's Recovery China's economic recovery continued in July with industrial growth remaining steady, even as weak retail sales undercut the rebound. Industrial output rose 4.8% in July from a year earlier, the same as in June, but lower than economists' expectations. Overall retail sales fell 1.1%, compared to a projected 0.1% increase. The July data show that China's recovery is still uneven, with consumption unable to keep up with the rebound in industrial output. China stock and currency markets showed little reaction to the data. Market Mood Welcome to a summer Friday. Asian stocks are drifting as investors mull the stalemate in stimulus talks in America and parse signs of an economic recovery. Treasury yields steadied near an eight-week high. Gold dipped and the dollar was steady. With markets in the Middle East closed today, we'll have to wait until Sunday to see how investors in the region react to the historic deal between Israel and the United Arab Emirates to begin normalizing relations. European equity futures are edging lower after a mostly positive week. Coming Up… The earnings calendar is devoid of household names, but there's some economic data. We'll get an update on how much the euro area's economy contracted in the second quarter; the initial report showed a 12.1% plunge. More importantly, we get euro-zone employment statistics, which could be misleadingly benign. France's unemployment rate yesterday fell to the lowest since 1983, but the statistic doesn't include people who wish to work but aren't counted as unemployed because they were unable to look for a job in confinement. And U.S. retail sales should show the consumer recovery slowed down in July from the 18.2% increase in May and a 7.5% jump in June. Economists on average forecast sales climbed 2.1%. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morning Yesterday's `Five Things' comment got me thinking more about the hope that a rotation into this year's laggards can kick off a new leg higher in U.S. stocks. Believers really need to temper their enthusiasm. There's a $14 trillion gap between the value of the S&P 500's five lagging sectors this year -- energy, financials, real estate, utilities and industrials -- and that of the leaders, which include technology and health care names. That means the laggards will have to perform disproportionately better in any stock rotation to drive an overall rally in the benchmark, as even a modest selloff in the leaders would quickly weigh. The combined market capitalization of the five worst-performing sectors -- ranging from the energy sector down 38% to industrials off 5% -- is just $7.5 trillion, according to data compiled by Bloomberg. That compares with a total $21.6 trillion for the six sectors in positive territory, where technology and consumer discretionary stocks have performed best, up 24% and 20% respectively. Stock pickers have the luxury of deciding where they want to put their money if they think a change in market leadership is coming. Index investors will still suffer the consequences even if the laggards rise.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. |

Post a Comment