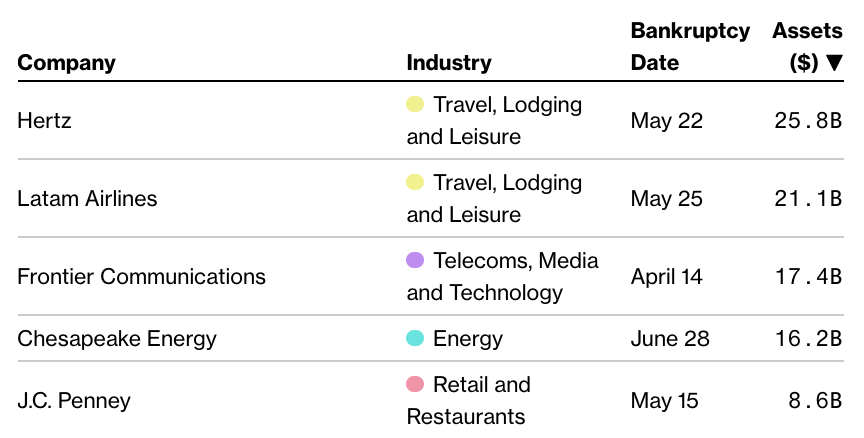

| China is pushing to increase the use of its currency globally. Asian stocks look set to kick off the week on an upbeat note. And hundreds of thousands of residents turned up for Hong Kong primary elections. Here are some of the things people in markets are talking about today. Faced with the prospect of restricted access to U.S. dollars, China's answer is to get more people to use its own currency instead. The increasing spillover of Sino-American tensions into the financial sphere has ignited a fresh push by China to promote the global use of the yuan. A growing number of government officials and influential market watchers have in recent weeks urged greater efforts on the endeavor, which gained renewed significance after China's new Hong Kong security law triggered the threat of retaliation from Washington. While such drastic action is far from being implemented by the U.S. — and could potentially do major damage to American interests and the entire global financial system — the risks alone have raised alarm bells. With almost a trillion dollars in offshore bonds and loans and $1.1 trillion in state-owned bank liabilities, access to the greenback is vital for Chinese companies and lenders. Yuan took up 2% of global central banks' reserves at end of first quarter. U.S. virus cases rose to 3.27 million with almost 56,000 new infections, less than the one-week average daily increase. Even so, Florida reported more than 15,000 cases, the biggest daily increase of any state since the coronavirus pandemic began. Florida's count exceeded records in New York, California and Texas, each of which has peaked at almost 12,000 daily cases so far. U.S. Education Secretary Betsy DeVos said "the rule should be that kids go back to school this fall." Meanwhile, one of U.S. President Donald Trump's coronavirus task force members said that infectious disease specialist Anthony Fauci doesn't necessarily "have the whole national interest in mind" in suggesting responses to the pandemic, reflecting tension in the administration before the November election. South Africa introduced a curfew and a booze ban after virus rules went unheeded. Here is how Bloomberg is tracking the virus. Asian stocks were set to gain on Monday as investors looked to the start of earnings season on Wall Street for further clues on how companies are planning for the future. S&P 500 futures opened firmer. Currency markets saw muted moves in early trading, while futures on Asia-Pacific stock indexes were higher. Banks — which kick off the reporting season this week — led the S&P 500 up on Friday, when Treasuries reversed a gain that had pushed the five-year yield to a record low. Oil was little changed. Global equities are trading near the highest since before the market swoon in late February. As governments gradually ease coronavirus shutdowns to revive growth, new outbreaks are causing further restrictions and leading some investors to wind back their expectations on the pace of recovery. Meanwhile, China will this week have a clearer picture of its progress on nursing the economy back to health when it reports second-quarter GDP on Thursday, along with monthly readings for industrial output and retail sales. Emerging markets have a lot going for them right now. Putting aside the worrying rise in Covid-19 cases, the positive narrative for investors in developing economies remains intact. China's economy probably returned to growth in the second quarter, putting the yuan — the current barometer of global risk sentiment — on course for further gains following its biggest weekly jump since January 2019. Goldman Sachs revised its 12-month forecast of the currency to 6.7 from 7, expecting it to benefit from a weaker dollar. That's likely to add further momentum to this month's rally in emerging-market currencies, with the 50-day moving average on an MSCI gauge now higher than its 100-day counterpart. Developing-nation currencies are cheap and will probably play catch-up with other risky assets as the foreign share of local debt holdings has shrunk to a record low, according to Deutsche Bank. Hundreds of thousands of Hong Kong residents defied concerns about social distancing and a new security law to vote in two-day primaries held by pro-democracy opposition parties. More than 580,000 people voted electronically as of 9 p.m. Sunday, more than triple the original target and amounting to over 13% of registered voters, according to Au Nok Hin, one of the organizers. Results are due Monday. Opposition groups were hoping to attract at least 170,000 voters to the unofficial primaries to select district candidates for September's Legislative Council election. The opposition hopes to ride a decisive victory in last November's district council elections to secure a majority in the legislature that would give it the power to block Chief Executive Carrie Lam's agenda. However, the new security law has compounded risks that the Beijing-backed government will disqualify pro-democracy candidates to keep them from winning enough seats. What We've Been Reading This is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in this morning Every once in a while one of the thorniest concepts in modern finance rears its ugly head. I'm talking of course about correlation, or the difficulty of identifying and forecasting links between markets and assets. Correlation can pop up in all sorts of surprising ways. Back in 2008, it became clear that Wall Street had misjudged the default risk of home loans packaged into an alphabet soup of securitized products, from RMBS to CDOs. The result was an unforeseen wave of mortgage defaults that overwhelmed financial structures that were supposed to be impervious to these kind of losses. Before that, unexpected market correlation helped sink the hedge fund Long Term Capital Management.  Historic correlations often break down in times of financial stress, and new linkages can emerge unexpectedly. All of this is on my mind as I watch the list of corporate bankruptcies grow ever larger. Take Brooks Brothers, for instance. The two-century-old suiting specialist filed for bankruptcy protection last week. I'm not an expert on the business of men's business attire, but it doesn't seem far-fetched to imagine that wool suppliers might get hit as a result of Brooks' Brothers' troubles — meaning a bankruptcy in the U.S. could, for instance, result in difficulties for wool suppliers in Bangladesh and India. And perhaps one of these wool companies is run by a mogul who is also invested in a San Francisco tech startup. That startup might now find a source of much-needed capital cut off. These are all hypotheticals, of course. The point is that few would have anticipated, much less modeled, a connection between a suit company and a startup in Silicon Valley. Yet these are the kind of theoretical linkages worth pondering as the corporate failures pile up. The best in-depth reporting from Asia and beyond. Sign up to get our weekly roundup in your inbox. |

Post a Comment