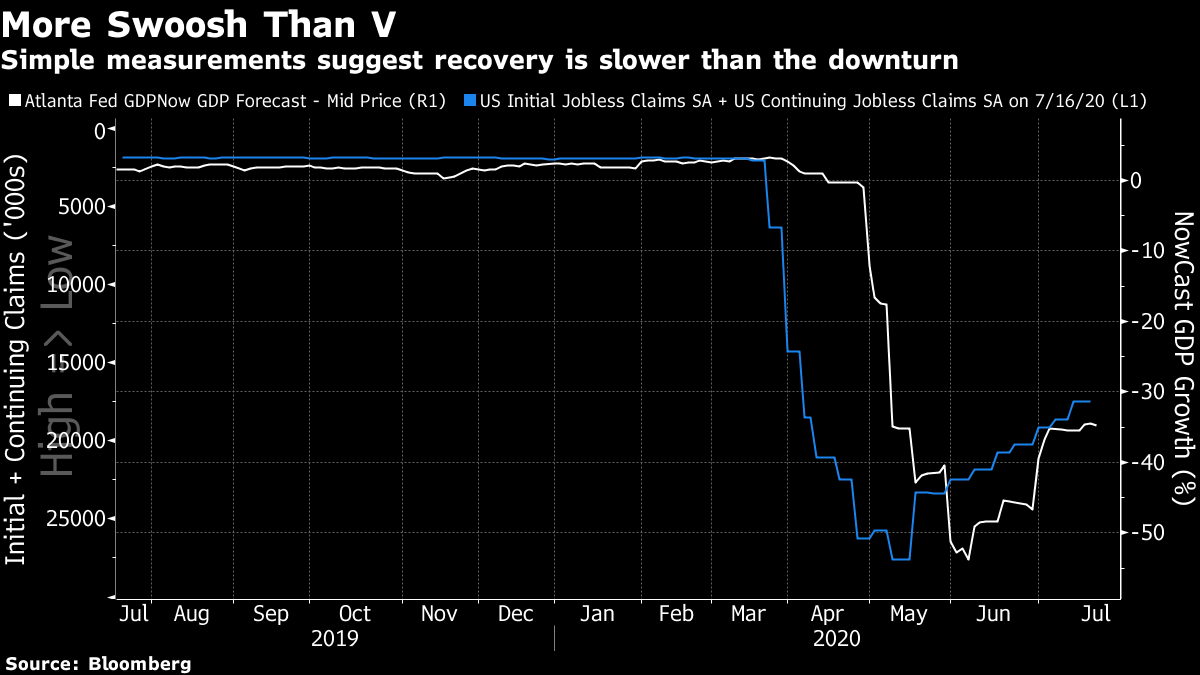

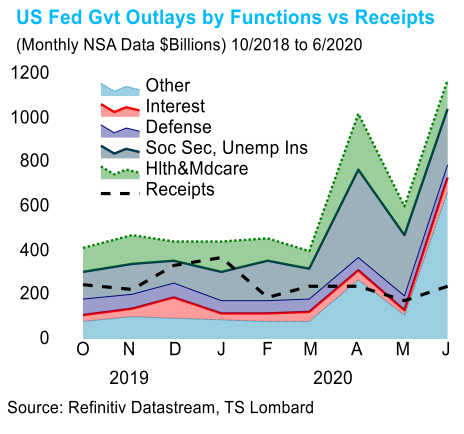

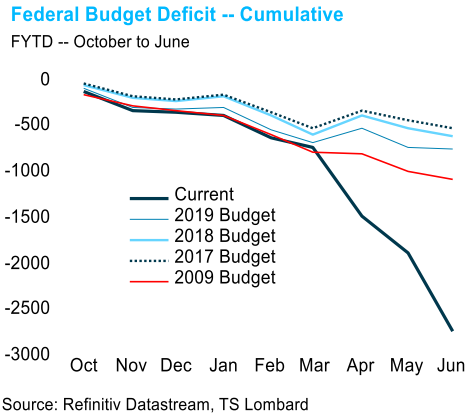

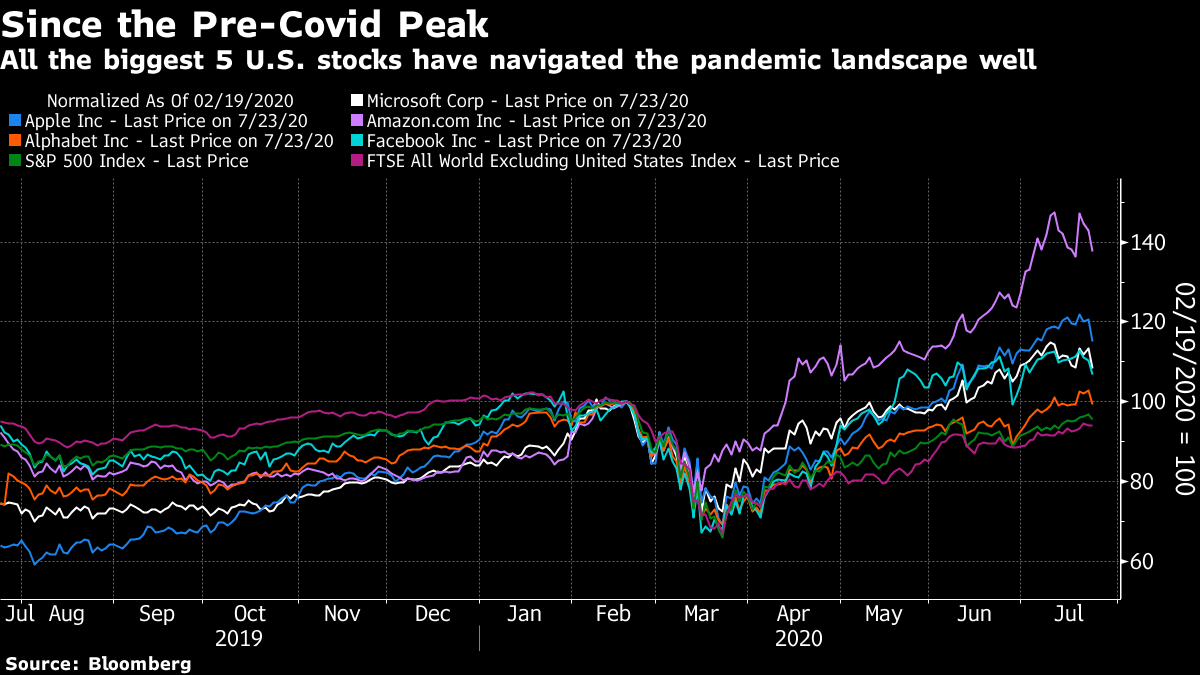

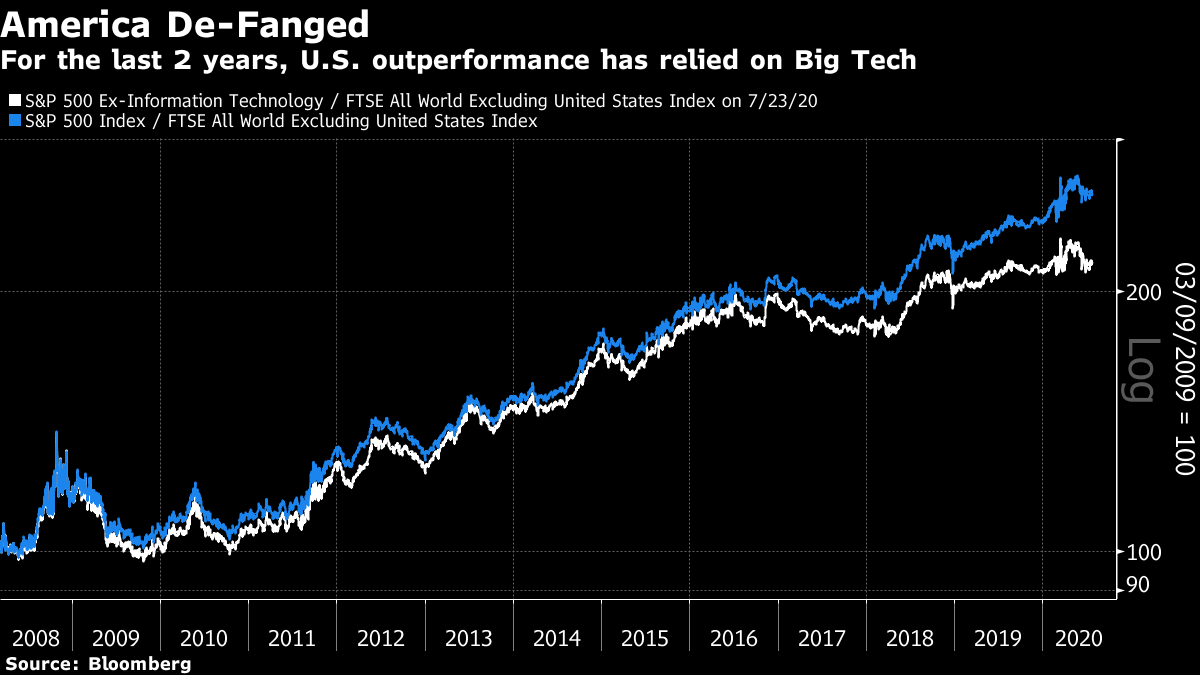

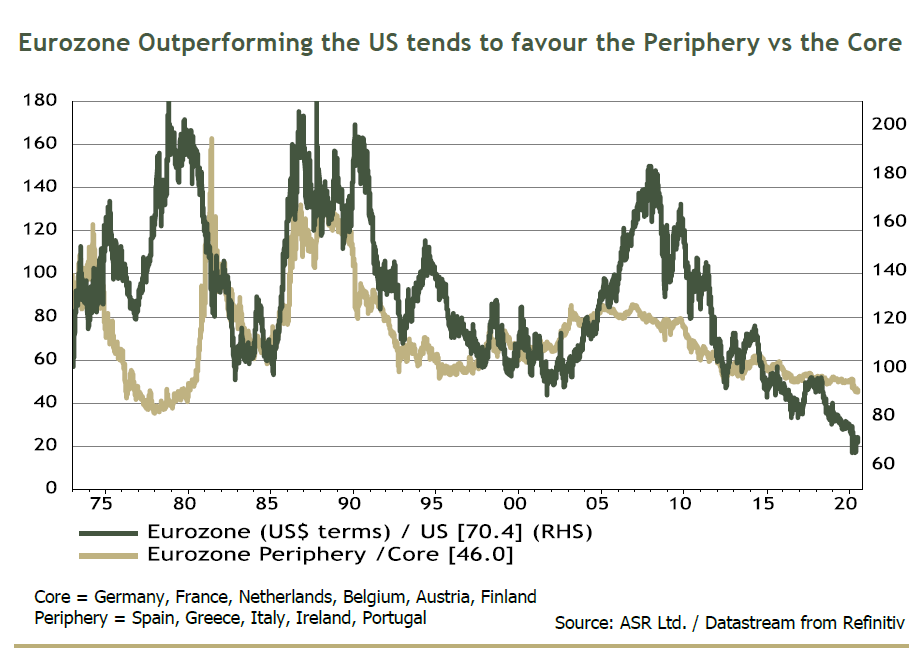

The Nike Swoosh Recovery Appetite for risk has just reversed. Why? And how seriously should we take this? At the macro level, the popular culprit was the new data on weekly initial jobless claims in the U.S., which saw the first week-on-week increase since the end of March. Against a backdrop of optimism that the U.S. economy was in a true "V-shaped" recovery, this was obviously disappointing, but it wasn't surprising given either the recent trends in claims, or the worrying pickup in Covid-19 cases and deaths. For a simple gauge of how the recovery is progressing, try the following chart. It includes the Atlanta Federal Reserve's GDPNow forecast, which aims to pull together recent data to show at what annualized rate the GDP is growing or rising at any one time. On the other scale is the total of both initial and continuing jobless claims, which are both announced weekly and give us a crude real-time measure of how the labor market is progressing. In both cases we see a spectacular fall, the beginning of what looks as though it could be a V-shaped rebound, and then a slowing into something that looks more like a Nike "Swoosh" logo.  These numbers aren't conducive to great optimism, and it's reasonable to guess that current stock-market prices presuppose a stronger recovery. In markets, there was a major landmark in the 30-year Treasury bond market. The real yield (accounting for inflation) hit the lowest ever in the period that inflation-protected bonds have been available. They now carry a negative yield that has dropped below its low from the crisis period back in March:  This implies acute problems for anyone trying to manage money for the long term, such as pension fund managers, as the cost of buying a guaranteed income becomes prohibitive. And the fact that people are prepared to lend to the government for such a long period while expecting a negative real return implies great negativity. Not coincidentally, this was accompanied by a further sharp rise in the gold price, which benefits from low real yields. In dollar terms, gold is now barely 1% below its all-time high, set in early September 2011 in the wake of the U.S. debt ceiling crisis. Normally, risk aversion leads investors to send money flowing into the U.S., but the dollar has actually weakened, as the relatively high bond yields that had previously attracted capital are no longer providing support. The dollar index, a popular measure of its level against other major currencies, dropped below the low it momentarily hit during the crisis in early March, and is now at its lowest in 22 months. The index is sharply below its long-term trend.  Another factor of rising importance is the need for someone to decide what happens to the fiscal support that has been cushioning the economic blow of the virus since March. As it stands, additional support for those laid off as a result of Covid-19 ends this month. That seemed a reasonable closing date back in March, but the worsening health and economic data make it plain that something more has to be done. This will require Congress to thrash out an agreement quickly, and then get the president to sign it. The cross-currents are treacherous. Republicans don't want to be cast as the party that pulled the plug on many who lost jobs through no fault of their own, only months before an election. But they also don't want to be the party that recklessly expands the deficit. As this chart from Steven Blitz, U.S. economist for TS Lombard, makes clear, the government's expenditure has now leapt far ahead of its receipts:  The good news is that the bond market (with much help from the Fed) is making it easy to finance that deficit. But the bad news is deepening in a spectacular way:  Something will be arranged because a "fiscal cliff" could be disastrous. But Republicans will try their hardest to make sure that payments don't unfairly disincentivize work. Such judgments are hard enough to make at the best of times. It will be very difficult to get it right in fraught conditions with a presidential election barely 100 days away. Blitz puts the dilemma as follows: The view rising among conservatives is either the economy is in a "V" recovery making such aid less necessary, or the virus has permanently changed the economy. If it is the latter, then better to let the capitalist system winnow out the losing businesses and free up capital rather than have government locked into supporting zombie firms in zombie industries. While their sentiment may be pure (unless the zombies are particularly impactful on their states), they have undue confidence that the bankruptcy courts could efficiently handle the surge. It isn't a V-shaped recovery. Covid has seen to that. The weakening dollar and record low bond yields make life easier for the U.S. and its policymakers, but the risk of a mistake, and of a solvency crisis to hit later, are real. Until these immediate policy issues are resolved, risk aversion will probably stay high, while confidence in the U.S. stays weak. Fangs for the Memories Another potentially big development was a nasty sell-off for the Fang stocks. In the case of Amazon.com Inc., and of Tesla Inc., which is included on some lists of Fang companies, including the NYSE Fang+ index, their stocks have made what looks nastily like "double-top" formations, which technical analysts who follow chart trends find particularly worrisome. Tesla's sharp fall came despite its announcement that it had made a profit for the fourth quarter in a row, which means that it is now eligible for inclusion in the S&P 500. Joining the index instantly forces many tracker funds to buy it, and this had been a key reason for optimism about Tesla — so the sudden reverse seems rather an extreme example of buying the rumor and selling the news. There is no particular reason to think that this is the moment the Fangs' rise comes to an end after several false alarms over the past few years. If we look at how the biggest five stocks in the U.S. have done since the pre-Covid peak on Feb. 19, we find that all are up since then (with the exception of Alphabet Inc., which is only slightly down), and that none are obviously setting into a downward trend. All have easily beaten the S&P 500, which outperformed stocks in the rest of the world.  But this leads to an interesting finding. The remarkable strength of the S&P 500 is at present largely down to the remarkable strength of Silicon Valley. Since Feb. 19, the rest of the world has actually outpaced the S&P once tech and telecoms are excluded:  'Twas not ever thus. Since the market's post-GFC nadir in March 2009, the S&P has handily outperformed the FTSE index for the rest of the world. What is intriguing, however, is that the tech-less S&P outperformed the rest of the world to almost exactly the same extent as the full S&P. It is only in the last few years, with the emergence of the Fang phenomenon, that U.S. exceptionalism has become tech-dependent. Without tech, the S&P 500 has only very slightly outstripped the rest of the world over the last two years:  This doesn't necessarily imply that the Fangs are overvalued. They are remarkably dominant companies that currently have a licence to print money. But it is possible that the Fangs are having more of a negative impact on other U.S. companies than they are on established companies in other markets, and hurting the performance of the rest of the S&P 500. And at this point the remarkable strength of the U.S. stock market should not be taken as a macro indicator that investors have more faith in the U.S. economy, but rather as an indicator that the U.S. has birthed a group of exceptional companies that are gobbling up all the competition. If the dollar continues to weaken, that should continue to strengthen the rest of the world relative to the U.S. Back to Club Med In a related development, the market is prepared to give the European Union the benefit of the doubt after its own vexed political negotiations over fiscal policy at the beginning of the week. The upshot was that a European recovery fund to aid the countries worst impacted by Covid-19, led by Italy, will indeed happen. And that in turn has brought down the spread at which Italian bond yields trade over German bund yields to levels that no longer suggest a crisis, or any risk to the continued existence of the euro.  U.S. politicians can hope for a similarly market-friendly resolution to their dilemma over post-Covid fiscal policy. But if we assume that European stocks can, with a little help from the currency, continue to outperform the U.S. for a while, that suggests that there might just be an opportunity in stocks of beleaguered Mediterranean countries. As this chart from London's Absolute Strategy Research shows, when Europe has outperformed the U.S. in the past, the countries of Europe's periphery have tended to outperform the core.  Circumstances have changed, but the periphery nations do offer the chance to make an effective "geared" bet on a European revival. During the EU sovereign debt crisis at the beginning of the last decade, they rejoiced in the miserable acronym of the PIIGS. Now, see if your stomach is strong enough to invest in Portugal, Italy, Ireland, Greece or Spain. Survival Tips Maybe don't plan any big gatherings in Florida for the rest of this summer. That way you avoid the risk of cancellation and unrefundable expenditures. It would be a shame to book a train in vain.

Have a good weekend. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment