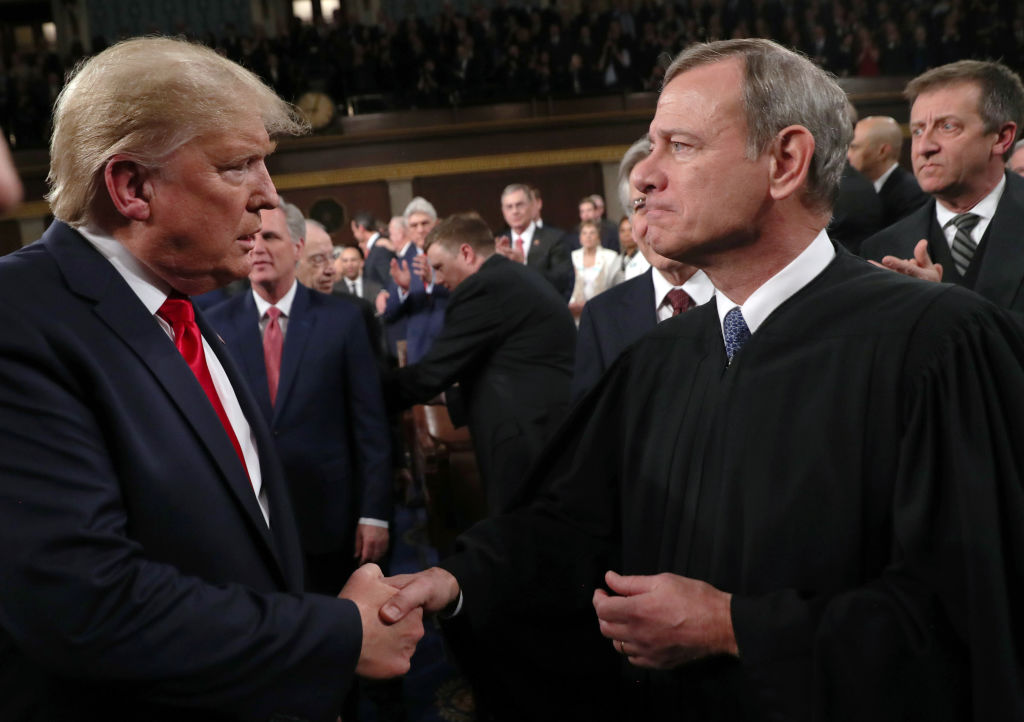

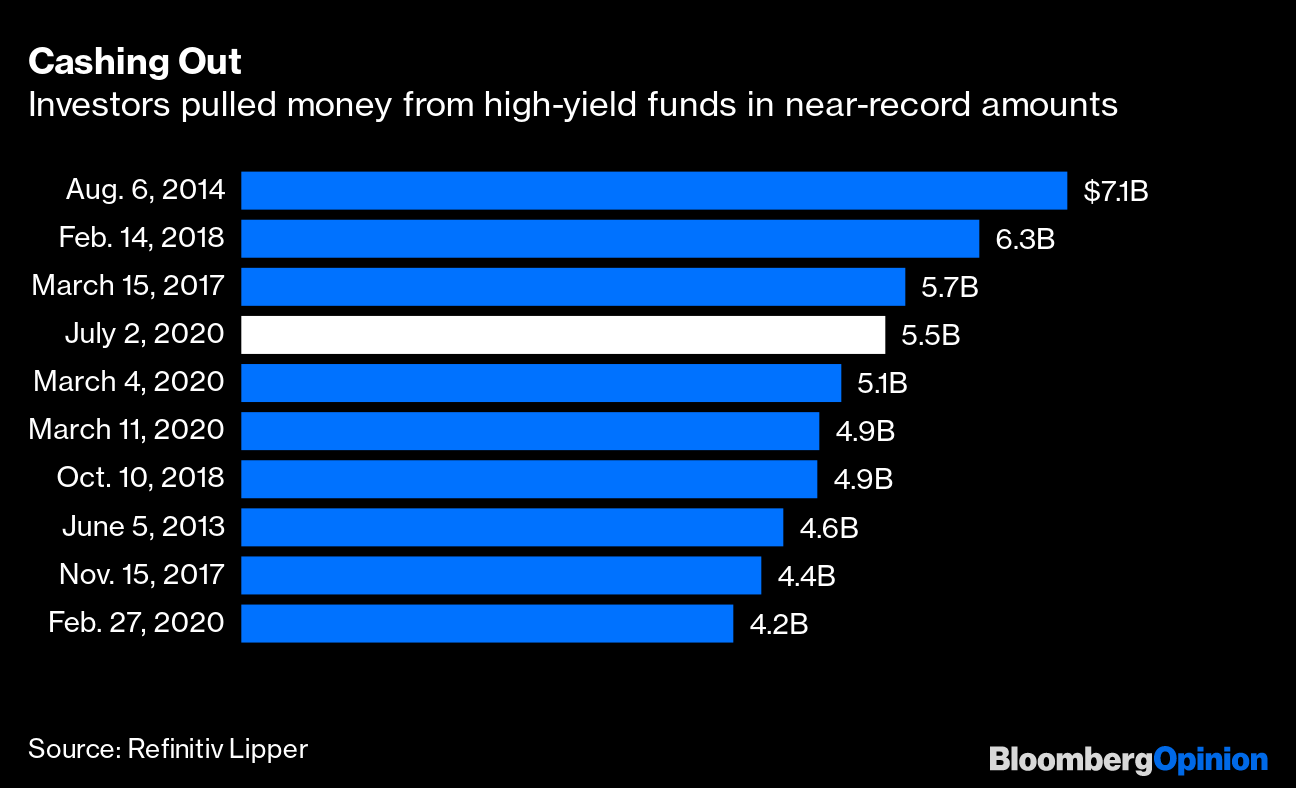

| This is Bloomberg Opinion Today, a floral arrangement of Bloomberg Opinion's opinions. Sign up here. Today's Agenda  President Donald Trump and Supreme Court Chief Justice John Roberts, in friendlier times. Source: Pool/Getty Images North America The Supreme Court Defends a Precedent Against a President In the two-front battle for his tax records, President Donald Trump can chalk up one as a loss, and the other as a draw. The Supreme Court, ruling on two cases for access to his filings, decided Manhattan District Attorney Cyrus Vance Jr. can see them, but that Congress must wait on the judgment of lower courts. The president, predictably, has railed against the court. But he may draw some quiet satisfaction from the second decision, which will likely allow him to avoid revealing his filings in the run-up to November's election. Even so, the decisions represent an important landmark. By ruling the president is not above the law, the court preserved a tradition going back over two centuries, and ensured it will endure. "This opinion will echo well beyond Trump's presidency," says Tim O'Brien. "It is a victory for the rule of the law at a time when it has been under withering attack, in words and actions, from the executive branch." For Noah Feldman, the twin decisions represent a win for the court itself, and especially for Chief Justice John Roberts, who, having witnessed Trump's manifest contempt for rules of any kind, seems to have made it his business to humble the president before the law. Says Feldman: "Overall, we can look at these decisions as genuine accomplishments by the Supreme Court. Somehow, against the odds, the court is reestablishing its legitimacy, and pushing the specter of the partisanship of Bush v. Gore further into the past." America is Dangerously Sanguine About Covid-19 Arizona, Florida, Texas: Covid-19 is resurgent in all the states that reopened early. But why isn't there a greater sense of alarm? When Cathy O'Neil, a data-scientist by training, looks at the numbers, she is mystified that some people can put an optimistic spin on them: At least the deaths aren't keeping up with the infection rate, according to one line of thinking, and the latter may simply be a function of more testing. In fact, Cathy notes, the proportion of people testing positive is growing, and many are simply staying home rather than wait in line to be tested. As for statistics showing deaths climbing more slowly than infections, that's likely because of a natural time lag. Young people who catch the virus take longer to die. "The horrible data suggest that we have learned nothing from the tragic experience of the past several months," Cathy writes, "that things are spinning out of control and that wishing for the best is folly." Return of the Dragon: China's Rising Again Just six months after setting off the global economic spiral with the coronavirus pandemic, China is staging a remarkable recovery—and might just pull the rest of us up with it. China's stocks have been in fine fettle, outperforming the rest of emerging markets. Its currency has appreciated noticeably. More tellingly, its appetite for metals has fueled a sharp rally in Bloomberg's industrial metals index. How has Beijing engineered this turnaround? By expanding credit, of course, notes John Authers: The People's Bank of China has unleashed a 20% increase in liquidity. "Nobody knows how long it can last," John writes, "but it looks like the Chinese economic machine might be able to drive one more economic cycle." This should be good news for the rest of the world. But the timing may be awkward for the Trump administration, which seems keen to decouple the U.S. economy from China's. In recent months, for example, federal pension funds have been advised against investing in indexes whose portfolios include large Chinese companies. This week, the White House wrote to the chairman of the U.S. Railroad Retirement Board, urging him to divest the hundreds of millions of dollars in pensions it controls from companies that support the Chinese military and participate in the mass detention of Uighurs in Xinjiang province. This is a familiar technique, says Eli Lake: "Before President Barack Obama imposed secondary sanctions against Iranian oil and its central bank, private groups like United Against a Nuclear Iran pressured investors to divest from companies and banks that did business with Iran's economy." China is no Iran, though; and investors, mindful of Trump's tendency to undermine his own policies, may simply disregard the latest guidance. Further China Reading: The new security law imperils Hong Kong's status as a regional hub for legal services. — Anthony Dapiran Telltale Charts Investors, looking for something to bet against, seem to be targeting high-yield bonds, notes Brian Chappatta. That may be a bad idea.  Further Reading Foreign companies listing in the U.S. should meet U.S. accounting standards. — Ken Griffin The U.S. economy is going through two recessions: one from the pandemic, the other a long-term slowdown. — Noah Smith Shaming businesses for taking PPP money misses the point. — Karl W. Smith New business deals with the UAE could be the excuse Israel needs not to follow through on annexation plans. — Seth Frantzman BBVA wants to use a bond as capital and a green-financing tool at the same time. It can't be done. — Marcus Ashworth and Elisa Martinuzzi New retailers will gobble up the real estate abandoned by the likes of Brooks Brothers. — Conor Sen ICYMI Seoul's missing mayor was found dead. The Justice Department is now fine with Roger Stone going to prison. What happens to cruise ships during a pandemic? Kickers The Far Side is back! (h/t Mike Smedley) Doesn't this defeat the whole point of cryptocurrency? Concorde's successor won't be here anytime soon. How to cook with mock-meat. Who wouldn't want to WFH ... from Barbados? Note: Please send biriyani or brickbats to Bobby Ghosh at aghosh73@bloomberg.net. |

Post a Comment