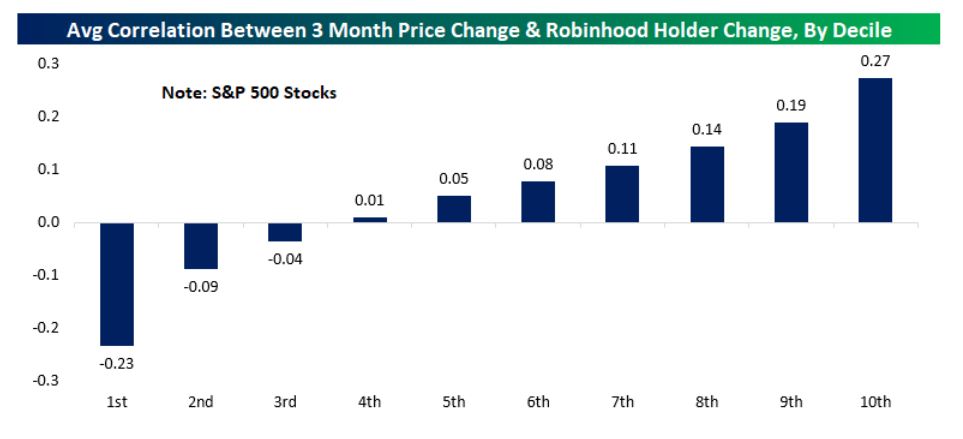

| Pompeo attacks China's "totalitarian ideology." Another blow to Hong Kong's economy. And time's running out for TikTok. Here are some of the things people in markets are talking about today. Secretary of State Michael Pompeo cast China's leaders as tyrants bent on global hegemony. President Xi Jinping "isn't destined to tyrannize inside and outside China forever unless we let him," Pompeo said Thursday. "Securing our freedoms from the Chinese Communist Party is the mission of our time." Pompeo cast competition with China as an existential struggle between right and wrong, hearkening back to the language of the U.S.-Soviet standoff during the Cold War. "If we bend the knee now, our children's children may be at the mercy of the CCP, whose actions are the primary challenge to the free world," Pompeo said, calling modern China a "Frankenstein" after decades of failed Western engagement. Meanwhile in China, President Xi Jinping is preparing for a leadership contest in 2022, when a once-every-five-years gathering is expected to take place to pick the Communist Party's top leaders — and public sentiment matters. A crucial pillar of support has been Xi's personification of standing "tall and firm" in the world. Stocks in Asia were poised to follow U.S. equities lower after an unexpected rise in jobless claims rekindled concern that the economic recovery has stalled, and treasuries rose. Futures slid in Hong Kong and Australia. Earlier, the S&P 500 Index slipped from a four-month high, led by losses in technology firms and companies that make non-essential consumer goods. The Nasdaq 100 Index dropped to a two-week low and turned lower for the week, erasing Monday's rally. Elsewhere, the yield on 10-year Treasuries fell to 0.58%. Crude slumped, while precious metals continued their torrid run of gains that have taken gold and silver prices to multi-year highs. Hong Kong's economy just can't catch a break. Having briefly shown signs of recovery in recent months from its deepest recession on record, the Asian financial hub is bracing for its stiffest test yet as a resurgent virus combines with an increasingly uncertain political and financial outlook. Hong Kong is facing fundamental questions about its long-term role as an international finance center, amid signs that tech firms are abandoning the city and global companies are spurning its once-vaunted legal system after imposition of a national security law. While that's happening, the more immediate prospects for growth are deteriorating by the day as the coronavirus case count spikes.On July 29 the government reports second-quarter economic growth figures: Economists forecast an 8.7% contraction from year-ago levels, almost equaling the record 8.9% decline posted in the first quarter. Zhang Yiming is the little-known Chinese entrepreneur who built TikTok into one of the most promising franchises on the internet. Now he's under pressure to save the business from Trump administration threats. So far he's tried building up TikTok's operations in the U.S., hiring an American chief executive officer and reassuring regulators that user data will not be shared outside the country. TikTok has also stepped up its lobbying in Washington, D.C. and signaled it would create 10,000 jobs in the country. It hasn't been enough. This month, Donald Trump said he's considering banning the app in the U.S. A decision is likely to come before the elections in November so time is running short for Zhang. The president could add TikTok to the U.S. entity list, forcing Apple and Google to drop the service from their app stores. In addition, the U.S. Committee on Foreign Investment in the U.S. is reviewing ByteDance's 2017 purchase of the business that became TikTok and could force a spinoff. Either move would hammer the value of the business. So what's next? Here is a look at the scenarios Zhang, ByteDance and its investors are considering to save TikTok. Overstretched health services and social-distancing measures to combat coronavirus are giving a boost to telemedicine across Asia, a phenomenon likely to continue even after the pandemic has been controlled. Economies as diverse as South Korea's — with its world-class techn sector — and India's, with low health-care costs and a deep pool of doctors, are exploring digital health possibilities at a time when patients may hesitate to visit clinics for fear of catching the virus. The potential is tremendous: The region's telemedicine market is expected to grow from $8.5 billion this year to $22.5 billion by 2025, according to Market Data Forecast. While it's mostly a domestic phenomenon for now, growing acceptance of remote consultations is improving the availability of health care for underserved communities across Asia. What We've Been Reading This is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in this morning My Bloomberg colleagues report that some hedge funds are interested in Robintrack, which tracks activity on the retail trading platform Robinhood. The thesis is that it might be useful to see what Robinhood traders are doing, even if we're not yet entirely sure what their impact is on the market. Regarding that impact though, we do have some clues. Analysts at Bespoke Invest, for instance, pointed out earlier in the week that contrary to their reputation for doing dumb things, Robinhood investors have generally been buying low and selling high this year — the very essence of rational investing.  Correlation between changes in Robinhood holdings and three-month price performance. Bloomberg The big question of course, is whether their behavior is impacting the market. On this point, Bespoke says there's little evidence of that in the short term, but the picture becomes less clear over a longer timeframe. Changes in Robinhood holdings are positively correlated with prices over a three-month period, they find. As Bespoke puts it: "Of course, we are unable to tell whether or not the correlation implies causation, but at least over the longer-term, increases in holdings by Robinhood traders are a possible factor driving stock prices." The idea that Robinhood stock picks might be positively correlated with price changes seems like a natural one to me. I've said this before, but in a market where flows arguably matter more than economic fundamentals, the guy trading stocks in his basement might actually have the edge. It's no wonder hedge funds are interested. The best in-depth reporting from Asia and beyond. Sign up to get our weekly roundup in your inbox. |

Post a Comment