| The U.S. ends Hong Kong's special status. Markets are set to advance partly on optimism about a Moderna coronavirus vaccine. And fears of a Hong Kong brain drain grow. Here are some of the things people in markets are talking about today. President Donald Trump said he issued an order to end Hong Kong's special status with the U.S. and signed legislation that would sanction Chinese officials responsible for cracking down on political dissent in Hong Kong, the latest escalation in tensions between the world's largest economies. Speaking in the Rose Garden, Trump used the event to repeat attacks on his Democratic opponent, Joe Biden, portraying him as having been cozy with China during his time as vice president. Trump has spent weeks blaming Beijing for the coronavirus pandemic and criticizing its handling of Hong Kong. The president has faced widespread criticism over his response to the virus, with cases once again surging as businesses reopen. The bipartisan legislation comes in response to the Chinese government's new national security law for the former British colony, which critics say is aimed at quashing political protests and stifling dissent. Read our explainer here. Moderna's Covid-19 vaccine produced antibodies to the coronavirus in all patients tested in an initial safety trial, federal researchers said. The neutralizing antibody levels produced were equivalent to the upper half of what's seen in patients who get infected with the virus and recover, according to the results published Tuesday in the New England Journal of Medicine. The Moderna vaccine is one of the farthest along for Covid-19. While stimulating production of neutralizing antibodies doesn't prove a vaccine will be effective, it's considered an important early step in testing. Here is how Bloomberg is tracking the virus. Asian stocks were poised for gains after an advance on Wall Street and optimism that progress is being made in treatment for the coronavirus. The dollar dropped. An exchange traded fund tracking the S&P 500 climbed in after-hours trading as Moderna's Covid-19 vaccine showed promise. S&P 500 futures opened up in Asia, building on earlier U.S. share gains in a volatile session as investors weighed earnings reports and the economic hit of rising virus cases. Futures in Japan, Hong Kong and Australia rose. Treasuries ended flat. The Bank of Japan is widely expected to keep its main policy settings unchanged Wednesday amid signs the virus-hit economy is past the worst, with attention likely to focus on the BOJ's quarterly economic projections. Fears of a Hong Kong brain drain are increasing after China moved to tax its citizens' global income, undermining the financial hub's appeal to thousands of bankers and other white-collar workers from the mainland.

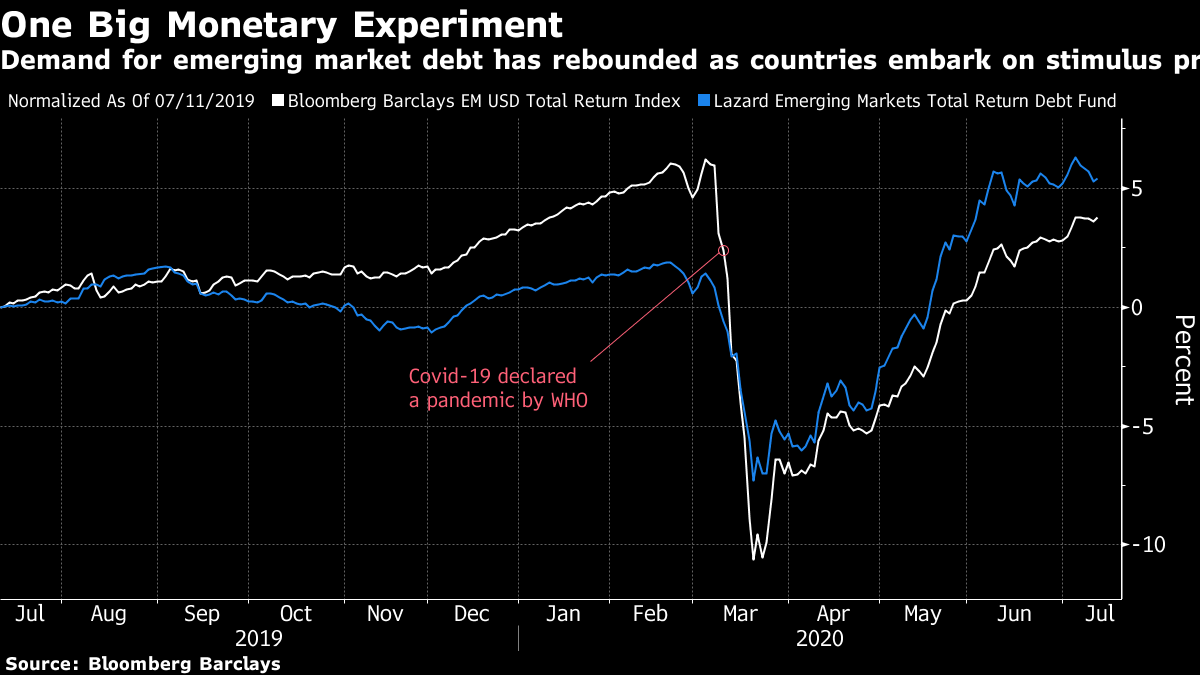

Faced with a tax rate as high as 45% — up from about 15% previously —Chinese professionals across Hong Kong are considering moving back home to avoid getting squeezed by both the new levy and sky-high living costs in the former British colony, according to interviews with workers and recruiters. The prospect of an exodus has upended expectations that mainland talent would help offset any outflow of locals and foreign expatriates from Hong Hong, many of whom are looking to escape the city's controversial new national security legislation. While it's too early to gauge how many people will ultimately move out, professionals of all stripes now have reasons to leave a city that not long ago was viewed as one of the world's most attractive places to build a career. Liu Xiaoming, China's envoy to Britain, called the U.K.'s decision to ban Huawei Technologies from its next-generation mobile networks "disappointing and wrong," and said it had become "questionable whether the U.K. can provide an open, fair and non-discriminatory business environment for companies from other countries." Under the blueprint agreed by Prime Minister Boris Johnson, operators will not be able to add any new Huawei components to their 5G networks after Dec. 31 this year. All equipment made by the Shenzhen-based company that's already installed will need to be removed from 5G infrastructure by 2027. The announcement was a reversal of the position set out by Johnson's government less than six months ago, and represents a diplomatic victory for Donald Trump. Other countries may now follow. What We've Been Reading This is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in this morning Economists at Nomura make an important point. They write that "Unconventional Monetary Policy (UMP) needs a new name, for it has become decidedly conventional." What's remarkable about the current state of affairs is that UMP has become the norm, rather than the exception. In particular, we've seen a bunch of emerging economies embark on bond-buying programs of one sort of another, with Indonesia even becoming a pioneer of direct financing in recent weeks. With inflation still low and growth sub-standard, it's not entirely clear whether UMP has been successful even in the developed world. Meanwhile the developing one seems about to test it at scale.  In doing so, emerging markets risk a couple of things. First of all, they risk squandering the structural reforms, in the form of independent central banks, that many of them have spent decades developing. Second, emerging markets have often been direct beneficiaries of yield-seeking capital flows — those might stop once central banks promise to keep rates lower for ever. What's going to be really interesting about the next few years is seeing whether or not UMP is just the preserve of developed nations who enjoy stable capital flows and reserve currency status, or whether it can be extended to everyone without adverse consequences. The best in-depth reporting from Asia and beyond. Sign up to get our weekly roundup in your inbox. |

Post a Comment