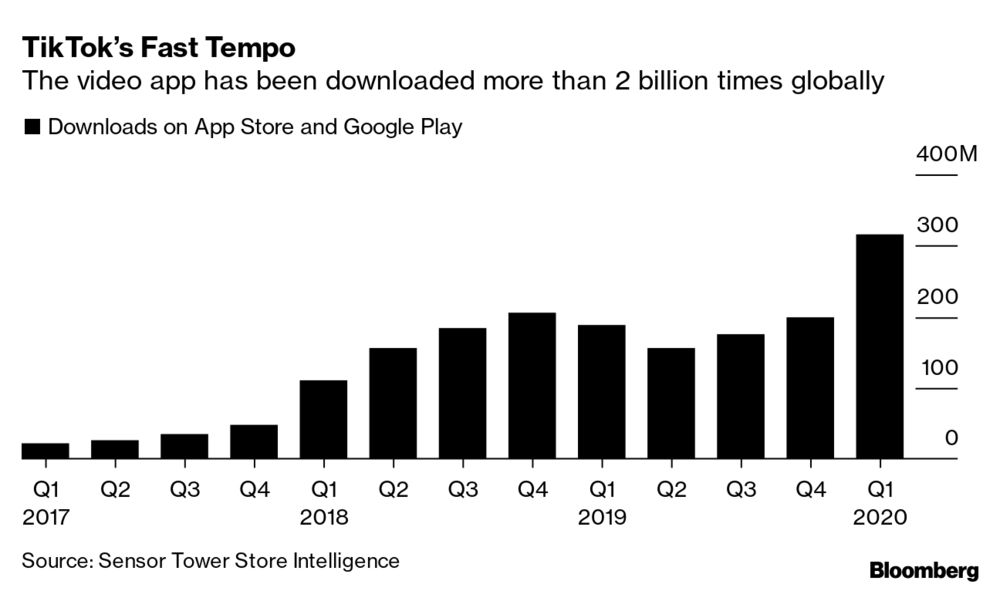

| In the U.S.-China tech war, a new front has opened up — one that's often accompanied by music, dancing and the occasional house cat. The TikTok app, developed by China's Bytedance, has become a global sensation by making it easy for hundreds of millions of people around the world to share videos of pets, babies and lip-synching dance routines. That success has made Bytedance the world's most valuable startup, as well as a national security concern. This week, U.S. Secretary of State Michael Pompeo and U.S. President Donald Trump both said publicly that banning TikTok was an option the administration is mulling. That came of course after India, still reeling from a border clash with China that left 20 of its soldiers dead, blocked TikTok and 58 other Chinese apps at the end of June.  At the center of American concern about TikTok is user data and who might have access to it. It's a worry that extends beyond Washington and New Delhi to countries including Denmark and Turkey. Bytedance has been trying to assuage that anxiety. In May, it hired Kevin Mayer, the architect of Disney's direct-to-consumer video strategy, to serve as TikTok's CEO and as COO of the larger group. When Pompeo raised the specter of a ban, TikTok quickly issued a response that noted it is now run by an American. The company also said it has never been asked for user data by Beijing and wouldn't comply if it were. TikTok's reaction to Hong Kong's national security law, which gives local authorities sweeping powers, would also seem to suggest independence from Beijing. The company announced this week that it has decided to leave the city. Facebook, Google and other U.S. tech companies, meanwhile, have expressed opposition to the law and stopped providing data to Hong Kong's government, but haven't taken steps to leave. Indeed, Bytedance has in the past considered even more extreme measures to allay suspicions. That has even included the potential sale of a majority stake in its TikTok business. It's hard to know if any of these steps will help the company avoid Washington's ire. If it doesn't and Bytedance meets a fate similar to that of Huawei's, it would represent a significant intensification of the tech war. Bull Run China's stock market has been on a tear. In less than two weeks, it has increased by more than $1 trillion in value, far outpacing gains anywhere else in the world. What could go wrong? The answer, as Beijing knows all too well, is plenty. It was just five years ago that a stock market bubble in China popped in an extraordinary $5 trillion rout, sending reverberations around the world. And so it's no surprise that policymakers are now watching with trepidation as this rally begins to exhibit some of the same signs of froth. Borrowing by investors to bet on the market, for example, has increased by the fastest pace since 2015. The rally is also bringing in a wave of new novice investors who feel "invincible." But there's some hesitation to pull the plug as well, given how powerful a little euphoria can be for an economy still recovering from the pandemic.  Dollar Peg The value of Hong Kong's currency has been pegged to the U.S. dollar for the better part of four decades. It's an arrangement that's survived the Asian financial crisis, SARS, the global financial crisis and many other periods of turmoil. But will it survive now? That was the question raised this week when it emerged that advisors to President Trump have been weighing whether to undermine the peg as a way to respond to Beijing's imposition of sweeping national security legislation in Hong Kong. While technically possible, doing so would be a drastic step likely to send shock waves across the world's financial system. That's why many economists find the notion impractical and investors called it a "wacky idea," though unfortunately it's also something no one can totally rule out. Electric Shuffle It has only been six months, but Tesla's plant outside Shanghai is already beginning to shake up the Chinese electric car market. A steady stream of domestically-made Model 3 sedans has quickly increased the company's share of total sales in China, and that's happened as the overall size of the market has shrunk thanks to Covid-19. The result has been a squeeze on other producers. Indeed, three sizable Chinese electric-car startups have already thrown in the towel this year. These developments are not necessarily all coincidence. Five years ago, Miao Wei, minister for industry and information technology, said that Beijing wanted to add a few "catfish" to the EV market, referring to newcomers and foreign rivals. The hope was that their entry could spur innovation and ultimately help created a more robust domestic industry. As catfish go, Tesla is a big one.  Bubonic Plague A disease known as the "Black Death" will get people's attention. So it was this week when authorities in the northern Chinese province of Inner Mongolia confirmed a case of bubonic plague had been identified. A warning was issued about the risk of human-to-human infection and residents were urged to report any dead animals or individuals running fevers for unidentified reasons. If any good has come of the Covid-19 pandemic, it has been the far greater level of vigilance there now is for public health issues. Thankfully, bubonic plague is no longer as dangerous as it was in the 14th century when it earned its "Black Death" nickname. Advances in medical science have armed doctors with the antibiotics to effectively treat infections, though that doesn't make it any less scary to hear a neighbor has come down with the plague. What We're Reading: And finally, a few other things that caught our attention: The best in-depth reporting from Asia and beyond. Sign up to get our weekly roundup in your inbox. |

Post a Comment