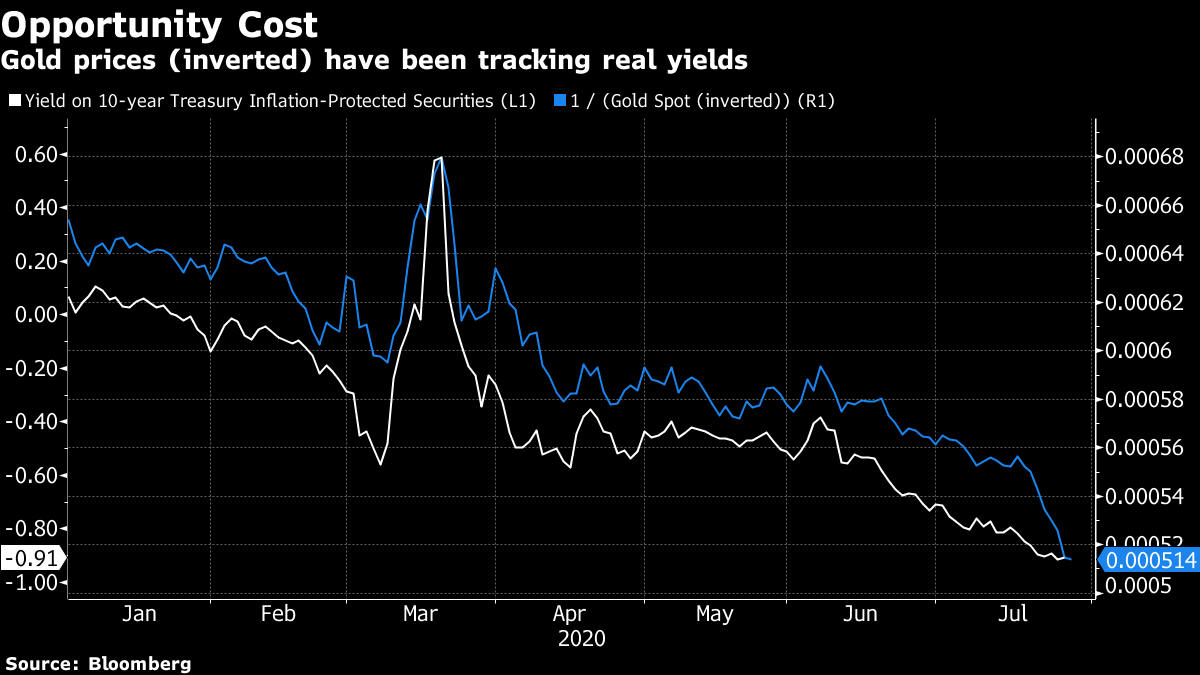

| China is lagging behind on purchases from the U.S. needed to hit the trade deal target. Australia's largest companies head into one of the worst reporting seasons yet. And bankers fleeing Hong Kong face grim job prospects overseas. Here are some of the things people in markets are talking about today. China isn't buying enough from the U.S. to meet the terms of the two nations' trade deal, amid a rapidly worsening diplomatic standoff that's stirring global fears of a new Cold War. By the end of the first half of this year, China had only bought about 23% of the total purchase target of more than $170 billion for goods in 2020, according to Bloomberg calculations based on Chinese Customs Administration data. That has quickened on a month-over-month basis from May's 19% marker, but it means China needs to buy about $130 billion in the remainder of the year to comply with the agreement signed in January. China had promised to purchase an additional $200 billion of U.S. goods and services over the 2017 level by the end of 2021, the agreement pausing a trade war between the world's two largest economies, caused in part by the Trump administration's concerns over the size of the U.S. trade deficit with China. Asian stocks looked set to for a muted start to trading Tuesday after their U.S. counterparts closed higher on speculation the Federal Reserve will reinforce its dovish message. Gold steadied at a record, while the dollar remained under pressure. Futures in Australia and Hong Kong pointed to modest gains, and were little changed in Japan. The S&P 500 erased last week's drop as a rebound in technology stocks overshadowed a slide in banks. A slew of earnings reports from Nasdaq 100 companies over the next few days will offer clues on whether the gauge's record-breaking advance through mid-July has been justified. Treasuries declined, pushing yields back above 0.6%. Elsewhere, oil advanced, erasing earlier losses. Australia's largest companies are heading into one of the worst reporting seasons on record amid a pandemic that's sent the economy into its first recession in almost 30 years. After some initial progress containing the coronavirus, the country is battling a renewed outbreak in its second-largest state that's forced around 5 million people into a six-week lockdown. Australia's budget deficit is set to blow out to a post-World War II record amid a surge in government spending aimed at cushioning the impact of the global health crisis. Firms have raised around A$20 billion ($14.2 billion) and are set to slash dividend payouts by the most since the global financial crisis as Covid-19 measures eroded corporate balance sheets. They'll also detail the hit from lockdowns, travel restrictions and cautious consumers, and offer clues on what's next on the path to recovery. As China strengthens its hold on Hong Kong with a new security law, residents considering an escape are coming to grips with the sacrifices they'll face. With the global economy enmeshed in the worst recession in almost a century, jobs are hard to find and countries are tightening borders. Hard-earned skills, languages and contacts that helped them thrive in the Asian finance hub won't all travel. And preferred destinations like Canada, Australia and the U.K. impose taxes that are three times higher. "Just because you were successful in Hong Kong doing a certain job doesn't mean that there's going to be an appetite for your skill set or experience in another country," said John Mullally, regional director at Robert Walters Plc, who handles financial sector recruitment for Southern China and Hong Kong. "It's probably one of the worst times in our living history to be rocking up in a new country and expecting to land a job." Some emigres in the financial sector are weighing up changing jobs altogether, rather than face uncertain prospects starting from scratch. Japanese banks face sharply higher bad loan costs due to the pandemic, but the damage is unlikely to show through in first-quarter earnings reports. The three largest lenders have already forecast credit costs will swell to an 11-year high of $10 billion in the year ending March 2021. Yet analysts predict actual expenses booked in the April-June quarter were relatively low because companies have been tapping credit lines and Bank of Japan loan assistance that will act as a support, at least for now. The Abe administration has unveiled 234 trillion yen ($2.2 trillion) in virus-related stimulus packages, while the Bank of Japan has introduced business lending programs worth as much as 90 trillion yen. The aid helped to keep bankruptcies and joblessness low in Japan, even after economic activity plummeted last quarter, but it remains to be seen how long the banks can hold off joining their global peers in making large provisions. Wall Street's biggest lenders set aside $35 billion last quarter alone. What We've Been Reading This is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in this morning The sound you hear is thousands of gold bugs cheering as the shiny metal reached a new record on Monday, surging past its previous all-time high of $1,921.17 an ounce in 2011, to reach $1945.26 an ounce on Monday. There are all sorts of explanations for sudden interest in gold. People talk about inflation fears as monetary and political authorities around the world embark on unprecedented stimulus, of course. They talk of gold's ability to act as a safe haven asset in volatile markets, or even the proliferation of futures contracts heaping pressure on physical gold delivery. The most basic explanation is that with yields on other investments so low, there's little opportunity cost in parking one's money in an aesthetically-pleasing rock. As the below chart shows, spot gold prices have largely been tracking U.S. real yields. Until that trend changes, there's not much evidence that gold bulls are betting on anything other than the slow erosion of real returns on capital. You can follow Tracy Alloway on Twitter at @tracyalloway.  Can global trade be saved? On top of the U.S.-China trade war, Covid-19 is closing borders to the flow of people, goods and services. Register now to join us on July 28 at 10 am EDT as we discuss the future of the multilateral trading system and whether it can survive the global pandemic. |

Post a Comment