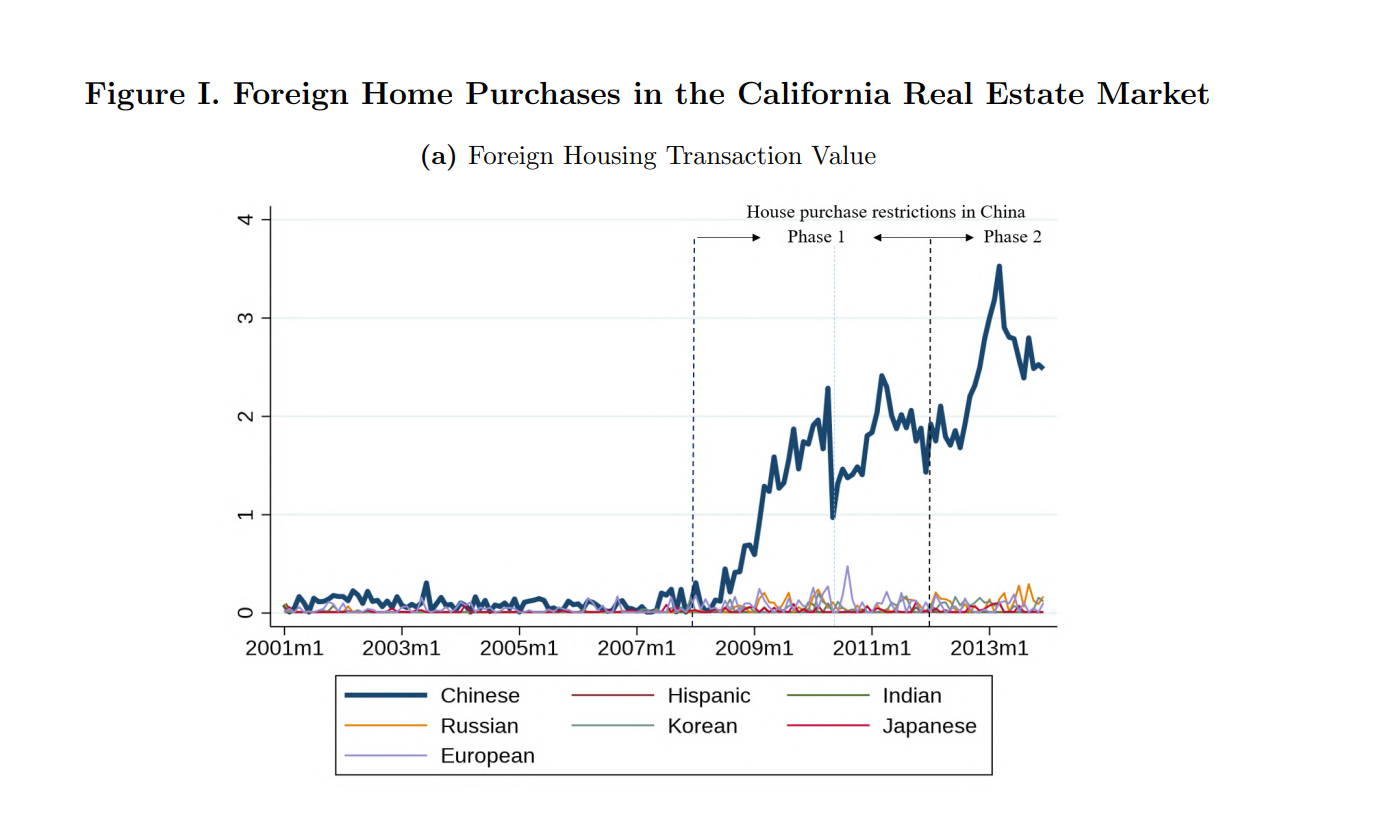

| Google scraps its cloud service in China. Hong Kong reports a second day of rising local virus infections. And analysts raise their earnings forecasts for a global litigation financier on an expectation of a surge in lawsuits. Here are some of the things people in markets are talking about today. Google abandoned plans to offer a major new cloud service in China and other politically sensitive countries due in part to concerns over geopolitical tensions and the pandemic, according to two employees familiar with the matter. The decision shows just how challenged U.S. tech giants are when it comes to securing business in those markets. In May, the search giant shut down the initiative, known as "Isolated Region" and which sought to address nations' desires to control data within their borders, the employees said. The action was considered a "massive strategy shift," according to one of the employees, who said Isolated Region had involved hundreds of workers scattered around the world. Google is pouring money into cloud computing, part of a broader effort to find new sources of growth beyond search advertising. Rivals Microsoft and Amazon.com already offer these capabilities via their cloud units. Asian stocks looked set for modest gains after U.S. tech shares climbed to new highs and investors looked past tensions between Washington and Beijing, while the dollar fell. Futures pointed higher in Japan, Hong Kong and Australia. The S&P 500 Index climbed to a one-month high, while advances in high-flying megacaps like Apple and Amazon.com sent the Nasdaq Composite to a record. Gold topped $1,800 an ounce, while Treasury yields inched higher. The offshore yuan rose above 7 per dollar. Elsewhere, oil traced at a four-month high despite U.S. crude inventories holding near a record and gasoline demand still at the weakest seasonal level in more than 20 years. Hong Kong reported a second day of rising local infections, disrupting a long virus-free stretch that had allowed life in the Asian financial hub to largely return to normal. The city found 19 new infections in the community with six of unknown origin, government officials said in a press briefing on Wednesday — the most since April 1. This follows the disclosure of nine new local cases on Tuesday, five of unknown origin. The number of new local infections that can't be traced suggest that hidden chains of transmission have been circulating in the city for some time as social distancing measures were eased and people returned to work and social activity. Hong Kong had successfully quelled two waves of infection in February and April and its total outbreak numbers only 1,323. The virus is roaring back across the region in a sobering reminder that the pandemic is far from over, even in places with the best containment track records. Australia's second-largest city, Melbourne, re-entered virus lockdown this week as cases surged in Victoria state, while Japan continues to find about a hundred new infections daily in its capital of Tokyo. In Beijing, schools remain closed to halt a new outbreak. In a sign of the times, analysts have rapidly lifted their earnings forecasts for a global litigation financier. Why? The pandemic looks set to spark more legal disputes. Forward consensus earnings estimates for Sydney-listed Omni Bridgeway have more than doubled since the start of the year and have seen the most positive percentage change on the S&P/ASX 200 Index, according to data compiled by Bloomberg. That's not the only growth they're experiencing: The company is embarking on a worldwide hiring spree to meet the surge in litigation demand, after funding applications increased three-fold amid the pandemic, said Chief Executive Officer Andrew Saker. Litigation finance is "very attractive in circumstances where there's heightened risk," Saker said in a video interview from Perth. "This type of demand will be around for the next couple years and may persist even longer." Five years after China's last big equity boom ended in tears, signs of euphoria among the nation's investing masses are popping up everywhere. Turnover has soared, margin debt is rising at the fastest pace since 2015 and online trading platforms are struggling to keep up. Over the past seven days alone, Chinese stocks have added more than $1 trillion of value — far outpacing gains in every other market worldwide. Unlike in most major markets, the nation's individual investors account for the lion's share of local stock trading and have been prone to extreme swings in sentiment that can have ripple effects on the economy and monetary policy. For now, indicators of market overheating are still comfortably below levels reached during the height of equity bubbles in 2007 and 2015. The risk is that breakneck gains — stoked in recent days by bullish articles in state-run media — could eventually result in a destabilizing crash. What We've Been Reading This is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in this morning Chinese investors snapping up property in the U.S. has been a hot-button topic for some time — particularly in places like New York and Los Angeles where controversies over empty apartments, housing affordability and gentrification have occasionally exploded into newspaper headlines. Rarely do you hear much written about the benefits of Chinese money flowing into U.S. property. So it was with some interest that I read this new Federal Reserve working paper, which claims to provide the first direct estimate of the impact of the 2007-2013 "China shock" in the U.S. real estate market.  Source: U.S. Federal Reserve Source: U.S. Federal Reserve The authors find that not only do Chinese capital inflows boost house prices (which one could argue acted as a stabilizing force for some U.S. homeowners in the aftermath of the 2007 housing crash), but that they also have a positive effect on the local labor market, with employment generally rising in neighborhoods that experience an influx of Chinese money. The whole paper is worth a read, especially in the context of ongoing U.S.-China tensions and increasingly fraught discussions over visas and immigration. Cross-border capital flows come with both negative and positive effects. And many of those are under-appreciated and under-studied, even as the world's two biggest economies continue to distance themselves from each other. The best in-depth reporting from Asia and beyond. Sign up to get our weekly roundup in your inbox. |

Post a Comment