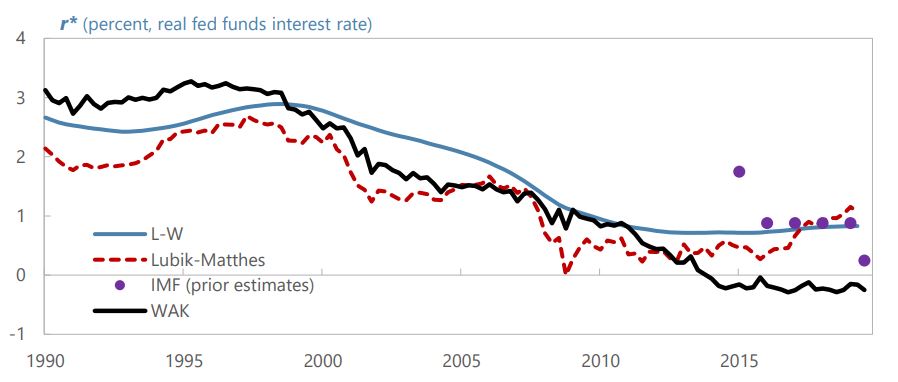

| Goldman Sachs warns the dollar's influence in global markets is waning, Credit Suisse is planning a revamp, and Asian stocks will come under pressure ahead of a Federal Reserve meeting and as earnings are being watched. Here are some of the things people in markets are talking about today. Goldman Sachs put a spotlight on the suddenly growing concern over inflation in the U.S. by issuing a bold warning that the dollar is in danger of losing its status as the world's reserve currency. With Congress closing in on another round of fiscal stimulus to shore up the pandemic-ravaged economy, and the Federal Reserve having already swelled its balance sheet by about $2.8 trillion this year, Goldman strategists cautioned that U.S. policy is triggering currency "debasement fears" that could end the dollar's reign as the dominant force in global foreign-exchange markets. While that view is clearly still a minority one in most financial circles — and the Goldman analysts don't say they believe it will necessarily happen — it captures a nervous vibe that has infiltrated the market this month: Investors worried that this money-printing will trigger inflation in years ahead have been bailing out of the dollar and piling furiously into gold. Credit Suisse is set to announce a sweeping overhaul of its business as Chief Executive Officer Thomas Gottstein seeks to tighten controls and boost the performance of the investment bank. The Swiss lender plans to merge the investment bank and capital-markets unit — which has posted losses in recent quarters — into the resurgent global markets trading unit, people with knowledge of the matter said. The bank also expects to combine its risk and compliance units, the people said, asking not to be identified because the matter is private. The changes are part of an overhaul Gottstein is counting on to increase profitability at the securities unit while tightening risk oversight after the lender was involved in a series of deals related to scandal-struck companies. They're also the first signs of the Swiss executive putting his stamp on the lender as it seeks to move past a damaging spying incident. The bank may announce the changes as soon as Thursday, when it reports second-quarter results, the people said. Stocks in Asia were poised to track U.S. shares lower ahead of the Federal Reserve's policy meeting. Treasuries climbed. Equity futures declined in Japan, Hong Kong and Australia. The S&P 500 Index earlier slipped as worse-than-estimated results from McDonald's, 3M and Harley-Davidson sent their shares slumping. Pfizer climbed after the drugmaker raised its earnings forecast and began a later-stage trial for a coronavirus vaccine with its German partner. Some of the world's largest companies are reporting earnings this week, and investors are looking for clues on whether a resurgence of Covid-19 around the world will derail a recovery of corporate profits and the economy. The Federal Reserve extended most of its emergency lending programs by three months, through the remainder of 2020. A drop in U.S. consumer confidence added to evidence that the pace of the rebound is cooling as the virus interrupts reopenings in several states. Global Infections New infections slowed in two U.S. states grappling with outbreaks, California and Arizona, while Florida reported a record number of deaths. The American Federation of Teachers authorized its members to strike if schools reopen without proper safety measures. Following a steady rise in cases in tourism-reliant Spain, Madrid reacted with anger to travel curbs imposed by the U.K., which is now considering ways to scale back the rules following the backlash. Beijing confirmed a new case after going weeks without any, while Hong Kong is considering a delay in legislative elections. Malaysia and Tokyo also saw an increase in cases and Vietnam is battling a flare-up. On the vaccine front, Moderna's vaccine candidate against Covid-19 protected against the virus in a trial that inoculated 16 monkeys, an encouraging step on the path to a defense for humans against the pandemic. Pfizer is preparing for the novel coronavirus to endure, leading to long-term demand for a seasonal shot to protect against Covid-19. This is how Bloomberg is tracking the virus. Seen as a test of Malaysia's anti-corruption credentials, the guilty verdict against former prime minister Najib Razak in the first of the 1MDB trials could strengthen the new government's hand after months of political turmoil. The High Court on Tuesday sentenced Najib to 12 years in jail after finding him guilty of all seven charges in the case involving 42 million ringgit ($10 million) of funds deposited in his personal accounts from a former unit of troubled state fund 1MDB. While Najib's lawyer said he would appeal the ruling, the decision provides Prime Minister Muhyiddin Yassin political capital at a time when his administration controls a razor-thin majority in parliament and talk of a snap election is heating up. The verdict comes days after a $3.9 billion settlement struck with Goldman Sachs Group Inc. to help resolve the 1MDB case against the bank, while seeing Malaysia recoup some of the money lost through the troubled state fund. What We've Been Reading This is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in this morning Happy FOMC day. On the occasion of this Federal Reserve meeting I give you the lowest estimate of the natural rate of interest for the U.S. so far. As a reminder, the natural rate of interest, or r* (r star), is the interest rate that strikes a balance between full employment and maximum output while keeping inflation constant. The idea that the natural rate of interest has been stuck at ultra-low levels is one that has been steadily capturing the imagination of economists in recent years, spawning numerous papers and attempts to calculate the rate. Fed Chair Jerome Powell discussed the difficulty of "navigating by the stars" in his 2018 speech at Jackson Hole, pointing out that it's hard to do so when "our best assessments of the location of the stars have been changing significantly."  Estimates of r* from new IMF paper Bloomberg Anyway, here is a new IMF working paper that estimates a natural rate of interest in the U.S. that is far lower than previous estimates. It uses a new framework in its attempt to define "the stars" with more precision, and suggests that the lower natural rate of interest means that actual benchmark rates were arguably closer to that level in recent years than previously thought, which means that monetary policy was tighter than the Fed perhaps intended it to be. The implication of this isn't that the Fed can slash rates further to get closer to r*, but, as the authors point out: "With less room for monetary policy to respond, counter-cyclical fiscal policy will become more important and judgments on the future path of government debt will need to account for much lower interest rates." You can follow Tracy on Twitter at @tracyalloway. |

Post a Comment