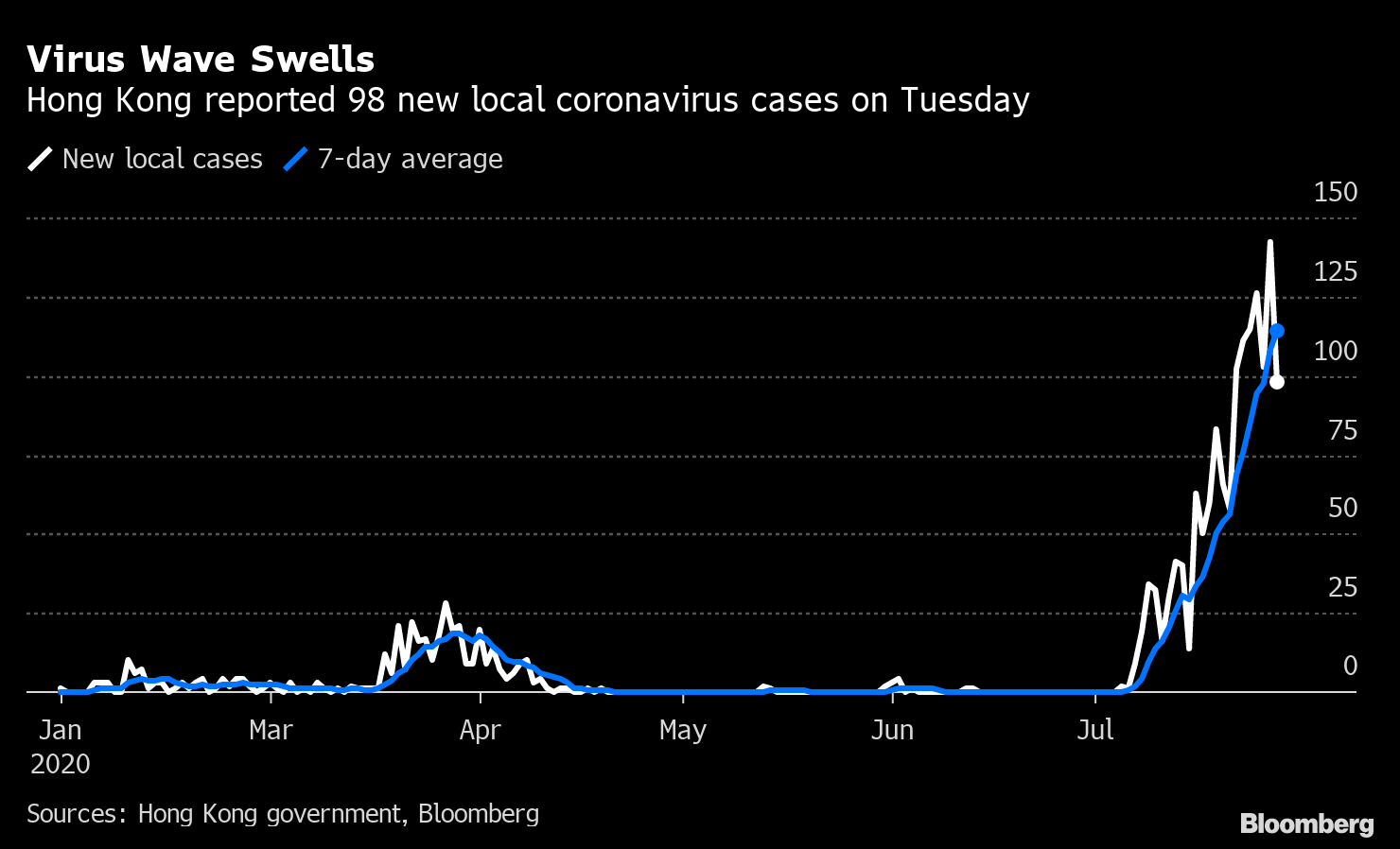

| The Federal Reserve keeps interest rates near zero. The U.S. reaches a grim virus milestone. And Mark Zuckerberg goes a little off-script in a Congressional antitrust hearing. Here are some of the things people in markets are talking about today. The Federal Reserve left interest rates near zero and vowed to use all its tools to support the recovery from an economic downturn that Chair Jerome Powell called the most severe "in our lifetime." In a virtual press conference, he said: "The path forward for the economy is extraordinarily uncertain, and will depend in large part on our success in keeping the virus in check." He also noted that there are signs that increases in infections are starting to weigh on activity. In its statement announcing the policy decision, the Federal Open Market Committee repeated prior language that the pandemic "poses considerable risks to the economic outlook over the medium term" and that the federal funds rate would remain near zero "until it is confident that the economy has weathered recent events and is on track to achieve its maximum employment and price stability goals." Powell also told reporters that supporting the recovery would need help from both monetary and fiscal policy. The U.S. coronavirus death toll topped 150,000, the highest official toll in the world and a grim milestone in a pandemic that is still raging in some states. Texas, Florida and California reported record daily fatalities. Brazil registered a record number of cases and deaths after days of reported issues with the transfer of the data from local governments into the national system. The Latin American country added 69,074 cases on Wednesday, pushing the total number of infections to over 2.55 million. Russia plans to register a coronavirus vaccine as soon as August 10, clearing the way for what its backers say would be the world's first official approval of an inoculation against the virus. And in India around six in ten people living in some of the nation's biggest slums were found to have antibodies for the novel coronavirus, indicating they've recovered from infection. It would appear to be one of the highest population immunity levels known worldwide. And here's what we know about how children contract and spread the virus. Asian stocks looked set for gains Thursday after the Fed's signal of more stimulus boosted U.S. equities and weighed on the dollar. Futures rose in Japan, Hong Kong and Australia. S&P 500 futures opened flat. The S&P 500 Index extended its July rally as the Fed kept rates near zero in a widely anticipated decision, pledging to use all of its tools to support a recovery from the coronavirus pandemic. Treasuries were steady, while gold continued to climb. Oil edged higher after the biggest decline in U.S. crude inventories this year, signaling a bright spot in a market weakened by Covid-19. Standard Chartered is set to begin a new round of job cuts, joining rivals such as Deutsche Bank and HSBC in restarting reductions put on hold at the outset of the pandemic. The London-headquartered firm has drawn up lists of several hundred employees it plans to eliminate and a cutback program is set to get underway, according to a person familiar with the situation. The company employs about 85,000 people. This "is not the result of any impact from the COVID-19 pandemic," the bank said in a statement. Focused on markets in Asia, Africa and the Middle East, the lender has faced pressure from investors to reduce costs to improve returns and boost its share price. Under Chief Executive Officer Bill Winters, who celebrated his fifth anniversary at the bank last month, Standard Chartered has undergone a radical revamp that's shrunk middle management and invested billions of dollars in improving its technology. During Wednesday's testimony before a Congressional antitrust panel, Mark Zuckerberg went off-script a little bit — at least the script we expected. He brought up the fact that Facebook actually lags behind a number of competitors, including Alphabet, Amazon and Apple . Zuckerberg isn't hesitating to use some sharp elbows, pointing out that Amazon is the fastest-growing advertising platform and Google is the biggest. That hasn't been the only hiccup from the antitrust hearing: damning evidence showed that Zuckerberg leveraged Facebook's market power over competitors and bought Instagram because he was concerned about the fast-growing company's potential to turn users away from Facebook. The Instagram purchase, for $715 million in 2012, was "exactly the type of anticompetitive acquisition that antitrust laws were intended to prevent," Representative Jerrold Nadler told Zuckerberg at a hearing Wednesday. Zuckerberg didn't deny it, and later said messaging platform WhatsApp, which his company bought in 2014, was also a competitor. What We've Been Reading This is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in this morning Here in Hong Kong we are experiencing the city's most severe wave of Covid-19 cases yet, which has resulted in the most stringent social distancing measures so far and sparked fresh concerns about the future of the economy. I've written a lot about how looking at stock vs. flow in economic data can result in a "Choose Your Own Adventure" narrative. If you look at month-on-month changes, for instance, you can often see sharp improvements compared to the March 2020 nadir. But if you look at a snapshot of where we are right now, you can see that the hole we have to dig ourselves out of to get back to a pre-virus economic "normality" is massive. As the world sees fresh waves of coronavirus infections it feels like we're adding yet another subjective layer to narratives, with economic "mini-cycles" that are open to interpretation. As Bank of America Merrill Lynch economists point out, the cycle now seems to be that the virus starts spreading, which leads to people staying home and curbing spending. This in turn slows the economy and the virus eventually retreats. Then people venture out once again and there's a nascent economic recovery, but eventually the virus re-emerges and the cycle begins again.  The various stages can be viewed positively or negatively — a population staying home, for example, is bad for consumer spending and hits the economy, but it could also be viewed as positive for the economy in that remaining indoors will halt the spread of the virus. All of that means that where we are in the virus cycle doesn't actually matter as much as minute changes in the cycle itself, such as whether consumers spend more throughout the cycle, if they become quicker to respond to new cases by staying home, or if they adopt basic health measures like wearing masks which could delay the speed at which cases re-emerge. In the meantime though, it's useful to remember that virtually every economic data point can be spun in a certain direction right now. You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment