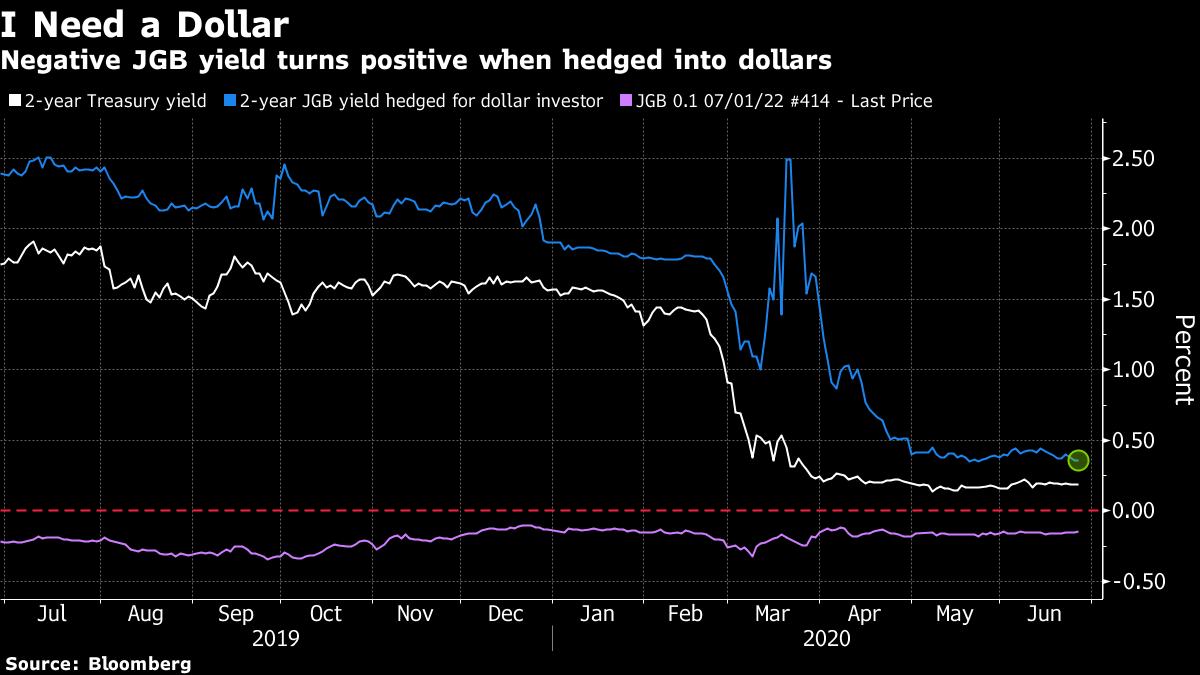

| China enacts sweeping powers to silence Hong Kong dissidents. U.S. stocks notch up their best quarter since 1998. And Anthony Fauci issues a grim warning as U.S. coronavirus cases continue to increase. Here are some of the things people in markets are talking about today. Beijing asserted broad new powers over Hong Kong to rein in those who criticize its rule — from pro-democracy protesters to news agencies to overseas dissidents — laying out a new national security law that activists and business groups warned endangered the city's appeal as a financial hub. The legislation passed by lawmakers in China and signed by President Xi Jinping allows for potential life sentences for crimes including subversion of state power and collusion with foreign forces. It extends to actions committed by anyone, whether or not they are Hong Kong residents, anywhere in the world and appears to cover even non-violent tactics employed by protesters in a wave of unrest that gripped the former British colony last year. China had flagged its intent to impose the law on Hong Kong for weeks, exasperated by the persistent protests which began in opposition to Hong Kong's plan — ultimately reversed — to allow extraditions to the mainland. Asian stocks were poised for a muted start to July following their strongest quarterly rally since 2009, and the best quarter for U.S. stocks since 1998. Investors are assessing better-than-estimated U.S. economic data amid concern over new coronavirus cases and fragile trade relations with China. Futures edged up in Japan and dipped in Australia, with Hong Kong closed for a holiday. S&P 500 futures dipped when they opened Wednesday. The S&P 500 extended its second-quarter rally to 20% as a report showed consumer confidence posted its biggest increase since 2011. After the close of regular trading, FedEx soared as the economic bellwether used an efficiency drive and a surge in health-equipment deliveries to shore up earnings. Treasuries and the dollar fell. Gold traded near $1,800 an ounce. Oil advanced. The U.S. is "going in the wrong direction" in its effort to contain the novel coronavirus and daily case counts could more than double if behaviors don't change, infectious-disease expert Anthony Fauci told a Senate panel Tuesday. Pinpointing indoor gatherings, particularly bars with lines out the door and patrons standing shoulder to shoulder, Fauci said new cases of Covid-19 could rise to 100,000 a day, up from the current level of about 40,000. Coronavirus cases in the U.S. increased by 48,096 to 2.61 million as compared with the same time Monday, according to data collected by Johns Hopkins University and Bloomberg News. The 1.9% gain was above the average daily increase of 1.6% over the past week. The European Union extended a travel ban for Americans, deeming the U.S. reponse to the outbreak insufficient. A strain of flu virus spreading in Chinese pigs has shown it can also infect humans, suggesting that another pathogen with pandemic potential is waiting in the wings. Here is how Bloomberg is tracking the virus. The U.S. Federal Communications Commission designated Huawei Technologies and ZTE as national security threats, a step toward driving the Chinese manufacturers from the U.S. market where small rural carriers rely on their cheap network equipment. The action means money from federal subsidies used by many small rural carriers may no longer be used to buy or maintain equipment produced by the companies, the FCC said in a news release. The FCC has increasingly scrutinized Chinese companies as tensions grow between Beijing and Washington over trade, the coronavirus and security issues. The agency is considering banning three Chinese telephone companies, and last year barred China Mobile from entering the U.S. market. Goldman Sachs is in the final stages of resolving its biggest legal threat in a decade after tussling with the U.S. government on one critical issue: a potential guilty plea for the first time in Goldman's history. To avert such a penalty over its work for the Malaysian sovereign fund known as 1MDB, Goldman has appealed to the Justice Department's highest ranks. The department's No. 2 official has been directly involved in the case, which has been overseen by Attorney General William Barr. Barr obtained a waiver because his former law firm represents Goldman. Now, a deal may be near. Prosecutors were emboldened to press Goldman for a guilty plea after a high-ranking Goldman banker pleaded guilty in 2018 and described a secretive corporate culture that sidelined compliance staff, people familiar with the case said. Since then, Goldman has pushed back on that narrative and secured a hearing from the nation's top law enforcement officers. What We've Been Reading This is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in this morning One of the funny things about economic crises is that they tend to exacerbate trends that were already happening. Take, for instance, the centrality of the U.S. dollar in the financial system. Most people would agree that the dollar is enmeshed in the global economy in a unique way, and that a stronger U.S. currency tends to be bad for much of the world. Hyun Song Shin at the Bank for International Settlements, for instance, has shown a negative relationship between world trade and the strength of the dollar; in other words, when the greenback gets stronger, the world economy tends to suffer. Sometimes that hit to the world economy is big enough to come back to haunt the U.S., necessitating action from the Federal Reserve to step in and do something to weaken the dollar and essentially break a feedback loop that could otherwise go on forever thanks to the U.S. currency's safe haven status in markets. (That feedback loop looks something like: Strong dollar > global economic hit > U.S. economic hit > strong dollar > global economic hit... and so on.)  Anyway, we saw the dollar strengthen during the worst of the coronavirus crisis and we also saw the Fed unleash currency swaps to provide much-needed dollar funding to the world. Beyond that though, the U.S. currency is also taking on a pivotal role in the bond market, as my Bloomberg colleagues Stephen Spratt and Ruth Carson wrote this week. They point out that investors are using more foreign-exchange swaps and cross-currency basis trades to eke out returns on ultra-low bond yields, which means movements in the cost of the dollar have become even more important in what is arguably the world's most important market. So even though a lot of people would agree that the centrality of the dollar in the financial system can be problematic, we've nevertheless seen the currency's unique role get further cemented during the coronavirus crisis. There's now a Japanese edition of Five Things. 世界のビジネスニュースを毎朝メールでお届けします。ニュースレターへの登録はこちら。 |

Post a Comment