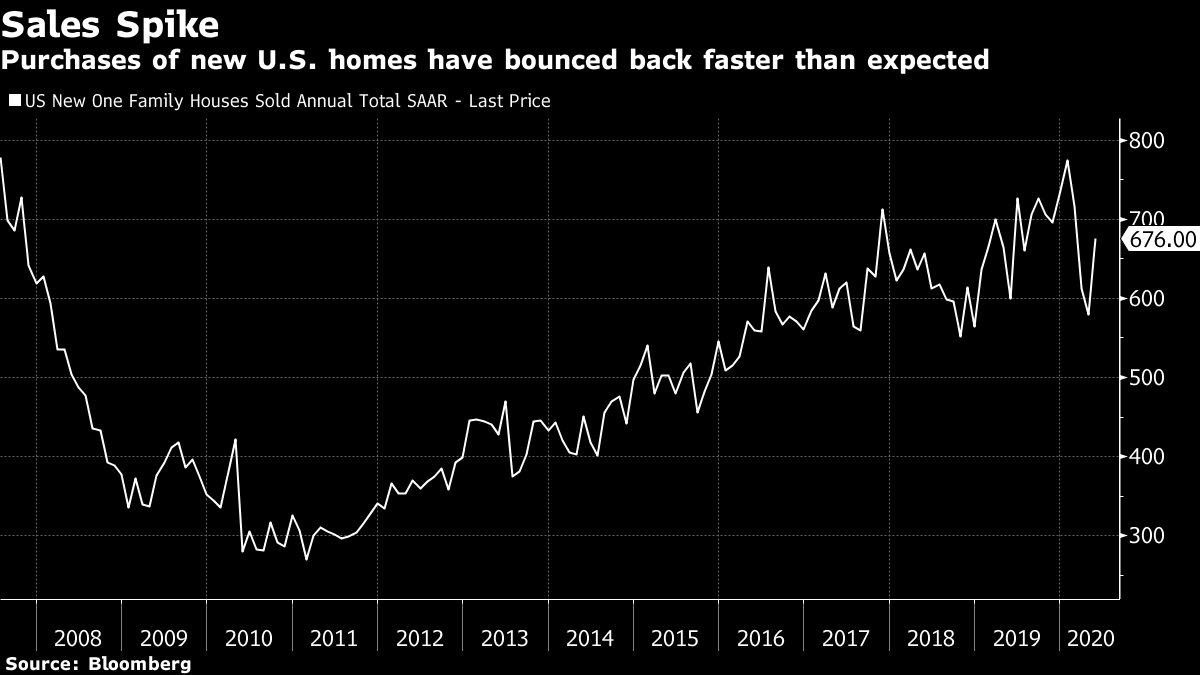

| The U.S. says China hackers stole virus data. Trump warns of a worsening Covid-19 crisis. And Xi's plan to liberalize China's stock market is looking prescient. Here are some of the things people in markets are talking about today. The U.S. accused two Chinese hackers of working for Beijing to steal or try to steal terabytes of data, including coronavirus research, from Western companies in 11 nations — the second time in a week that a foreign nation has been singled out for vaccine-related hacking. The Justice Department said two men were assisted by China's Ministry of State Security and that defense contractors and weapons systems were hacked along with medical research. The accusations threaten to escalate existing tensions between the U.S. and Beijing even further; intellectual-property theft concerns have long been a source of strain between the two powers. Meanwhile, a hacking group tied to the Russian government was accused of using a combination of known security vulnerabilities and custom-made malware to infiltrate organizations involved in developing a vaccine for Covid-19. Covid-19 antibodies in patients with mild symptoms fade quickly, raising concerns that their immunity from a future infection may not last very long, researchers said in the New England Journal of Medicine. European regulators are preparing for the possibility of approving a vaccine this year after a flurry of promising results, even as comments from the U.K.'s chief medical officer reflected uncertainty in the scientific community. These are the leading candidates to produce a shot to fight the pandemic. The Centers for Disease Control and Prevention found that far more people were infected than previously reported in several corners of the U.S., while U.S. President Donald Trump on Tuesday restarted his coronavirus briefings by warning about a surge in U.S. cases. This is how Bloomberg is tracking the virus. Asian equities looked set to give back some of the strong gains seen earlier this week as investors weighed the prospects for the global recovery from the pandemic and eyed more earnings reports. Treasuries edged higher and the dollar fell. S&P 500 futures had a muted open in Asia after the benchmark earlier eked out a small gain, though finished well off session highs after Senator Mitch McConnell cast doubt on reaching a fresh rescue bill before some current benefits expire. Tech shares led the Nasdaq Composite lower. Stock futures dropped in Japan, Hong Kong and Australia. Equities began the week higher after European Union leaders clinched a rescue package that helped send the euro to the highest since 2019. Oil pulled back. South Korea slipped into a recession in the second quarter, official data are expected to show Thursday, after its no-lockdown strategy and stimulus failed to offset a slump in exports. Gross domestic product is expected to have fallen 2.4% last quarter from January-March, according to a median estimate of economists surveyed by Bloomberg. A negative outcome would mark the first recession since 2003. South Korea took an alternative approach to handling the virus crisis, leaning on mass testing and contact tracing instead of shutting down large swathes of the economy. The government also took various initiatives to boost consumption, handing out cash to all households and encouraging retailers to offer promotions. The fiscal stimulus pledged so far amounts to 14% of GDP. A plan by President Xi Jinping hatched in late 2018 to liberalize China's constrained stock market and prevent home-grown tech firms from flocking to New York is turning out to be a prescient move. The reforms took shape in the form of a new, relatively small venue in Shanghai, called the Star board, which started trading exactly a year ago. The goal was radical by China's standards: Minimize red tape and relax tight controls on what kind of companies could list, and how much their shares could move. More than 130 companies have raised a combined $30 billion from the board over the 12 months. While the board went quiet after an explosive first few weeks, high-profile candidates including Jack Ma's Ant Group and China's top chipmaker are putting it back in the spotlight. What We've Been Reading This is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in this morning It's fairly obvious that the Covid-19 outbreak has had a disproportionate effect on the lower-income households. People making less money have been more likely to lose their jobs (55% of households earning less than $35,000 in the U.S. have lost employment income, compared to just 40% for those earning $75,000 or more, according to Bank of America Merrill Lynch data) and they've been more likely to miss out on some of the benefits of easy monetary policy in the form of lower borrowing rates or higher risk asset prices. It seems pretty clear that the two very different experiences of lower- and higher-income families in this crisis will translate into economic data. In fact, we can already see some evidence of that in U.S. housing. Home prices have remained stubbornly high and new home sales have swiftly recovered — arguably in part because homeowners tend to be higher earners with more savings.  It's going to be important to think about that segmentation dynamic when looking at economic trends going forward, and to question how much of the resilience or recovery of a particular economic data point will actually trickle down to the wider economy. The best in-depth reporting from Asia and beyond. Sign up to get our weekly roundup in your inbox. |

Post a Comment