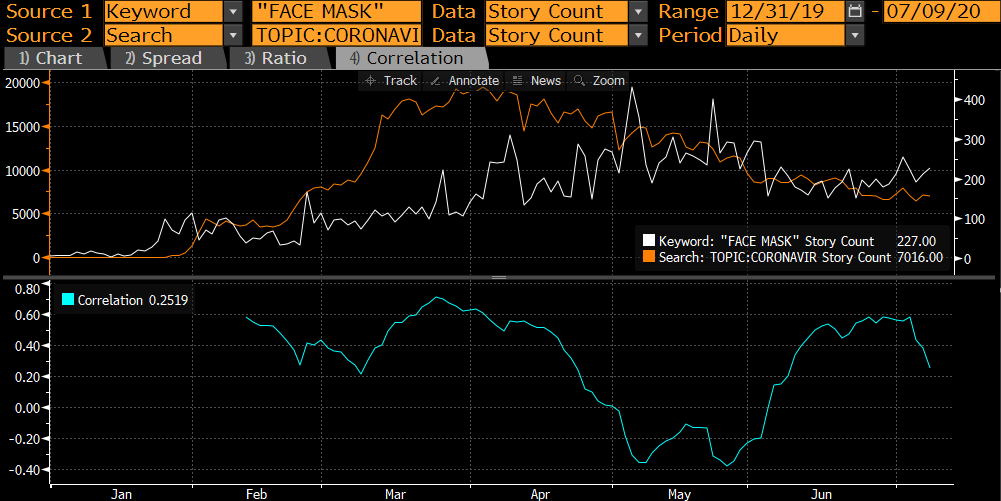

| The U.S. imposes sanctions on four Chinese officials over Xinjiang ties. Singapore heads to the polls. And Masayoshi Son's wealth more than doubles to $20 billion. Here are some of the things people in markets are talking about today. The U.S. sanctioned a top member of China's ruling Communist Party and three other officials over human rights abuses in the western province of Xinjiang — a major escalation in the Trump administration's increasingly tense rivalry with the country. The U.S. move is tied to the widespread detention of Muslim Uighurs in Xinjiang, a policy that has been sharply criticized by top American officials as well as human rights groups. It comes amid soaring tensions between Beijing and Washington over the origin of the coronavirus pandemic, China's moves to quell dissent in Hong Kong and a debate over the use of Chinese technology by the U.S. and allies. It seems that everyone is getting swept into the turmoil — now, global banks are at risk of breaching China's new security law by complying with the U.S. Asian stocks were on course to follow their U.S. peers with modest declines amid concern that a resurgence in coronavirus cases could slow the global economic recovery. Oil dipped below $40 a barrel and Treasuries jumped. Equity futures pointed lower in Japan, Hong Kong and Australia. The S&P 500 Index earlier fell 0.6%, with financial firms among the worst performers as Wells Fargo prepared to cut thousands of jobs because of the pandemic. Still, the tech-heavy Nasdaq advanced to a fresh record high. Longer-dated Treasuries rose following an auction for 30-year securities that showed strong demand. The start of Chinese trading will be in focus Friday as the Shanghai Composite makes a bid for a ninth day of gains. Singapore heads to the polls today as Prime Minister Lee Hsien Loong's ruling party seeks to extend its 55-year rule with a fresh mandate to counter the city-state's worst-ever recession. Special precautions such as temperature screenings, the use of disposable gloves and safe distancing rules are being implemented at the polling booths, which are open from 8:00 p.m. to 8:00 p.m. Vote counting will begin immediately afterward, with the final outcome likely to be clear either late Friday or early Saturday. It could be Lee's final election before he hands power to the so-called "fourth generation" of People's Action Party (PAP) officials led by Deputy Prime Minister Heng Swee Keat, who have helped spearhead the government's response to Covid-19. While Singapore bans opinion polls during election campaigns, analysts and the opposition parties expect the PAP to easily win the most seats and form the next government. Still, any drop in support compared with the 2015 vote could potentially affect Lee's succession plan or prompt the government to adopt more populist measures like it did in 2011 following its worst-ever result. The deluge of debt sold around the world is raising risks for bond buyers. Take it from Man Group, the world's largest publicly listed hedge fund firm. Companies around the globe have sold over $2 trillion of bonds this year, a 55% jump from the same period last year and a record tally, according to Bloomberg-compiled data. With Covid-19 wreaking havoc on the global economy, government and state-related agencies have also raised $1.6 trillion this year to fund stimulus spending, the most since 2009. "Post the market selloff in March, the supply could be easily absorbed by demand as investors added risk back at cheaper valuations, but we think we may now be close to a tipping point," said Lisa Chua, portfolio manager at Man GLG, a unit of Man Group, which joins other big funds such as Oaktree Capital Management in warning that markets could turn after a steep rally. Meanwhile a brutal selloff that's made Chinese government bonds one of the world's worst performers is showing no signs of ending any time soon. With SoftBank's shares surging to their highest price in two decades, founder Masayoshi Son's net worth hit $20 billion on Thursday, more than doubling from $8.4 billion in March, according to the Bloomberg Billionaires Index. It is the first time the 62-year-old's fortune has topped $20 billion since January 2013, when the ranking first started tracking his wealth. The calculation excludes about $13.3 billion of his SoftBank Group shares pledged as collateral, representing some 40% of his stake, according to regulatory filings. A further 26% of his holding is lent out for a fee to different entities, mostly brokerages, likely to add liquidity to the market. Those shares are included in Son's net worth calculation because he retains control over them. SoftBank shares have surged 134% from a March low, taking the Tokyo-based company's market value to $123 billion. While its Vision Fund lost almost $18 billion in the latest fiscal year as it wrote down the value of investments in WeWork, Uber and others, record equity buybacks and a series of wins helped the stock recover. What We've Been Reading This is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in this morning Every once in a while a new data point captures the market's collective imagination and becomes the economic indicator du jour. For instance, the daily fixing of the yuan became a daily fixation (ahem) for the broader market after China unexpectedly devalued its currency back in 2015. Commercial and industrial lending by banks zoomed into focus shortly after Donald Trump became president as an early way of gauging whether or not his campaign promises were translating into real economic growth. With concerns over the spread of Covid-19 dominating the market, it seems likely that we're going to see attention shift to new data points.  Economists at Goldman Sachs and Bank of America Merrill Lynch have written recently about the importance of wearing masks in staving off coronavirus infections and thereby boosting the economy. BAML goes a step further, however, by suggesting in a note published this week that a new Pew poll asking Americans whether or not they're wearing face masks could become a forward indicator for economic recovery. Some 65% of respondents said they were wearing a mask all or most of the time in June, the survey said. "A key thing to watch is whether those numbers shift significantly in the next survey," as BAML puts it. "More masks will mean a more sustainable and broader reopening." The best in-depth reporting from Asia and beyond. Sign up to get our weekly roundup in your inbox. |

Post a Comment