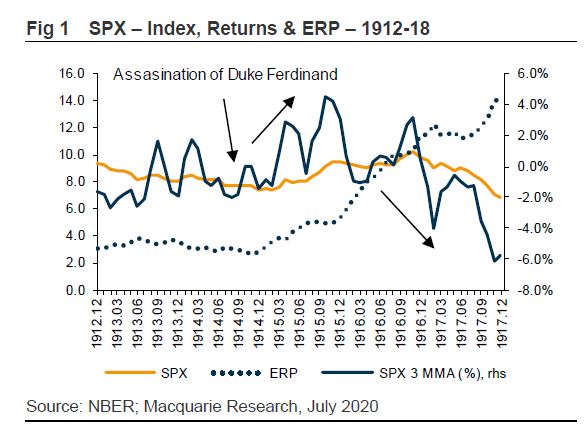

| China promises retaliation over the closure of its Houston consulate. Australia is set to release an economic and fiscal update. And Hong Kong's stock market is showing some confusing signs. Here are some of the things people in markets are talking about today. China vowed retaliation after the U.S. forced the closure of its Houston consulate, in one of the biggest threats to diplomatic ties between the countries in decades. The U.S. government gave China three days to close its consulate in America's fourth-most populous city in an "unprecedented escalation," Foreign Ministry spokesman Wang Wenbin said Wednesday in Beijing. China planned to "react with firm countermeasures" if the Trump administration didn't "revoke this erroneous decision," Wang said. The State Department said it ordered the consulate shut "to protect American intellectual property and Americans' private information," without giving more details. At least two Chinese citizens have been convicted of stealing energy industry trade secrets in Houston in recent years. The consulate is one of five China maintains in the U.S. along with its embassy in Washington. The move to close it is a severe diplomatic blow to a relationship already under strain, and will likely lead to a smaller U.S. footprint in China. In fact, Beijing's vow to retaliate likely means one of those diplomatic compounds may close. Asian stocks were on course for a mixed start to Thursday trading as investors weighed the likelihood for a new U.S. spending bill and potential coronavirus vaccines against concern about an escalation of tensions with China. The dollar weakened to the lowest level since March. Equity futures were little changed in Australia and Hong Kong, with Japan closed Thursday and Friday for holidays. The S&P 500 earlier rose to a five-month high, with utilities, real estate and industrial shares leading the gains. Trump administration officials are said to be discussing a short-term extension of unemployment insurance before the benefits lapse. Traders will also be watching the open of Chinese markets after news that the country's Houston consulate has been ordered to close. The Australian government is preparing to announce the nation's biggest budget deficit since World War II today. And business investment is set to plunge this fiscal year, smothered by the economic shutdown and a renewed lockdown in Victoria. A statement released ahead of the economic and fiscal update showed spending by firms will slump 12.5% in the 12 months through June 2021, after tumbling 6% in the fiscal year that ended last month. Australia's initial success in containing the virus is shadowed by Victoria's renewed outbreak, which has forced around 5 million people in Melbourne into a six-week lockdown. The shutdown of the nation's second-biggest city, which contributes about one-quarter of GDP, will prolong the economic recovery. The economic and fiscal statement will be released at 11 a.m. It's becoming increasingly difficult to tell where Hong Kong's stock market is going. If you look at the Hang Seng Index, the city's 50-year-old benchmark, it's down 11% for the year, and on a price-to-earnings basis it's near the cheapest on record relative to MSCI's index of global shares. Last month it clocked up the worst quarterly drop versus the S&P 500 Index since the Asian financial crisis in 1998. But on the flipside is HKEX, the firm that actually operates the stock exchange. Worth $59 billion, it's the second-biggest of the world's 24 listed bourses, closing in on Chicago's CME Group. It's the priciest exchange, trading at 40 times price-to-earnings, and boasts a 60% premium to peers. The stock, which closed at a record on Tuesday, is up more than 40% in 2020. With two of the most straightforward ways to bet on the future of a stock market telling opposing stories, investors are getting very mixed signals. Tesla posted a fourth consecutive quarterly profit, a milestone that paves the way for the electric car-maker to join the ranks of the blue-chip S&P 500 Index. The results validate the unconventional efforts that Elon Musk, Tesla's chief executive officer, made to shore up earnings in the midst of the global pandemic that's expected to leave other U.S. automakers posting losses. The profit may further boost Tesla's already lofty share price, which has quadrupled since March. Tesla reported a profit of 50 cents a share on a GAAP basis Wednesday, beating analysts' consensus estimate for a loss of $1.06 a share. Revenue fell to $6.04 billion, topping analysts' expectations for $5.4 billion. A 12-month period of profitability meets criteria that Standard & Poor's index committee uses when deciding whether to add stocks to the S&P 500. Adding Tesla to the benchmark likely would force money managers who track the index to buy the stock. What We've Been Reading This is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in this morning It's rarely a good sign when sell-side analysts start crunching the numbers on how stock markets performed just before the first and second world wars. Viktor Shvets at Macquarie did just that in a note published earlier this month. He points out that the assassination of Archduke Franz Ferdinand — widely considered by modern historians to be the catalyst for WWI — did not lead to a massive drop in equities. In the run-up to WWII, he says, investors in German stocks largely ignored signs of creeping fascism and political tensions to focus on the massive government stimulus that was helping the German economy regain its footing. German stocks rallied all the way into the Battle of Stalingrad in early 1942, doubling over a five-year period.  Shvets's point is that investors are terrible at picking watershed moments in political relations — especially those that deal with binary outcomes, such as a major military conflict or de-escalation. It's worth remembering that as we look at the market reaction to the biggest diplomatic upset between the U.S. and China in years, with the S&P 500 rallying 0.6% to close at a five-month high. As Shvets puts it: "After a political event, one often reads: 'stock prices are up, reflecting investor confidence'; it mostly reflects nothing of the kind. Investors are not equipped to deal with binary outcomes. They are trend followers using economic (not political) lenses, guided by short-term signals." The best in-depth reporting from Asia and beyond. Sign up to get our weekly roundup in your inbox. |

Post a Comment