High stakes stimulus talks continue, virus back in Beijing, and another monster day for earnings. DividedThe $1 trillion stimulus package announced by Republicans has kicked off what is likely to be a difficult round of negotiations with Democrats. House Speaker Nancy Pelosi labeled it "pathetic" while saying she hoped to find enough common ground to reach a deal. To make things more difficult for Senate Majority Leader Mitch McConnell, some of his own GOP senators are unhappy with the bill with conservatives such as Texas Senator Ted Cruz wanting to spend far less. The pressure to reach a deal remains high as the U.S. economic recovery stalls and previous spending plans run out. Second waveBeijing reported its first new case of coronavirus in three weeks while the government in Hong Kong is considering postponing upcoming legislative elections. The decision by the U.K. to curb travel to Spain has received an angry response from Madrid. There was some good news in the U.S. with increasing signs the pandemic is reaching a plateau in the hardest-hit states as public health measures start to pay off. On the vaccine front, Moderna Inc. kicked off its late-stage trial while Pfizer Inc. and BioNTech SE are also continuing studies of their top candidate. EarningsSpeaking of Pfizer, the pharmaceutical company is among the many, many U.S. corporations reporting earnings today. McDonald's Corp. also reports pre-market, with investors more likely to focus on forward-looking commentary, rather then results from a quarter that saw massive business disruption. 3M Co.'s PPE sales may help offset losses in office supplies. Starbucks Corp. has already warned that its sales took a massive hit in the quarter, so attention will also be on the outlook when the company reports after the close. eBay Inc. probably had a better season. On that note, Advanced Micro Devices Inc. may benefit from the issues at Intel Corp. Markets mixedEquity investors across the globe seem to be lacking conviction this morning as they await a round of tech earnings and the Fed decision this week. Overnight the MSCI Asia Pacific Index added 0.4% while Japan's Topix index closed 0.5% lower. In Europe, the Stoxx 600 Index was 0.2% higher at 5:50 a.m. Eastern Time, with some stronger-than-expected earnings helping lift the gauge. S&P 500 futures pointed to little change at the open, the 10-year Treasury yield was at 0.610% and gold tumbled. Coming up...S&P CoreLogic house prices for May are released at 9:00 a.m. Richmond Fed manufacturing and Conference Board Consumer Confidence are at 10:00 a.m. The two-day FOMC meeting begins. Talks on the next round of stimulus continue. There may be some fireworks when Attorney General William Barr testifies before the Democrat-led House Judiciary Committee. What we've been readingThis is what's caught our eye over the weekend. And finally, here's what Joe's interested in this morningIf you want to understand gold's extraordinary rally over the past several weeks, the most important thing is to not ask a gold bug. Nothing against them, but they always have the exact same view ("buy gold because of money printing and hyperinflation") and so they're not equipped to explain why gold transitions from one regime to the next. Also right now the common gold bug framework is seductive and wrong. So it's better to talk to someone who's been bullish lately, but is not a perma.

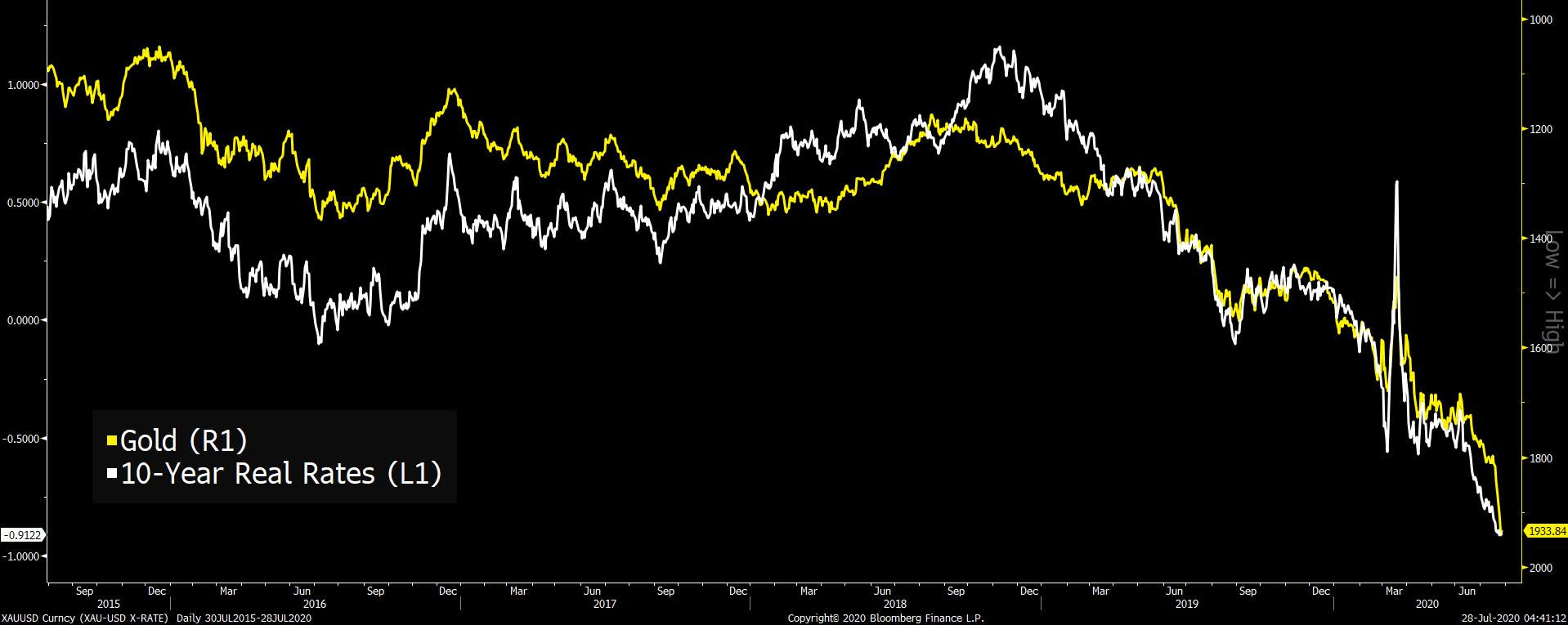

Naufal Sanaullah, the Chief Macro Strategist at Eia Alpha Partners, has been bullish for awhile now, but not because money printing or economic failure, but because he's actually seen it as a proxy for economic policy success. He explained to me yesterday: "Generally speaking the thesis is pretty simple.... to the extent the reflation works, real yields should go down and metals should go up." You can see it in this chart. For years now, gold in yellow (which I've flipped over) tracks 10-year real rates almost perfectly.  Ok, so you ask, why have real rates plunged so much? You can really see it in this chart, where you can decompose the real rate into the nominal rate on 10-year Treasuries and the 10-year breakeven inflation rate. Basically what it shows is that the market expects the Fed to be on hold for an extremely long time (hence the rock-bottom rates on government bonds) but investors also think that policy makers will succeed in reflating the economy to levels that are somewhat in the ballpark of pre-crisis levels. That divergence between the blue and orange lines gives you the negative real rates, which explain the gold surge above.  So gold's rally has been a bet on successful policy reflation. Sanaullah sees the terrain from here for gold getting rougher. He noted the aggressive Chinese industrial recovery helped boost the price of copper (contributing to the reflation of the market) but that the "peak impulse is in the rear view." Next week's jobs report is also an opportunity for investors to reassess whether the reflation is still on track, or if we're backsliding.

The one other potential bullish catalyst for gold in the medium term may be, he says, if portfolios start permanently holding more as a hedge now that Treasuries yield so little. Big picture though, the key thing is gold tracks real interest rates, which have plunged due to expectations of the Fed staying on hold and policymakers overall successfully reflating the economy. If such reflation expectations falter, watch out. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment