Fed decision day, stimulus talks get bogged down, and tech CEOs in Congress. Fed dayThe Federal Open Markets Committee is all but certain to hold rates unchanged when their decision is announced at 2:00 p.m. Eastern Time. Fed Chairman Jerome Powell will hold a press conference 30 minutes later during which he is expected to reinforce the message that the bank will do whatever it can to support the recovery. While the committee may discuss changes to the bank's forward guidance, a final decision is unlikely today. Powell may also repeat his call for more fiscal help from Congress. Talks That fiscal help may still be some way off, as talks in Washington on the the next stimulus plan are already hitting some roadblocks. House Speaker Nancy Pelosi said Senate Majority Leader Mitch McConnell's push to protect businesses from coronavirus litigation suggests he is not serious about reaching a deal. Republican fiscal conservatives have also found their voice again as they attempt to put the brakes on even the smaller $1 trillion package proposed by McConnell. Treasury Secretary Steven Mnuchin said "we still obviously have a lot of work to do" after yesterday's talks. One thing that hasn't changed is the deadline for agreement, with Congress breaking for recess soon and unemployment benefits already running out. Face offThe chief executive officers of Amazon.com Inc., Apple Inc., Alphabet Inc. and Facebook Inc. will appear today in front of the House Judiciary Committee's antitrust panel. The company leaders are likely to face tough questions from lawmakers over whether their firms have become too powerful. Jeff Bezos, the world's richest person, will describe his company as an American success story, according to prepared remarks. Mark Zuckerberg will focus on the threat to the industry from China, while Tim Cook will defend Apple's App Store. Markets mixedGlobal equity investors continue to remain subdued in the face of an avalanche of earnings and ahead of today's Fed decision. Overnight the MSCI Asia Pacific Index slipped 0.3% while Japan's Topix index closed 1.3% lower after electronics and carmaker results disappointed. In Europe, the Stoxx 600 Index was 0.1% higher at 5:50 a.m. Eastern Time after a very mixed morning for earnings. S&P 500 futures pointed to a slightly higher open, the 10-year Treasury yield was at 0.589% and gold was little changed. Coming up...Wholesale inventories and advanced goods trade balance data for June is at 8:30 a.m. Pending home sales for June are at 10:00 a.m. Oil investors, currently going through a period of little change in prices, will get the latest U.S. inventory data at 10:30 a.m. There is another mammoth list of companies reporting today, with Boeing Co., General Electric Co., PayPal Holdings Inc., Spotify Technology SA and Qualcomm Inc. likely to be among the most closely watched. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningThe US dollar has fallen almost 10% since late March. Between that and the surge in gold and Bitcoin, the aggressive Fed actions, the high deficits, and of course the virus, there's a lot of giddy talk about some major change afoot. Goldman was out with a note yesterday about growing warnings on the end of the dollar's global reserve status. It's all very exciting stuff. Lots of vivid stories to tell.

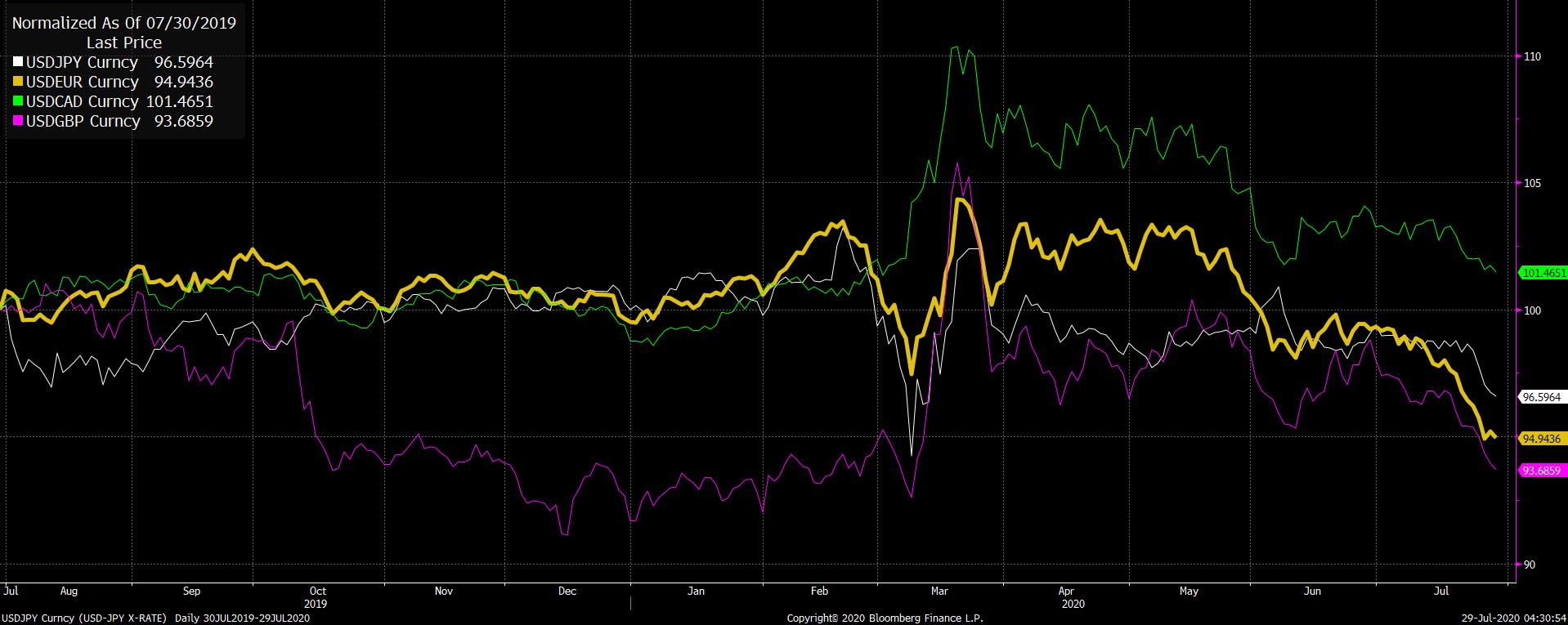

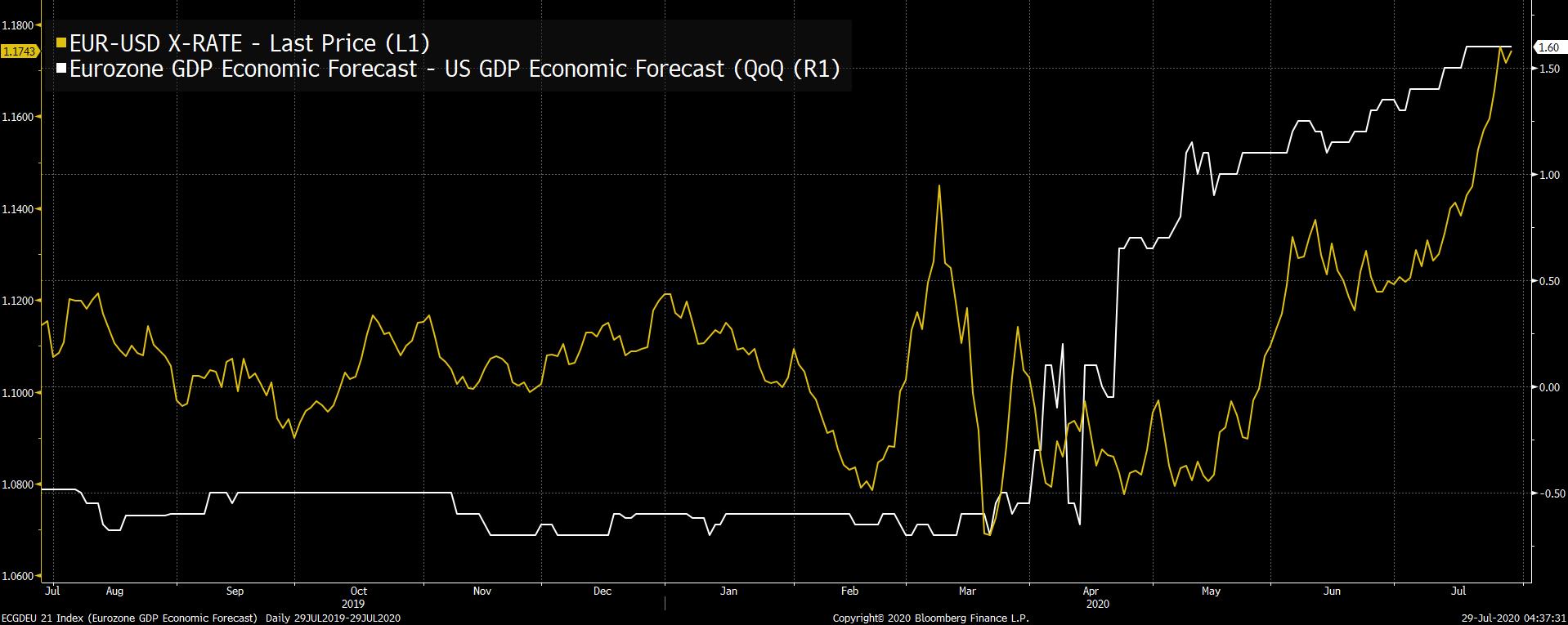

So here's a boring story about how the dollar's move just isn't that dramatic. To start, here's a 5-year chart of the Bloomberg Dollar Index. One thing that stands out is that if you put your fingers over March and April and block out that historic spike in volatility and massive surge in demand for dollar liquidity, the dollar is basically just trading in the same range it's traded in for years. It's at the lower end, but really nothing special outside those insane months. Focus on the red bar, and it looks ho hum.  The next thing to realize is that a big part of this weakness is against the euro specifically. Here's the one-year performance of the dollar against the euro, yen, Canadian dollar, and British Pound. Combined, these four currencies comprise nearly 70% of the Bloomberg Dollar Index. Only against the euro is the dollar even at its weakest level of the last year.  As for the euro, the big story there is that we're in a rare moment where European growth is expected to outpace U.S. growth. According to IMF data, this has happened only eight times since 1992. Between its seemingly superior virus suppression and improvement on addressing fiscal issues, Europe is definitely regarded as a bright spot right now.

As you can see, since the end of March, estimates for euro area GDP in 2021 have increased relative to U.S. GDP. And so we've seen the euro rally along with that.  Bottom line: With a little perspective, the dollar story is less dramatic than it first appears. A big part of it is just coming off the boil in March and April. Outside of that, it's not that dramatic. Furthermore, a big chunk of it can be explained by the euro specifically, which is expected to do better in the short term than the U.S. It's interesting and important stuff, but nothing indicating some major foundational issue with the dollar's place in the world. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment