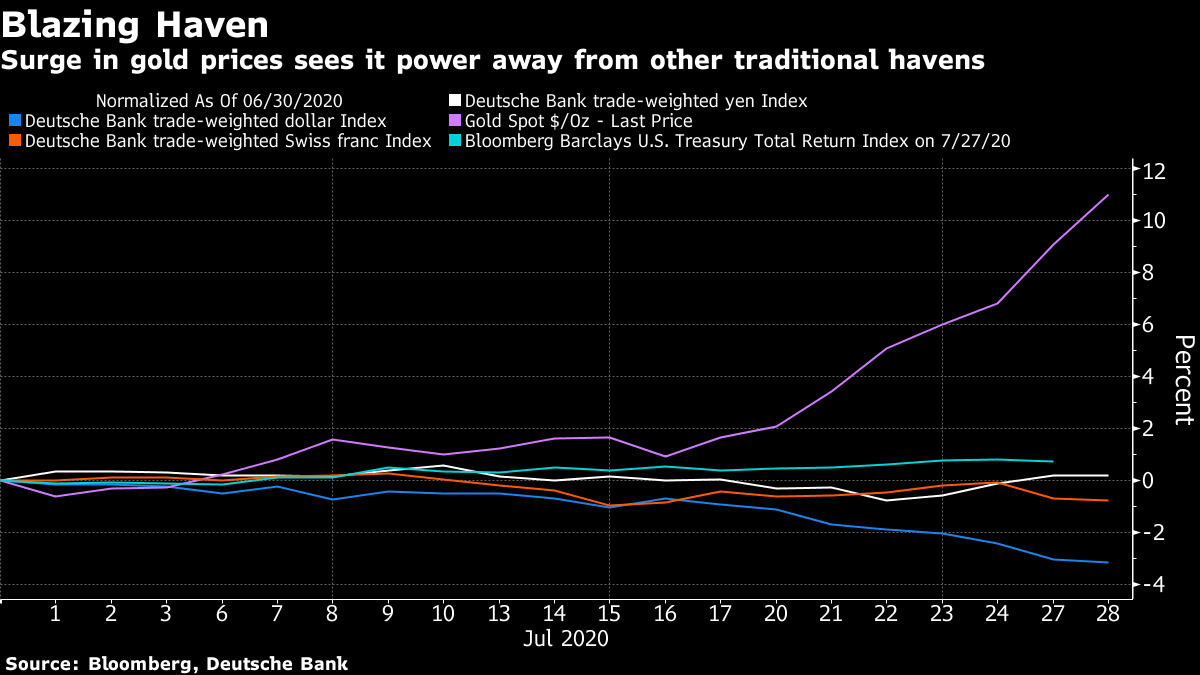

| Want the lowdown on what's moving European markets in your inbox every morning? Sign up here. Good morning. Britain updated its quarantine rules again, U.S. Republicans presented a stimulus plan and a luxury giant reported earnings. Here's what's moving markets. Guidance Change Spain responded angrily as the U.K. updated its travel advice once again to include the all-important Balearic and Canary Islands among destinations to which non-essential travel should be avoided. With some other European countries also advising against visits to certain areas in Spain, lawmakers in Madrid are battling to protect a tourism sector that accounts for for 12% of their nation's economy. Meanwhile, the European Union appears set to keep its external borders shut to travellers from most countries, including the U.S., for at least two more weeks. Member states are also tweaking domestic controls, with Belgium saying each household will be allowed to have leisurely contact with no more than five other persons for the next four weeks starting Wednesday. GOP Plan Senate Republicans presented their $1 trillion plan to bolster the pandemic-ravaged U.S. economy in a series of bills that would trim extra unemployment benefits, send $1,200 payments to most Americans and shield businesses, schools and other organizations from lawsuits stemming from coronavirus infections. The bill introductions were just the first step toward negotiating a compromise plan with Democrats, who have offered their own $3.5 trillion stimulus plan. House Speaker Nancy Pelosi delivered a harsh assessment of the proposal, calling it a "pathetic" approach and saying it wasn't adequate to the country's needs. Posh Stuff LVMH said second quarter sales slumped 38% on an organic basis, though that was better than the 42% drop forecast by analysts. The maker of Louis Vuitton handbags followed Richemont and Burberry Group Plc in reporting what is expected to be the luxury goods industry's worst ever quarter, though it also cited signs of recovery across several businesses in June and a particularly strong rebound in China. Gucci owner Kering SA updates after the close of trading today. Golden Hour For broader markets, the start of the week has been all about the dollar and gold, with a gauge of the former trading at the lowest level since September 2018 ahead of an expected dovish message from the Federal Reserve Wednesday and the latter printing a new record high before paring the rally this morning. Futures on the precious metal touched $2,000 an ounce for the first time ever amid a demand for havens. Silver, meanwhile, has been lifted by concerns about supply too. In the debt market, the world's massive pile of bonds that cost investors money to hold has left investors "desperately" searching for yield. Coming Up… Data are expected to show Spanish unemployment in the second quarter rose to the highest level in more than two years amid the ongoing tourism crisis. Meanwhile, it's a packed earnings day with Dettol cleaning product-maker Reckitt Benckiser Group Plc and Peugeot maker PSA Group among the big names to look out for. Also watch U.K. homebuilder stocks after property portal Zoopla said prices grew in June at the fastest pace in nearly two years. Finally, stock futures are creeping higher this morning. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morning The spectacular rally in gold this month is many things, a dash for a risk-asset haven is not one of them. While the yellow metal has jumped about 11% in July to an all-time high, its traditional haven cousins have languished. Trade-weighted gauges of the yen and Swiss franc are little changed on the month while an index of U.S. Treasuries -- the ultimate safe haven -- is up less than 1%. And of course the dollar is sliding, its decline lending support to the move in gold. Whilst sympathetic to the argument that investors are betting on an inflation hedge, expectations for price rises remain below pre-pandemic levels and their rise from the March lows is lacking the urgency seen in the gold surge. Ironically, linking the gold price to inflation bets is likely to undermine the metal as a haven should risk assets sell off. If expectations for a robust economic rebound falter, dragging inflation expectations back down and risk assets with them, gold could well follow. In other words, gold's recent rally could ruin its status as a haven.  Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment