Fresh warnings on economic growth, setbacks for reopenings, and oil takes a hit. Deeper slumpThe European Commission cut its growth projections for the euro area further, with its latest forecasts now predicting an 8.7% contraction this year. The trouble caused by the slower-than-expected emergence from lockdowns was shown in German industrial production numbers this morning which grew at a slower pace than expected. Another aspect of the pandemic gaining greater attention is how it seems to be redrawing the geopolitical map, with America finding itself increasingly isolated from allies. LingeringThere was little sign of a turnaround in the pace of the virus spread in the U.S., with cases now approaching 3 million. The mayor of Miami-Dade announced he plans to re-close restaurants and gyms in the latest setback to efforts to return to normal. In Australia, the city of Melbourne has gone into a six-week lockdown, while cases have increased in Tokyo and Iran. Brazil's President Jair Bolsonaro has undergone further tests after showing symptoms of the virus. Dr. Anthony Fauci warned that any vaccine developed to fight Covid-19 would likely be limited in how long it could give protection. Oil haltA barrel of West Texas Intermediate for August delivery briefly dipped below $40 this morning as the industry awaits the latest government data on stockpiles which is expected to show a jump in gasoline supplies because of the curtailed summer driving season. The American shale patch took another hit yesterday with the Supreme Court decision to order the closing of the Dakota Access pipeline. The court also refused to allow construction to start on the much-delayed Keystone XL pipeline in what was a grim 24 hours for the industry. Markets slipMonday's bullish start to the week has faded with major gauges -- with the exception of China -- firmly in the red this morning. The MSCI Asia Pacific Index dropped 0.7% overnight while Japan's Topix index closed 0.3% lower. In Europe, the Stoxx 600 Index was down 1.1% at 5:50 a.m. Eastern Time with technology and real estate shares leading the losses. S&P 500 futures pointed to a weak open, the 10-year Treasury yield was at 0.671% and gold slipped. Coming up...Commodity watchers will be keeping an eye on Chile's copper export numbers at 8:30 a.m. JOLTS U.S. job openings for May is at 10:00 a.m. Atlanta Fed President Raphael Bostic, Fed Vice Chair for Supervision Randal Quarles, San Francisco Fed President Mary Daly and Richmond Fed President Thomas Barkin all speak later. New Jersey primaries are today. Levi Strauss & Co. is among the companies reporting earnings. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningYesterday I wrote about the rapid rise in permanent unemployment. While the vast majority of people who have lost their jobs so far in this crisis are technically on temporary layoffs -- people who hopefully will go back to their old roles when the virus is beaten -- a number of jobs are already gone for good.

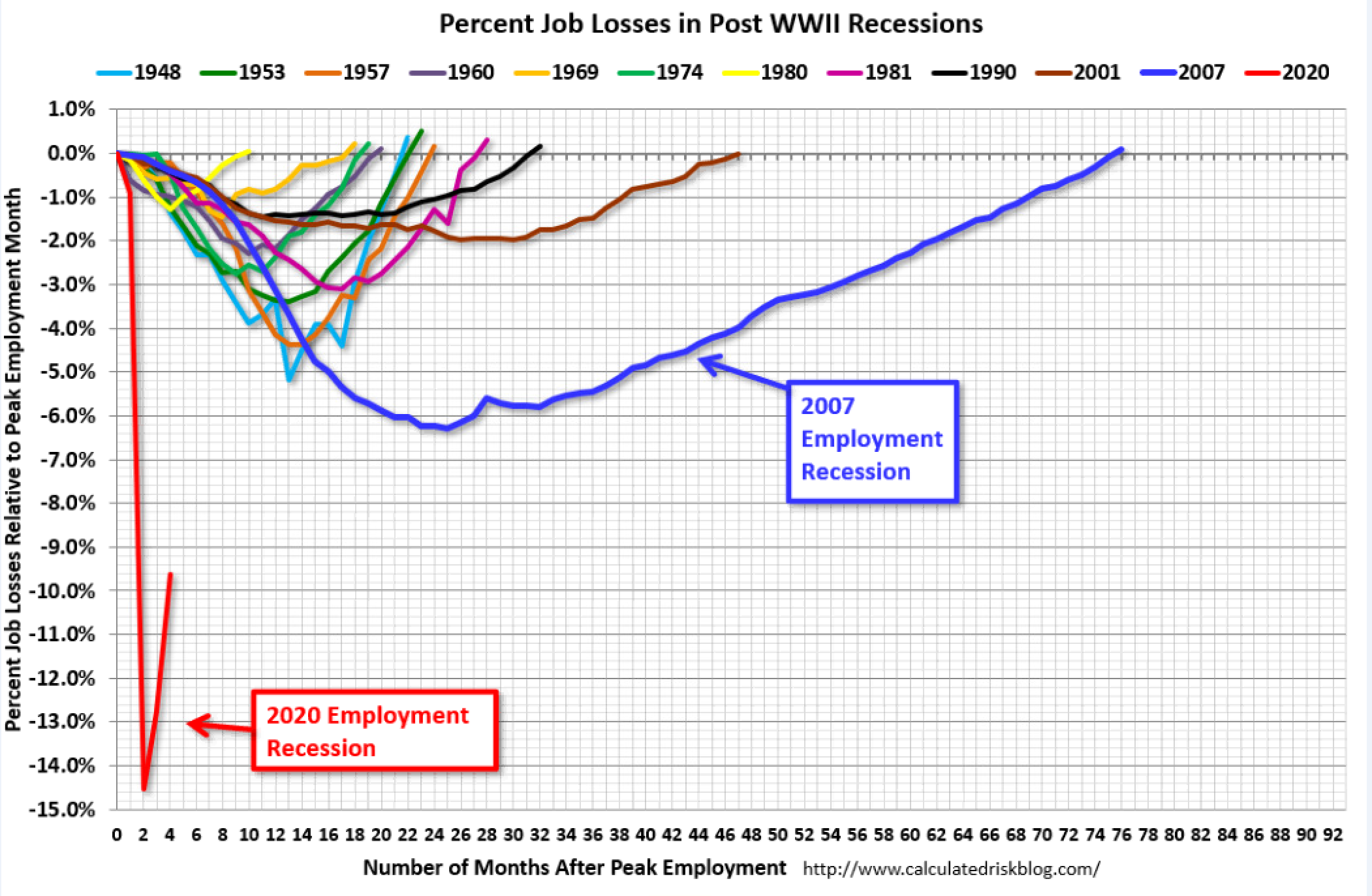

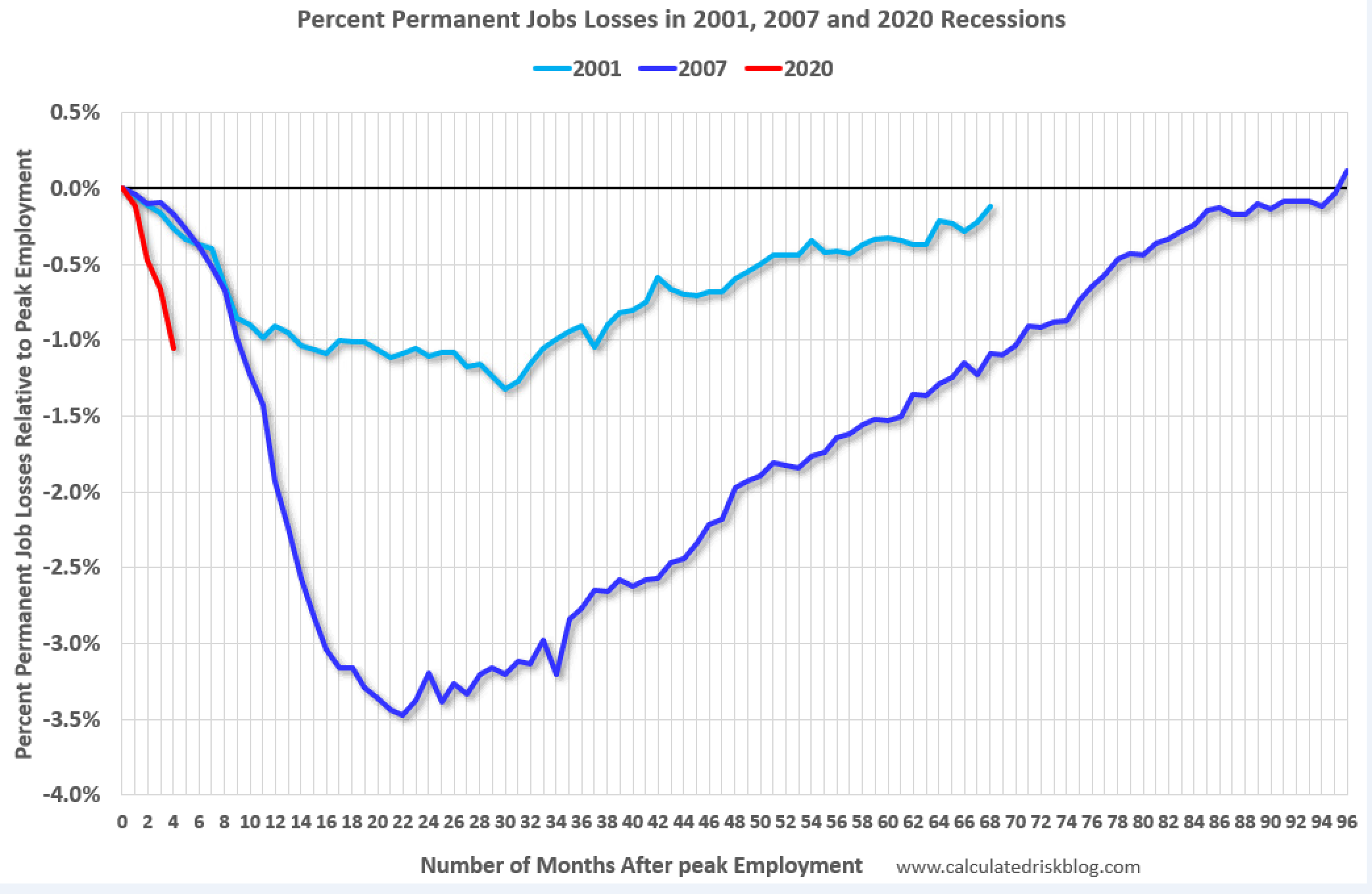

Here's another way of looking at it. For a long time, Bill McBride, the great blogger at the site Calculated Risk, has been putting together a great chart comparing the trajectory of job losses in different recessions, and you can see how this crisis looks nothing like other recessions. Just totally different in scale and shape.  But of course, most of the job losses in prior recessions weren't initially characterized as temporary, so the comparison isn't exactly apples to apples. So I asked him to make a version that looked just at permanent layoffs. And the chart at this point looks like this.  The glass half-full scenario here is that permanent job losses are still not nearly as deep as last time. So far in this crisis, we've lost just over 1% of jobs on a gone-for-good basis. On the other hand, these losses starting off way faster and way steeper. And in the meantime, the massive stimulus has already gone out the door, and we still haven't gotten the virus under control.

Either way, in a sense, it's this red line, not the exaggerated line from above, that gives the clearest picture of the recession, since it represents clear economic damage, as opposed to virus mitigation efforts. As Washington D.C. gears up for another round of stimulus talks, this is the chart to think about, with a goal of preventing it from getting as bad as last time. It's arguably not as bad as last time yet, but the direction so far is way worse.

Joe Weisenthal is an editor at Bloomberg.

Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment