It's jobs day, China sanctions bill due and Vladimir Putin extends his rule. Jobs mirageJobs day is here, a test of mettle for stock bulls looking for more reason to go all in on the recovery. If forecasts are on target, the tentative rebound is gathering pace with the unemployment rate dropping to 12.5% from 13.3% and employers adding 3.06 million workers to payrolls in June, a second month of record gains. But even then there's debate about how much stock you should put in the report that the Labor Department will release at 8:30 a.m. Eastern Time -- a day early in deference to the July 4 holiday. The figures have been beset by data-quality issues, particularly the misclassification of those unemployed. Meanwhile the pandemic that's put so many people out of work is surging again in parts of the country, leading California and New York to backtrack on reopenings. New U.S. cases topped 50,000 for the first time. Putin entrenched Russian President Vladimir Putin won a resounding endorsement of his bid to extend his two-decade-long rule potentially to 2036, even as some polls show his approval ratings near historic lows as living standards stagnate. The Kremlin pulled out all the stops to ensure a high turnout and resounding approval in the ballot. Populist sweeteners included an effective constitutional ban on gay marriage and prize drawings for voters. Downplayed was the removal of term limits for Putin and blocking any campaigning against a 'yes' vote. Turnout was 65%. China sanctions The U.S. House of Representatives passed a bill imposing sanctions on banks that do business with Chinese officials involved in cracking down on pro-democracy protesters in Hong Kong. The measure is a response to Beijing's strict new security law for the former British colony and financial center, 23 years after its handover to China. House Speaker Nancy Pelosi said the new law "signals the death of the one country, two systems" model China had followed with Hong Kong. The bill still has to be approved by the Senate before going to President Donald Trump for his signature as soon as today. Markets hopefulHopes for reassuring jobs data later from Washington is helping the market advance. Overnight the MSCI Asia Pacific Index added 1.4% while Japan's Topix index closed 0.3% higher. In Europe, the Stoxx 600 Index was up 1.1% at 5:45 a.m. with every sector in the green. S&P 500 futures pointed to gains at the open, the 10-year Treasury yield was at 0.673% and oil was higher. Coming up...Aside from the jobs report and initial jobless claims at the same time, expect data on durable goods and factory orders at 10:00 a.m. The Baker Hughes rig count is due at 1:00 p.m. San Francisco Fed President Mary Daly and Richmond Fed President Thomas Barkin will discuss the economy at 2:00 p.m. in an event organized by the National Association for Business Economics. The bond market closes early for the Independence Day weekend. What we've been readingThis is what's caught our eye over the last 24 hours. - Life, liberty and face masks.

- Sanctioned billionaire finds a haven in tiny Congolese bank.

- How a Chinese firm jumped to the front of the vaccine race.

- India shows China tech the other side of the fence.

- Vladimir Putin is ready for his next act.

- Did a Chinese hack kill Canada's greatest tech company?

- Monstrous black hole found devouring about one sun every day.

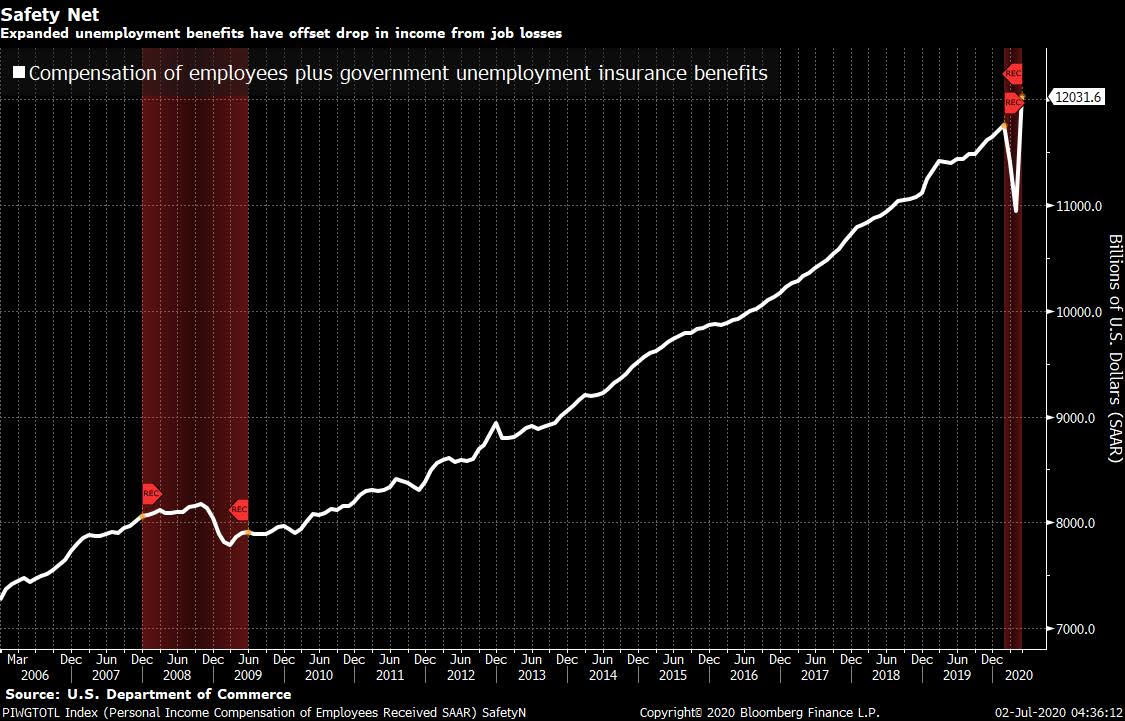

And finally, here's what Joe's interested in this morningThis chart, put together by my colleague Matt Boesler, gets my vote for the most important in the world right now.  It shows that despite the incredible job losses we've seen since the pandemic the total compensation for workers and the unemployed is actually up from before the crisis. This is, in large part, due to the expansion of the Unemployment Insurance program as agreed to by the CARES Act. While there are certainly numerous individuals and households who have taken a major blow to their finances during this crisis, the net change in income has been an increase. To the extent that businesses are still seeing some demand hold up and people are able to eat, pay rent, pay their bills, mortgages, and so forth, the fact that there's been this huge disconnect between employment (way down) and income (up) is a major reason why.

There's a view out there, primarily from a lot of people in markets, that the only thing holding up stocks is the Fed, and zero interest rates and some bond buying. But that's clearly not true. The aggressive fiscal response has helped allay calamity, and everyone should see how substantial it's been. Meanwhile, this expansion is due to expire at the end of this month, unless Congress votes on its extension. We have no idea, exactly, what the next stimulus bill (assuming one passes) looks like. But if there's one thing to keep in mind throughout the negotiations, it's the above chart, and whether the bill helps maintain its positive direction, or whether household incomes are set to plunge due to some arbitrary date that has nothing to do with the trajectory of the virus.

Joe Weisenthal is an editor at Bloomberg. |

Post a Comment