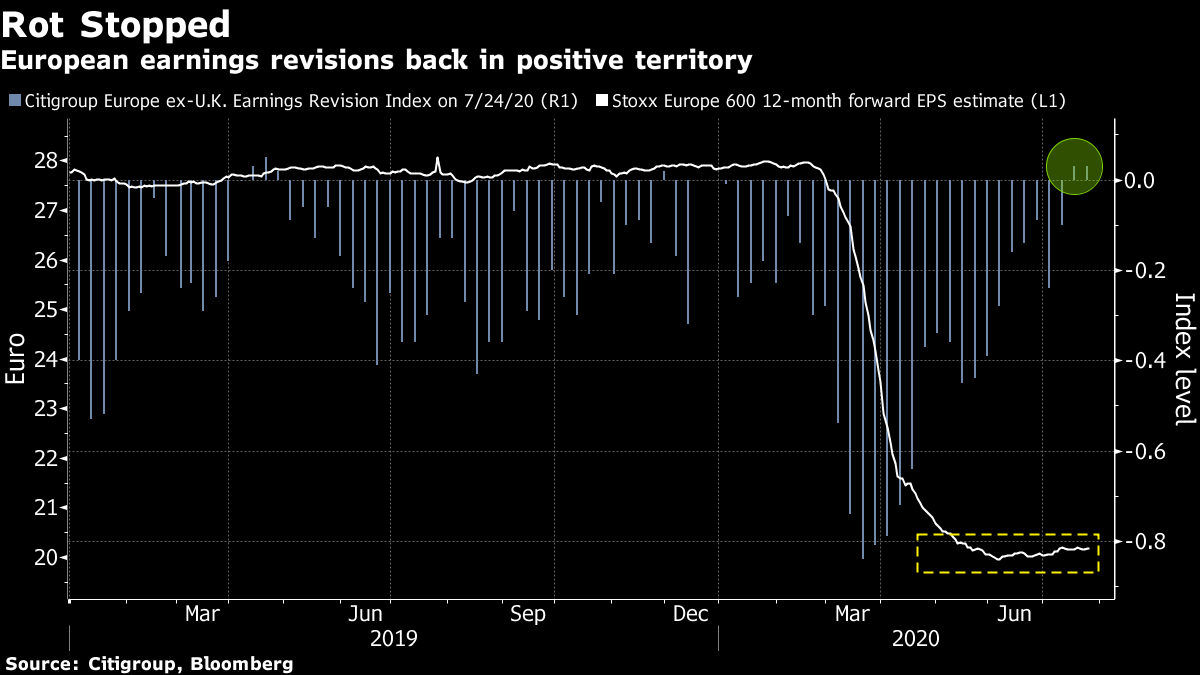

| Want the lowdown on what's moving European markets in your inbox every morning? Sign up here. Good morning. It's a big day for European banks, China's Covid-19 cases rose and the Federal Reserve is due to update on monetary policy later. Here's what's moving markets. Banks Time Credit Suisse Group AG is set to announce a sweeping overhaul of its business, merging the investment bank and capital-markets unit -- which has posted losses in recent quarters -- into the resurgent global markets trading unit, people with knowledge of the matter said. The changes are part of an effort to increase profitability at the securities unit while tightening risk oversight. It's a big day for results in the European banking sector as well, with Germany's Deutsche Bank reporting the biggest gain in fixed-income trading in almost eight years and Spain's Banco Santander SA announcing a 12.6-billion-euro impairment charge due to the pandemic. U.K. lender Barclays Plc is scheduled to update shortly. China Cases Rise China reported a rise in new coronavirus cases, mainly coming from local infections, while the U.S. neared 150,000 deaths even as daily infections slowed in some hard-hit states. Meanwhile, America's top infectious disease expert, Anthony Fauci, said it's "reasonable" to say that by December we're going to have an effective vaccine. The comments came as Moderna Inc.'s drug candidate was shown to protect against the virus in a trial that inoculated 16 monkeys. In this region, the U.K. is considering ways to loosen its coronavirus quarantine rules after restrictions on trips to Spain provoked a backlash from tourists, airlines and the government in Madrid. Spanish Prime Minister Pedro Sanchez is facing the prospect of losing German tourists in the busiest summer month as well. Stocks Mixed Stocks saw modest gains in Hong Kong and outperformed in China, while Japan's shares fell as Fitch Ratings cut the outlook on the country's sovereign debt rating to negative from stable and earnings at printer maker Canon Inc. disappointed. European and U.S. futures are pointing lower. Elsewhere, gold slipped, as did an index tracking the dollar, with Goldman Sachs warning that the currency's world reserve status is at risk. Here's a rundown of some of the other "erratic" market moves of late. Fed Awaited Stimulus talks between U.S. President Donald Trump's representatives and Democrats slowed Tuesday over demands by Senate Majority Leader Mitch McConnell that his proposed changes to liability law be included wholesale in the aid package. House Speaker Nancy Pelosi said McConnell's position suggests that he's not serious about reaching a deal. All this comes as traders await the Federal Reserve's interest rate decision tonight, though it might not bring major news: "We do not anticipate any meaningful policy announcements," Deutsche Bank economist Brett Ryan wrote in a note to clients, predicting the meeting will be used to "set the stage" for announcements on forward guidance to come in September. The Fed extended most of its emergency lending programs on Tuesday. Coming Up… Along with big banks, drugmakers Sanofi and GlaxoSmithKline Plc are among names to look out for in today's busy earnings slate, as is ailing carmaker Aston Martin Lagonda Global Holdings Plc. Gucci-owner Kering said revenue slumped in the last quarter though it is seeing signs of a recovery led by online sales. French grocer Carrefour SA got a boost from better-than-expected performance in both Europe and Latin America. In Germany, a parliamentary committee takes a break from its summer recess today to grill members of Chancellor Angela Merkel's cabinet about the accounting scandal that brought down one of the country's biggest tech companies, Wirecard AG. Finally, we'll get a French consumer confidence reading and emerging market currency traders may look out for South Africa inflation and Turkey's trade balance. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morning As Europe's earnings season rumbles on, perhaps the best takeaway so far is that the rot has finally stopped on falling profit expectations. Results are coming in above forecasts for the most part, with the obvious caveat that those estimates were incredibly pessimistic. My colleague Michael Msika noted this week that European earnings revisions have turned positive for the first time this year which is encouraging, and although forward profit estimates have yet to turn noticeably higher, at least they seem to be bumping along what is hopefully a bottom. Still, after having a better June than their U.S. counterparts, European shares are on the back foot again this month -- the Stoxx 600 is up 2% so far in July, but the S&P 500 is up almost 4%. We're only about a third of the way through the season, so there is still scope for some hiccups ahead. But so far at least there has been nothing to spoil the improving investor sentiment toward Europe that the historic stimulus package has helped to grow.  Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment