EU negotiations on stimulus package continue, U.S. talks on more fiscal measures begin, and the virus latest. Slow dealTalks between European leaders aimed at securing a mammoth stimulus package which began Friday and continued through the weekend are due to resume today. Negotiation teams seem to have bridged enough of the differences for leaders to express confidence that a path to full agreement is now visible. The two main outstanding areas are finding a mechanism to ensure funding is used properly, and whether to make distributions contingent on adherence to democratic standards.With the region outperforming the U.S. since the stimulus package was announced in May, European investors are holding their nerves. StimulusWhile talks on the European stimulus deal are close to wrapping up, in Washington meetings begin today on formulating another fiscal package to counter the economics effects of the pandemic. Senate Majority Leader Mitch McConnell, Treasury Secretary Steven Mnuchin and others will meet in the White House later today with Republicans expected to produce a plan worth about $1 trillion. That number is far below the $3.5 trillion proposed by Democrats. House Speaker Nancy Pelosi said last week that she is confident that the GOP will ultimately agree on a figure that is closer to the Democrat target. Virus latestLos Angeles Mayor Eric Garcetti warned that the city is on the brink of another stay-at-home order as cases accelerate. Florida had its fifth consecutive day of more than 10,000 cases, while the number of new infections in Texas dropped. Shares in AstraZeneca Plc rose ahead of news from a clinical trial of its experimental vaccine. A tiny U.K. company, Synairgen Plc, saw its stock soar 373% on news it developed a treatment that saw the probability of a patient requiring ventilation or dying dropping by 79%. Markets mixedWith investors waiting on stimulus news from both sides of the Atlantic, stocks are having a fairly directionless session so far. Overnight, the MSCI Asia Pacific Index added 0.2% while Japan's Topix index closed 0.2% higher. In Europe, the Stoxx 600 Index was up 0.3% by 5:50 a.m. Eastern Time with traders preferring defensive companies. S&P 500 futures pointed to a slightly lower open, the 10-year Treasury yield was at 0.617% and oil was lower. Coming up...It's a fairly blank state on the economic data front today. Later U.S. Secretary of State Michael Pompeo travels to the U.K. to meet Prime Minister Boris Johnson as both countries maintain pressure on China over Hong Kong. Haliburton Co., International Business Machines Corp. and Steel Dynamics Inc. are among the companies reporting today as earnings season gathers pace. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningIn the middle of March, when the world was falling apart, imagine if someone had said to you: "By June, household income will already be higher than it is now, retail sales will have fully rebounded, oh and housing will be booming." Back then, you would have probably said it all sounds like a V-shaped recovery.

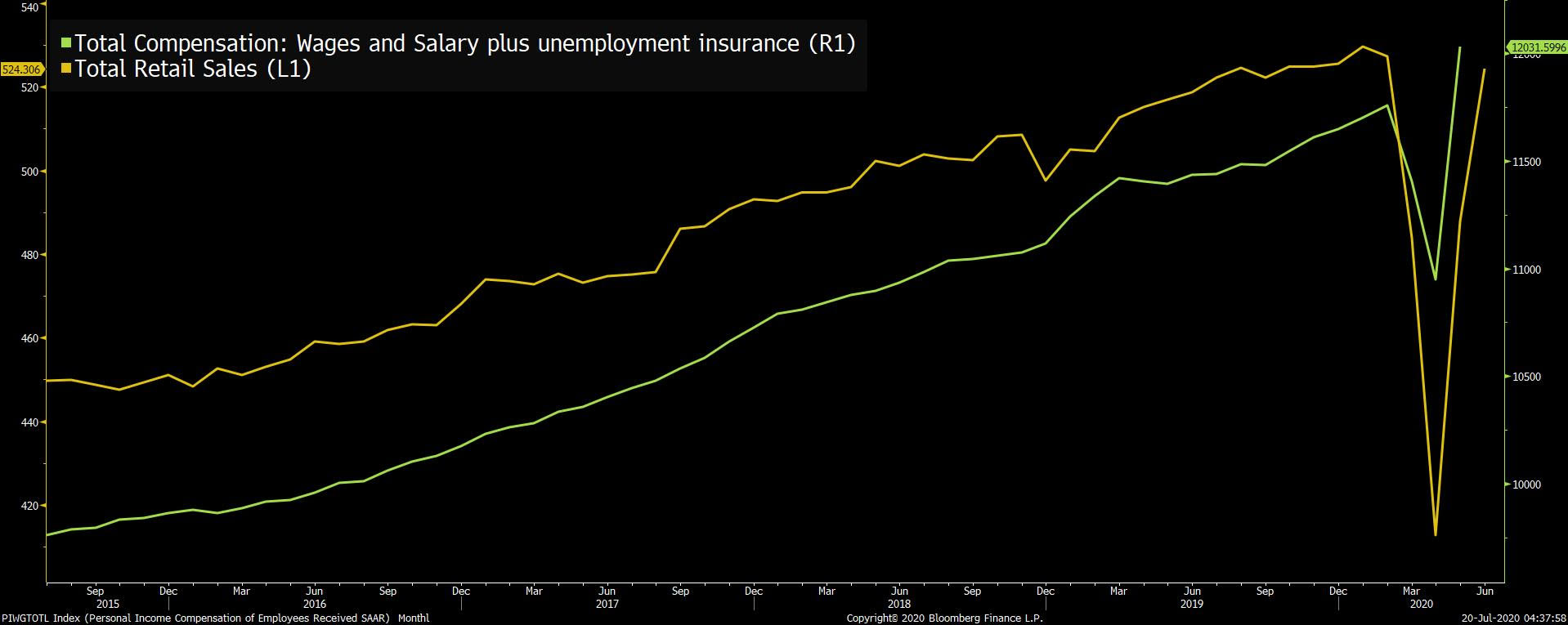

That's exactly what we got. As you can see on the chart, total retail sales in yellow have basically erased all their losses. And total household compensation in green, when you include unemployment insurance, is above pre-crisis levels. There are a lot of chart crimes out there, but this isn't one. These two lines are Vs, no question about it.  Of course, what's head-scratching is the disconnect between the V-shaped recovery in total household compensation and the awful situation in the labor market.

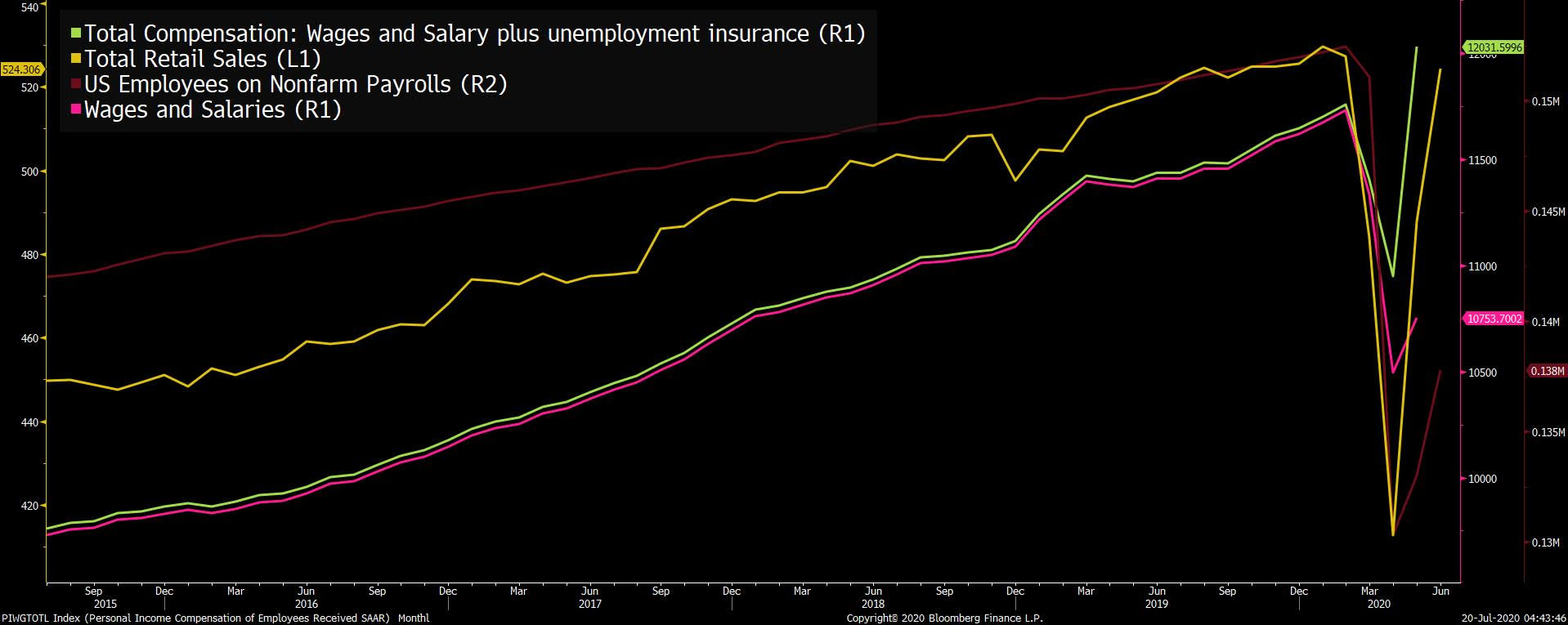

If you add into this chart the plunge in employment (red), and you only look at wage and salary compensation and exclude unemployment benefits (pink) the situation looks much worse. It's nowhere close to a complete recovery.  Some might argue that those two new lines are more the "real" state of the economy because they weren't boosted by temporary policies that are due to expire in just a few days. And some might argue that it's unsustainable to maintain such a large divergence between total household income, and household income from employed labor. But all that's for another debate. For now the actual situation that we've seen is a V-shaped recovery in income and a V-shaped recovery in spending. Now the question is whether the government pulls the plug on it. Joe Weisenthal is an editor at Bloomberg. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

ReplyDelete$$$ GENUINE LOAN WITH 3% INTEREST RATE APPLY NOW$$$

Do you need finance to start up your own business or expand your business, Do you need funds to pay off your debt? We give out loan to interested individuals and company's who are seeking loan with good faith. Are you seriously in need of an urgent loan contact us.

Email:fastestloaninvestment@gmail.com

LOAN APPLICATION DETAILS.

First Name:

Last Name:

Date Of Birth:

Address:

Sex:

Phone No:

City:

Zip Code:

State:

Country:

Nationality:

Occupation:

Monthly Income:

Loan Amount:

Loan Duration:

Purpose of the loan:

where did you hear about us;

Email:fastestloaninvestment@gmail.com