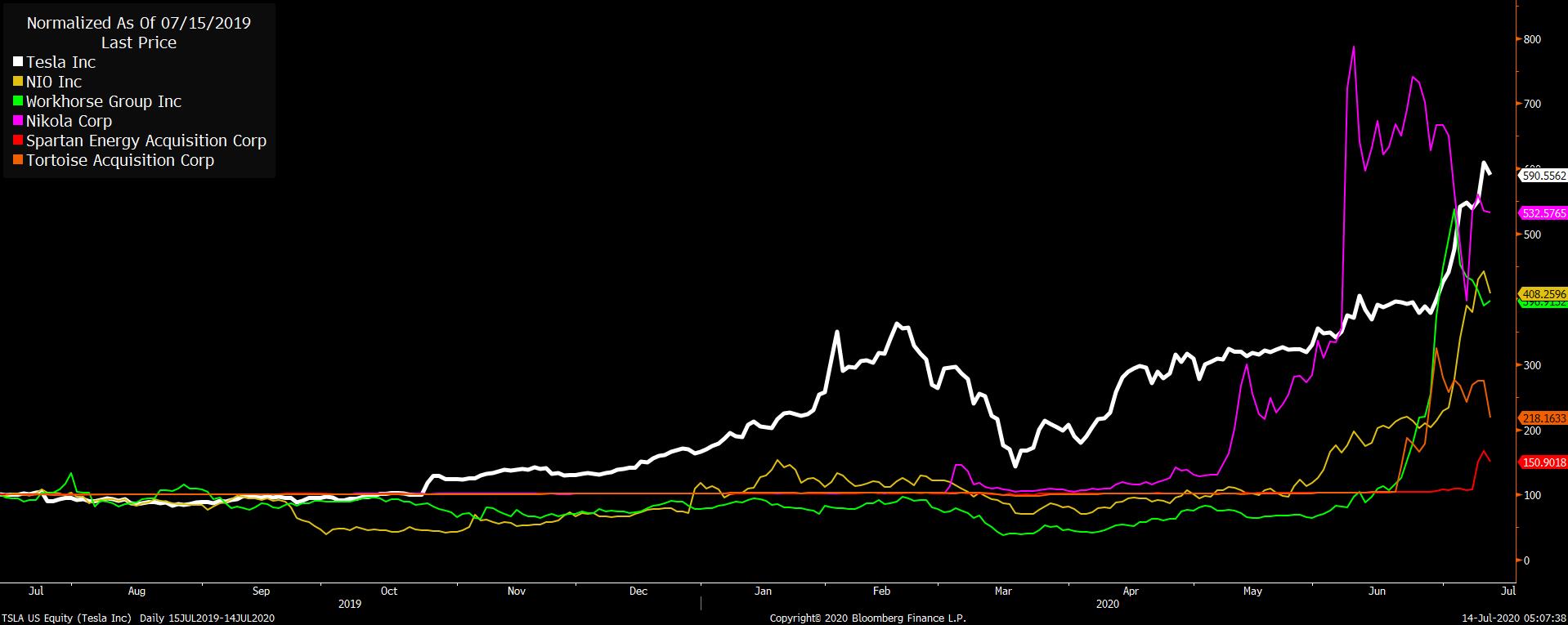

Lockdown policies tighten, U.S.-China tensions rise, and earnings season kicks off. Shutdowns are back Yesterday's order by California Governor Gavin Newsom that all indoor entertainment, including bars and restaurants, will close spooked markets. In something of a change of tone from the White House, Vice President Mike Pence told U.S. governors that theadministration would back them on any measures they take to control the pandemic. The stop-start pace of reopenings is a global phenomenon with Hong Kong tightening rules, Tokyo looking at declaring another state of emergency if the case count continues to rise, and Iran closing schools and religious sites. Conversely, shares in gambling stocks in Asia surged after some Chinese travel restrictions for Macau were lifted. Taking sidesThe Trump administration rejected China's expansive claims in the South China Sea, with Secretary of State Michael Pompeo saying they are "completely unlawful." The statement is a reversal of a previous policy of not taking sides in maritime disputes in the region. In another sign of tensions rising between the world's two largest economies, China announced it was imposing sanctions on Lockheed Martin Corp. after the U.S. approved a deal for the supply of missile parts to Taiwan. Relations between the nations have been hit on a number of fronts, including by the security law imposed in Hong Kong, treatment of minorities in Xinjiang, and the pandemic itself. Earnings weekJPMorgan Chase & Co., Citigroup Inc. and Wells Fargo & Co. get Wall Street earnings season started before the bell this morning. The results are expected to be dominated by big provisions for loan losses, with trading revenue likely to be the only silver lining. Investors will likely pay close attention to management commentary as they try to get a handle on what is a very cloudy outlook for the industry. Markets riseCalifornia's shaped virus reality-check delivered just before markets closed in the U.S. yesterday put pressure on investor sentiment across the world. Overnight, the MSCI Asia Pacific Index slipped 0.8% while Japan's Topix index closed 0.5% lower. There were signs some of the air has come out of China's market surge. In Europe the Stoxx 600 Index was down 1.2% at 5:50 a.m. Eastern Time, led by declines in tech and travel shares. S&P 500 futures pointed to a small rebound at the open, the 10-year Treasury yield was at 0.628% and gold was lower. Coming up...U.S. inflation data for June at 8:30 a.m. is expected to show prices ticked higher in the month. Fed Governor Lael Brainard, Atlanta Fed President Raphael Bostic, St. Louis Fed President James Bullard and Philadelphia Fed President Patrick Harker all speak this afternoon. OPEC's monthly oil-market report is due as demand concerns for the commodity rise again. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningI would never call Tesla a bubble, because that's not my job, and making such calls are incredibly risky and almost never turn out well. That being said, if you do think that Tesla is in a bubble, here's something for your argument. Remember back in late 2017, when the Bitcoin bubble peaked and burst (you can easily call them in retrospect), one of the things we saw was the explosion of alternative coins to satisfy the overwhelming demand for cryptocurrencies. Bitcoin's supply is, of course, fixed, but that didn't stop the industry from pumping and hyping dozens of others coins onto fresh retail money. On December 19, 2017 the popular exchange Coinbase announced it was listing something called Bitcoin Cash which was a fork of Bitcoin itself. Then for one brief moment, the largest holder of the cryptocurrency XRP became wealthier than Mark Zuckerberg. At the same time, the media was introducing the world to coins like Stellar and Cardano. All this stuff proceeded to collapse massively in the years ahead, as the manufacture of new financial assets more than satisfied the demand to own them. That's one way bubbles die. The industry just churns out more and more of what people want, whether it's cryptos, Beanie Babies, or safe assets tied to U.S. housing.  Anyway, you could argue that we're in a similar stage with electric cars. There was a point where you could say that Tesla was the only game in town if you really wanted to bet on the industry. But not anymore. Now there's Nikola. And Fisker. And Workhorse. And don't forget about Nio. Oh and Hyliion. The list goes on and on, and it can keep going on as long as speculators are able to bring SPACs to the market, with the intention of buying EV companies.

In a 2017 academic paper called Bubbles for Fama, the economists Robin Greenwood, Andrei Shleifer, and Yang You identified several characteristics of stock bubbles, including extremely sharp price increases, new stock issuance, and investor preference for newer and younger firms. The paper is worth a read when trying to assess this or any other market. Joe Weisenthal is an editor at Bloomberg. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment